“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

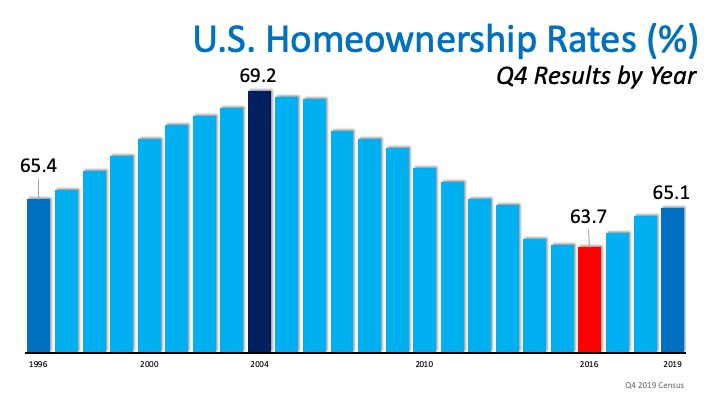

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below:

This increase does not come as a surprise. According to realtor.com,

This increase does not come as a surprise. According to realtor.com,

“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

With so many Millennials entering a homebuying phase of life and getting into the market, the Millennial Report also explains,

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

Today’s low interest rates are providing a break to new homeowners too, regardless of generation, making homeownership more desirable and achievable at the same time. Freddie Mac explains,

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

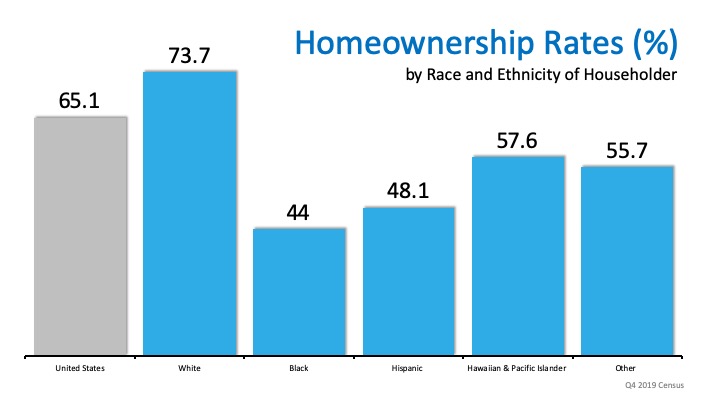

The increase in homeownership rate was also represented by race and ethnicity of the householders. HousingWire explains,

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

If you’re considering buying a home this year, let’s get together to set a plan that will help you get one step closer to achieving your dream.

To view original article, visit Keeping Current Matters.

Sell Your House Before the Holidays

A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

3 Trends That Are Good News for Today’s Homebuyers

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too.

Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first but a trusted real estate professional can help.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.