Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

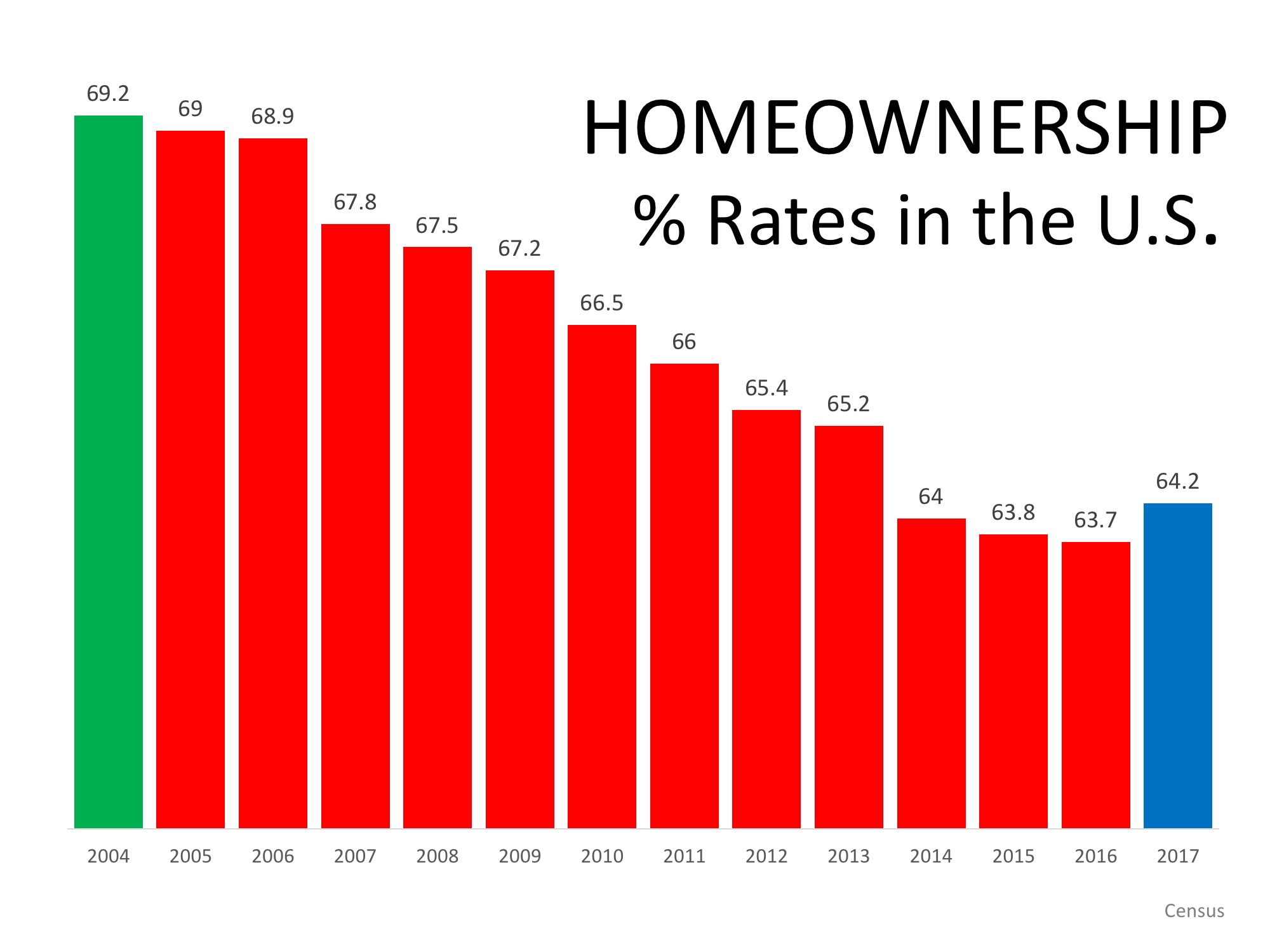

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not importantBottom Line: Homeownership has been, is and will always be a crucial element of the American Dream.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.

Simple Steps To Help You Save for Your First Home

Reaching your savings goal doesn’t mean making huge sacrifices overnight – small, consistent steps can get you there over time.

How Eco-Friendly Features Can Boost Your Home’s Value

Not sure which upgrades to prioritize? That’s where a local real estate agent comes in.

The Biggest Perks of Buying a Home This Winter

Since homes generally take longer to sell during the winter, sellers are often more motivated to close a deal.

How Home Equity May Help You Buy Your Next Home in Cash

Building equity in your house is one of the biggest financial advantages of homeownership.