“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

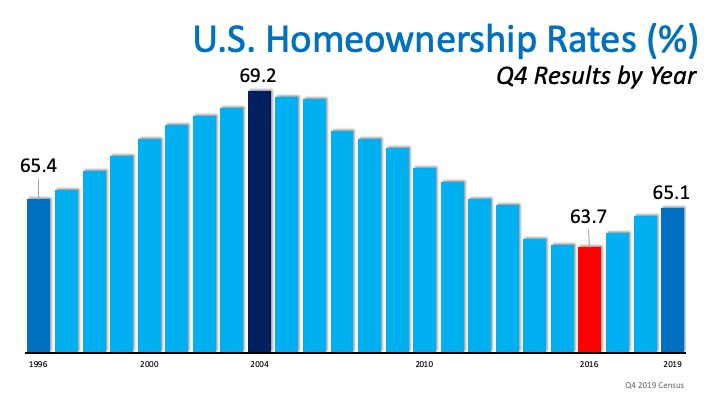

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below:

This increase does not come as a surprise. According to realtor.com,

This increase does not come as a surprise. According to realtor.com,

“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

With so many Millennials entering a homebuying phase of life and getting into the market, the Millennial Report also explains,

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

Today’s low interest rates are providing a break to new homeowners too, regardless of generation, making homeownership more desirable and achievable at the same time. Freddie Mac explains,

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

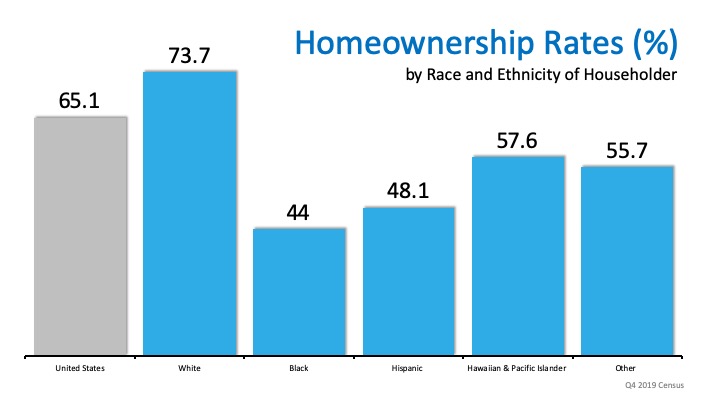

The increase in homeownership rate was also represented by race and ethnicity of the householders. HousingWire explains,

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

If you’re considering buying a home this year, let’s get together to set a plan that will help you get one step closer to achieving your dream.

To view original article, visit Keeping Current Matters.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.