“U.S. homeownership rate rose again, signaling great strength in the recovery of the housing market and an indication that even in a time of crisis, Americans still feel confident about buying a home.”

So far, it’s been quite a ride this year, and our nation has truly seen its fair share of hurdles. From COVID-19 to record unemployment and then the resulting recession, just to name a few, the second quarter of 2020 has had more than a few challenges. Amidst the many roadblocks, however, the U.S. homeownership rate rose again, signaling great strength in the recovery of the housing market and an indication that even in a time of crisis, Americans still feel confident about buying a home.

Yesterday, the U.S. Census Bureau announced:

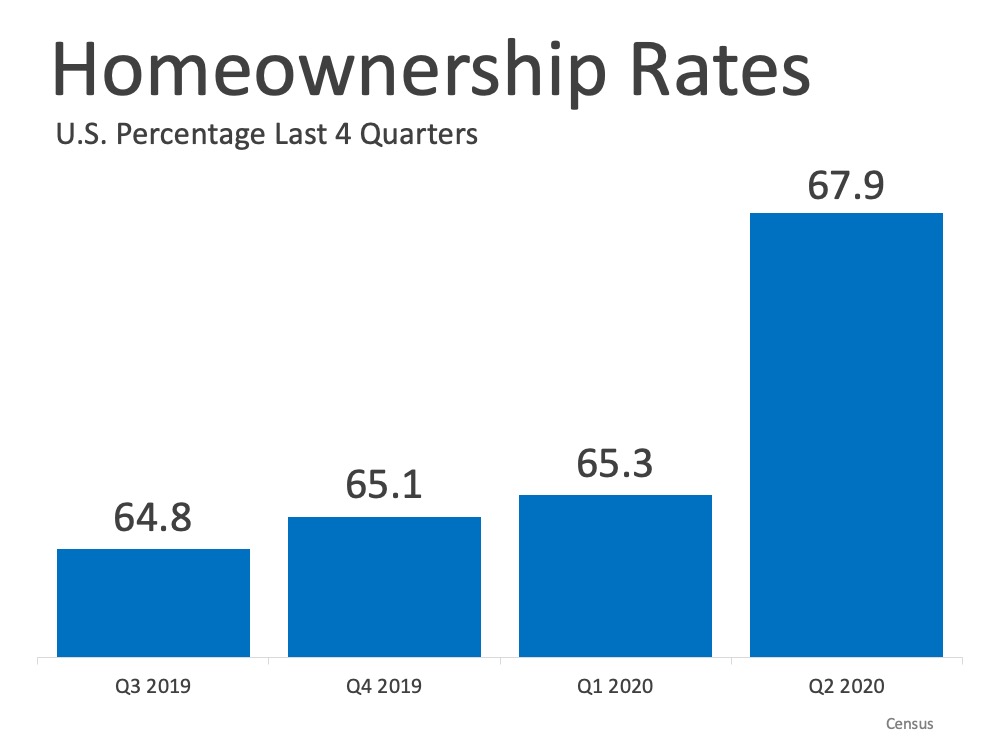

“The homeownership rate of 67.9 percent was 3.8 percentage points higher than the rate in the second quarter 2019 (64.1 percent) and 2.6 percentage points higher than the rate in the first quarter 2020 (65.3 percent).”

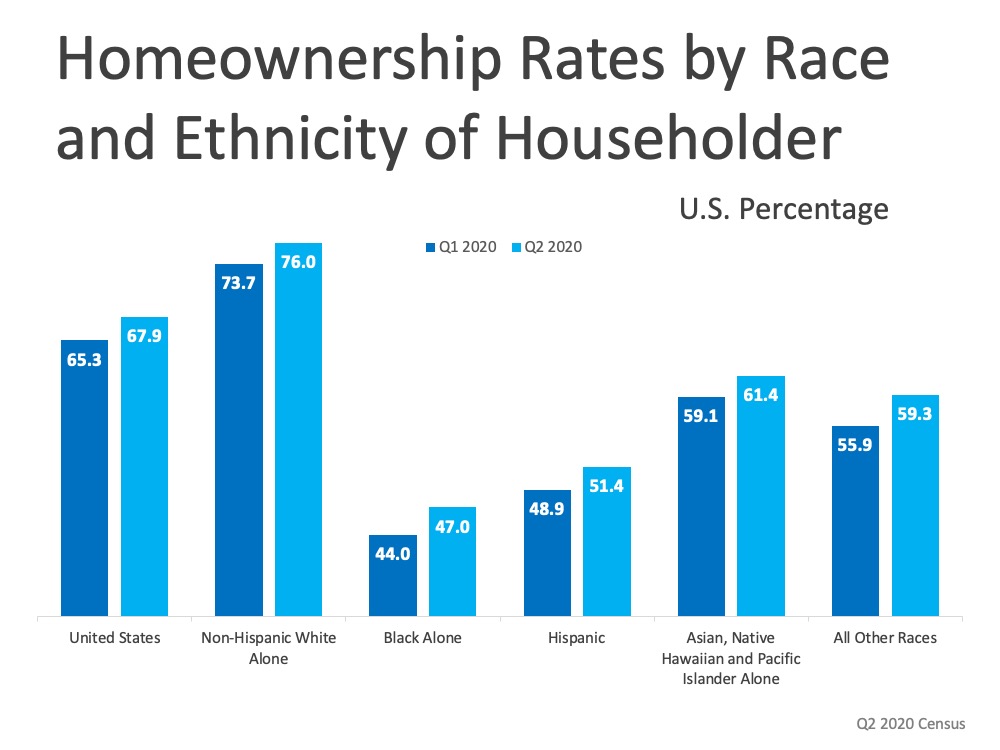

The increase is also represented by race and ethnicity of the householder:

The increase is also represented by race and ethnicity of the householder: There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates. Rates hovering at all-time lows are helping to drive affordability and enabling more potential homeowners to enter the market today. According to Ralph McLaughlin, Chief Economist for Haus:

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates. Rates hovering at all-time lows are helping to drive affordability and enabling more potential homeowners to enter the market today. According to Ralph McLaughlin, Chief Economist for Haus:

“Mortgage rates are the icing on the cake for households that were thinking about buying…They found an unexpected opportunity during the worst economic downturn America has seen since the Great Depression.”

In addition, many potential homebuyers have been using their time this year to search for homes that offer more space than their current rental apartments. Many of these homebuyers are younger and, as noted by Odeta Kushi, Deputy Chief Economist at First American, are the buyers driving the homeownership rate in an upward direction:

“Big jump in the homeownership rate today, mostly driven by younger households. We saw a spike in the number of owners, and a decline in the number of renters. This is the highest rate of homeownership since 2008.”

This growth is outstanding news for the housing market and for those who have recently found their new homes. If homeownership is on your shortlist this year, maybe now is a great time to meet with a real estate professional to evaluate your current situation. Perhaps historically low mortgage rates can help you to become a homeowner too.

Bottom Line

If you’re thinking of buying a home this year, let’s connect today to take your dream one step closer to reality.

___

Announcement from the census: As a result of the coronavirus pandemic (COVID-19), data collection operations for the CPS/HVS were affected during the second quarter of 2020. In-person interviews were suspended for the duration of the second quarter and replaced with telephone interview attempts when contact information was available. If the Field Representative was unable to get information on the sample unit, the unit was made a Type A no interview (no one home, refusal, etc.). See the FAQ for more information.

To view original article, visit Keeping Current Matters.

Is the Housing Market Starting To Balance Out?

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years.

Do You Know How Much Your Home Is Worth?

The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

If you’re debating whether to buy now or wait, remember: real estate rewards those in the market, not those who try to time it perfectly.

Are Investors Actually Buying Up All the Homes?

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth

Is a Newly Built Home Right for You? The Pros and Cons

An agent can walk you through the pros and cons of considering a newly built home and help you decide if it makes sense for you.

How To Buy a Home Without Waiting for Lower Rates

Even if mortgage rates don’t drop substantially, there are still ways to make buying a home more affordable.