Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

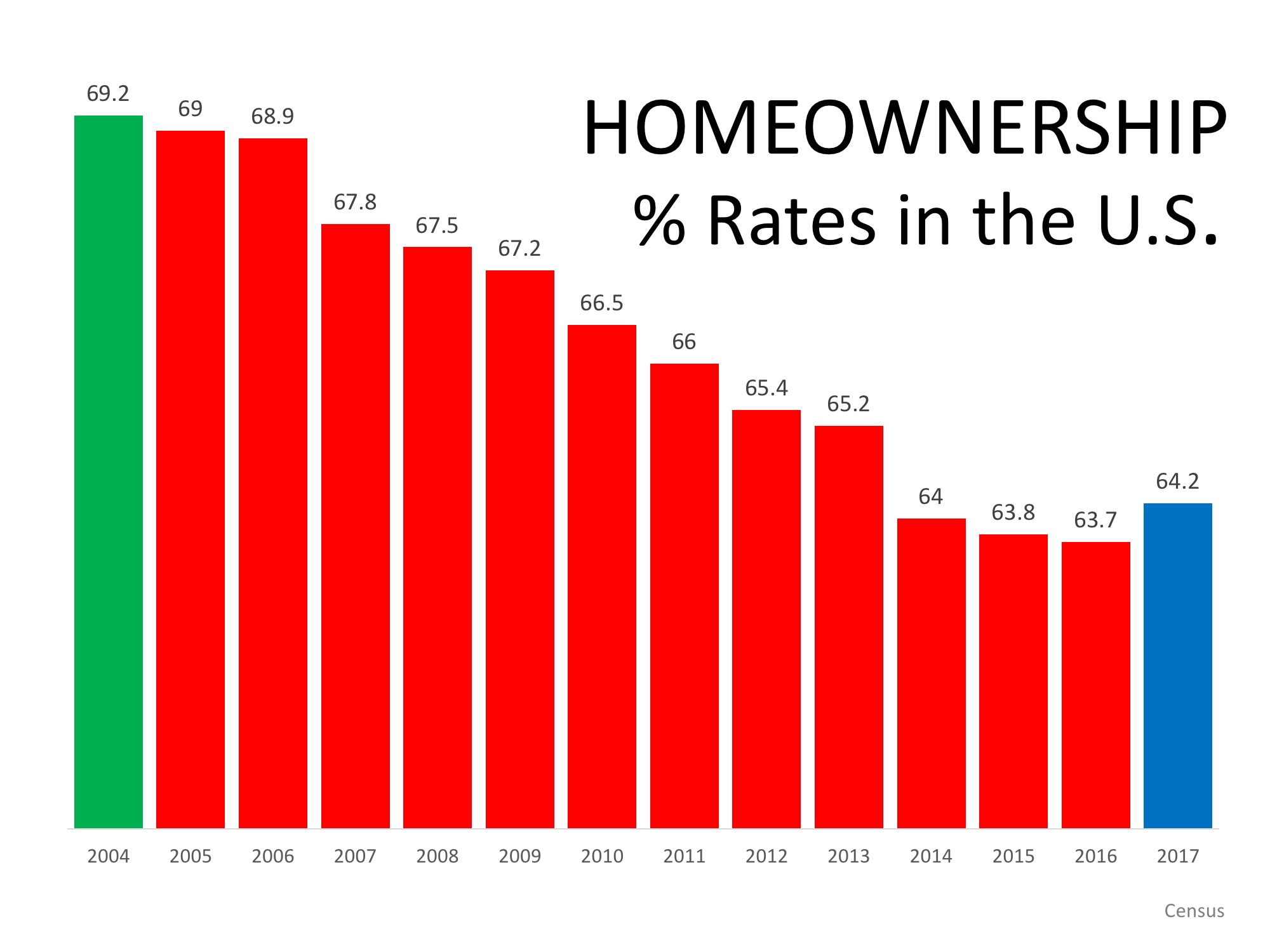

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not importantBottom Line: Homeownership has been, is and will always be a crucial element of the American Dream.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.

Thinking About Using Your 401(k) To Buy a Home?

Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.

Homeowner Net Worth Has Skyrocketed

Buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time, meaning you have more equity.

Reasons To Sell Your House Before the New Year

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition.

Don’t Believe Everything You Read About Home Prices

If you believe home prices are falling, it may be time to get your insights from the experts, and they’re saying prices are climbing.

Foreclosures and Bankruptcies Won’t Crash the Housing Market

Foreclosure filings are inching back up to pre-pandemic numbers, BUT they’re still way lower than when the housing market crashed in 2008.

Affordable Homeownership Strategies for Gen Z

One of your best resources on the journey as a young homebuyer is a trusted real estate agent.

The Perks of Selling Your House When Inventory Is Low

Buyers have fewer choices now than they did in more typical years. And that’s why you could see some great perks if you sell today.