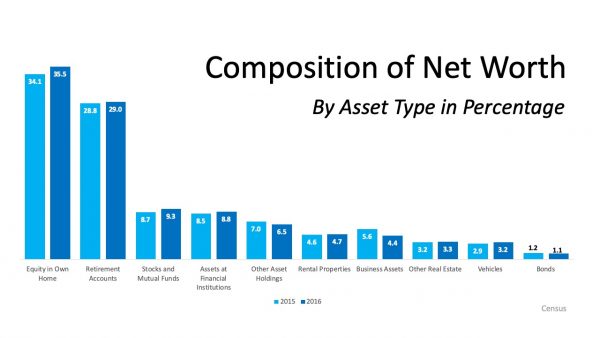

“The biggest determinants of household wealth are owning a home and having a retirement account.”

Many people plan to build their net worth by buying CDs or stocks, or just having a savings account. Recently, however, Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the U.S. Census Bureau, shared the biggest determinants of wealth,

“The biggest determinants of household wealth [are] owning a home and having a retirement account.” (Shown in the graph below):

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

“Net worth is an important indicator of economic well-being and provides insights into a household’s economic health.”

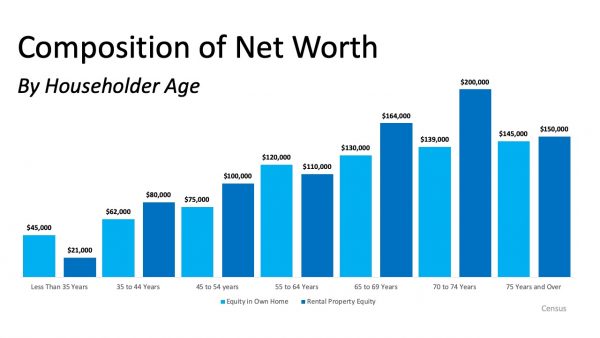

Having equity in your home can help your family move in that direction, building toward substantial financial growth. According to the report noted above, people are not only creating net worth in the homes they live in, but many are also earning equity in rental property investments too. (See below): John Paulson said it well,

John Paulson said it well,

“If you don’t own a home, buy one. If you own one home, buy another one, and if you own two homes buy a third and lend your relatives the money to buy a home.”

Bottom Line

There are financial and non-financial benefits to owning a home. If you would like to increase your net worth, let’s get together so you can learn all the benefits of becoming a homeowner.

To view original article, visit Keeping Current Matters.

This Is the Sweet Spot Homebuyers Have Been Waiting For

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible.

Buying Beats Renting in 22 Major U.S. Cities

Whether you live in one of these budget-friendly cities or any town in-between, it’s time to to talk a local real estate agent to get started.

Don’t Fall for These Real Estate Agent Myths

Don’t let myths keep you from the expert guidance you deserve. A trusted local real estate agent isn’t just helpful, they’re invaluable.

The Down Payment Assistance You Didn’t Know About

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it.

Is Your House Priced Too High?

Pricing your house correctly is one of the most crucial steps in the selling process and if you’re asking too much you may be turning potential buyers away.

Falling Mortgage Rates Are Bringing Buyers Back

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.