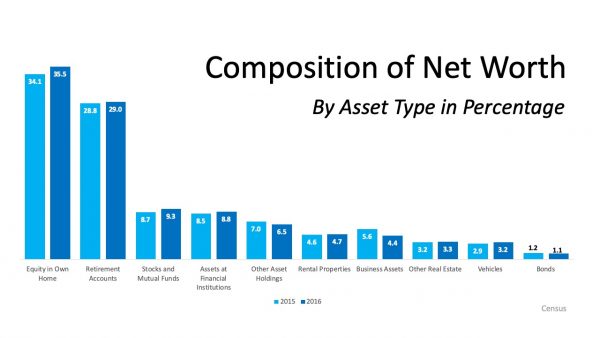

“The biggest determinants of household wealth are owning a home and having a retirement account.”

Many people plan to build their net worth by buying CDs or stocks, or just having a savings account. Recently, however, Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the U.S. Census Bureau, shared the biggest determinants of wealth,

“The biggest determinants of household wealth [are] owning a home and having a retirement account.” (Shown in the graph below):

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

“Net worth is an important indicator of economic well-being and provides insights into a household’s economic health.”

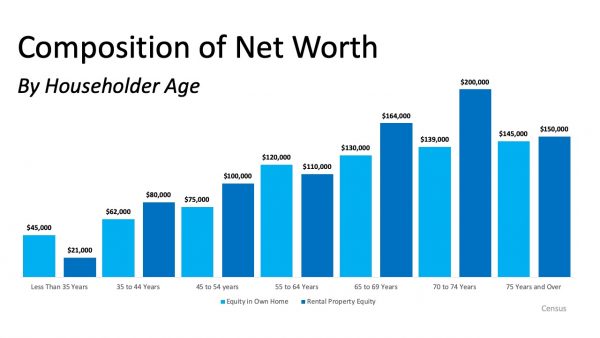

Having equity in your home can help your family move in that direction, building toward substantial financial growth. According to the report noted above, people are not only creating net worth in the homes they live in, but many are also earning equity in rental property investments too. (See below): John Paulson said it well,

John Paulson said it well,

“If you don’t own a home, buy one. If you own one home, buy another one, and if you own two homes buy a third and lend your relatives the money to buy a home.”

Bottom Line

There are financial and non-financial benefits to owning a home. If you would like to increase your net worth, let’s get together so you can learn all the benefits of becoming a homeowner.

To view original article, visit Keeping Current Matters.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.