“The biggest determinants of household wealth are owning a home and having a retirement account.”

Many people plan to build their net worth by buying CDs or stocks, or just having a savings account. Recently, however, Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the U.S. Census Bureau, shared the biggest determinants of wealth,

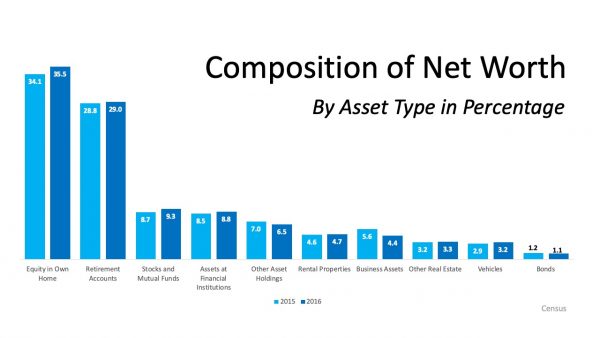

“The biggest determinants of household wealth [are] owning a home and having a retirement account.” (Shown in the graph below):

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

This does not come as a surprise, as we often mention that homeownership can help you to increase your family’s wealth. This study reinforces that idea,

“Net worth is an important indicator of economic well-being and provides insights into a household’s economic health.”

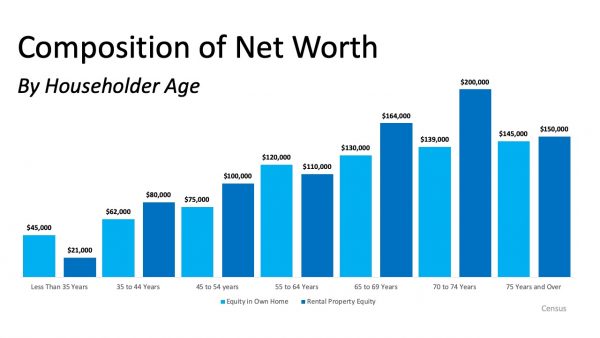

Having equity in your home can help your family move in that direction, building toward substantial financial growth. According to the report noted above, people are not only creating net worth in the homes they live in, but many are also earning equity in rental property investments too. (See below): John Paulson said it well,

John Paulson said it well,

“If you don’t own a home, buy one. If you own one home, buy another one, and if you own two homes buy a third and lend your relatives the money to buy a home.”

Bottom Line

There are financial and non-financial benefits to owning a home. If you would like to increase your net worth, let’s get together so you can learn all the benefits of becoming a homeowner.

To view original article, visit Keeping Current Matters.

Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first but a trusted real estate professional can help.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.

How To Prep Your House for Sale This Fall

Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment.

If You’re Thinking of Selling Your House This Fall, Hire a Pro

A trusted real estate advisor will keep you updated and help you make the best decisions based on current market trends.