For years, real estate has been considered the best investment you can make. A major reason for this is due to the net worth a household gains through homeownership. In fact, according to the 2019 Survey of Consumer Finance Data from the Federal Reserve, for the average homeowner:

“…a primary home accounts for 90% of the total wealth of a family in the U.S.”

How do homeowners gain wealth?

Most large purchases, like cars and appliances, depreciate in value as they age, so it’s understandable to question how owning a home can increase wealth over time. In a simple equation, the National Association of Realtors (NAR) explains how the combination of paying your mortgage and home price appreciation grow overall wealth:

Principal Payments + Price Appreciation Gains = Housing Wealth Gain

As home values increase and you make payments toward your home loan, you’ll gain wealth through equity. The same article from NAR also addresses how wealth gains tend to play out over time:

“Housing wealth accumulation takes time and is built up by paying off the mortgage debt and by price appreciation. And while home prices can fall, home prices tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales was $311,800, a 35% gain since July 2006 when prices peaked at $230,000.”

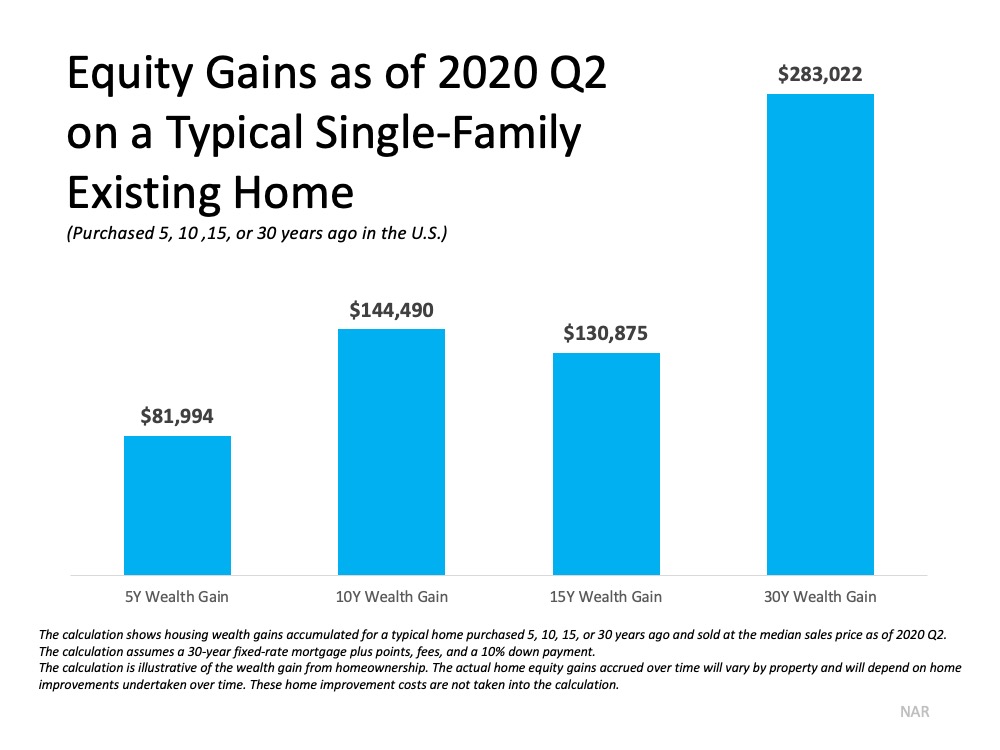

Taking a look at how equity has grown for the typical homeowner, it’s clear to see how real estate is a sound long-term investment. NAR notes:

“Nationally, a person who purchased a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020.” (See graph below):

Bottom Line

Whether you’re a current homeowner planning to put your equity toward a new home or have hopes of buying your first home soon, homeownership will always be a great opportunity to build your net worth and overall wealth. Owning a home is truly an investment in your financial future.

To view original article, visit Keeping Current Matters.

5 Tips for Making Your Best Offer

In today’s sellers’ market, standing out as a buyer is critical. Multi-offer scenarios and bidding wars are the norm due to the low supply of houses for sale and high buyer demand.

Why It’s Still Safe To Sell Your Home

Real estate professionals use new technology, tools, cleaning procedures, and the latest guidance to meet your changing needs and to keep you safe.

Understand Your Options To Avoid Foreclosure

There are alternatives available to help you avoid having to go through the foreclosure process and a real estate professional can help you.

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021.

Reasons You Should Consider Selling This Fall

If you’re trying to decide when to sell your house, there may not be a better time to list than right now.

5 Reasons Today’s Housing Market Is Anything but Normal

The market is still extremely vibrant as demand is still strong even while housing supply is slowly returning.