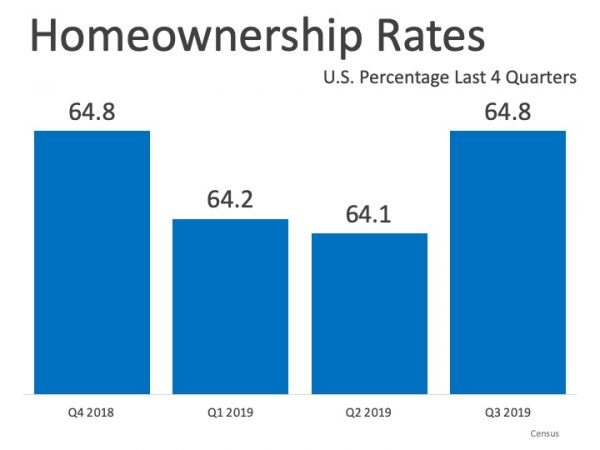

“U.S. homeownership rose again in the 3rd quarter. “

In the third quarter of 2019, the U.S. homeownership rate rose again, signaling another strong indicator of the current housing market.

The U.S. Census Bureau announced,

“The homeownership rate of 64.8 percent was not statistically different from the rate in the third quarter 2018 (64.4 percent), but was 0.7 percentage points higher than the rate in the second quarter 2019 (64.1 percent).”

Today there is still a lack of inventory, particularly at the entry and middle-level segments of the market, but that is not stopping buyers from making every effort to pursue homeownership. The many financial and non-financial benefits continue to drive the American Dream and will likely do so for generations to come.

Today there is still a lack of inventory, particularly at the entry and middle-level segments of the market, but that is not stopping buyers from making every effort to pursue homeownership. The many financial and non-financial benefits continue to drive the American Dream and will likely do so for generations to come.

Bottom Line

If you’re thinking of buying a home, let’s get together to make your dream a reality.

To view original article, visit Keeping Current Matters.

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Two Reasons Why Today’s Housing Market Isn’t a Bubble

Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation.

The Average Homeowner Gained $64K in Equity over the Past Year

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home.

More Americans Choose Real Estate as the Best Investment Than Ever Before

Your house is also an asset that typically increases in value over time, even during inflation.

Why You Need an Expert To Determine the Right Price for Your House

Your goal is to aim directly for the center – not too high, not too low, but right at market value.

What Does the Rest of the Year Hold for the Housing Market?

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market.