“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

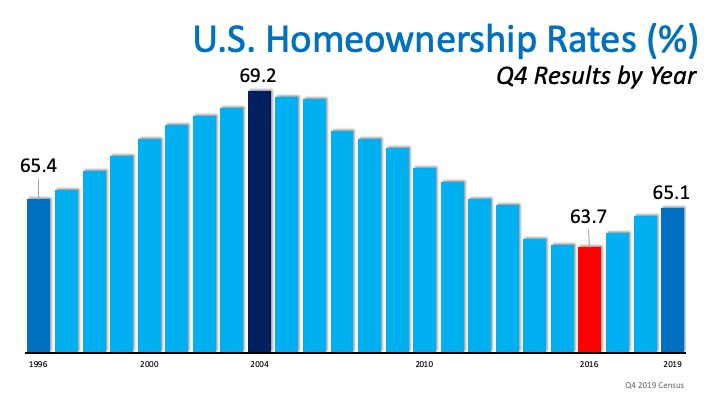

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below:

This increase does not come as a surprise. According to realtor.com,

This increase does not come as a surprise. According to realtor.com,

“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

With so many Millennials entering a homebuying phase of life and getting into the market, the Millennial Report also explains,

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

Today’s low interest rates are providing a break to new homeowners too, regardless of generation, making homeownership more desirable and achievable at the same time. Freddie Mac explains,

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

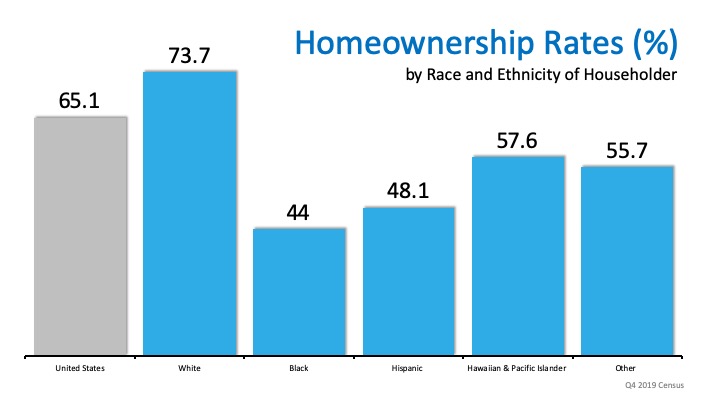

The increase in homeownership rate was also represented by race and ethnicity of the householders. HousingWire explains,

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

If you’re considering buying a home this year, let’s get together to set a plan that will help you get one step closer to achieving your dream.

To view original article, visit Keeping Current Matters.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.

What’s the Impact of Presidential Elections on the Housing Market?

Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.

What Mortgage Rate Are You Waiting For?

If you’ve been holding out and waiting for rates to come down, know that it’s already happening.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.