Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

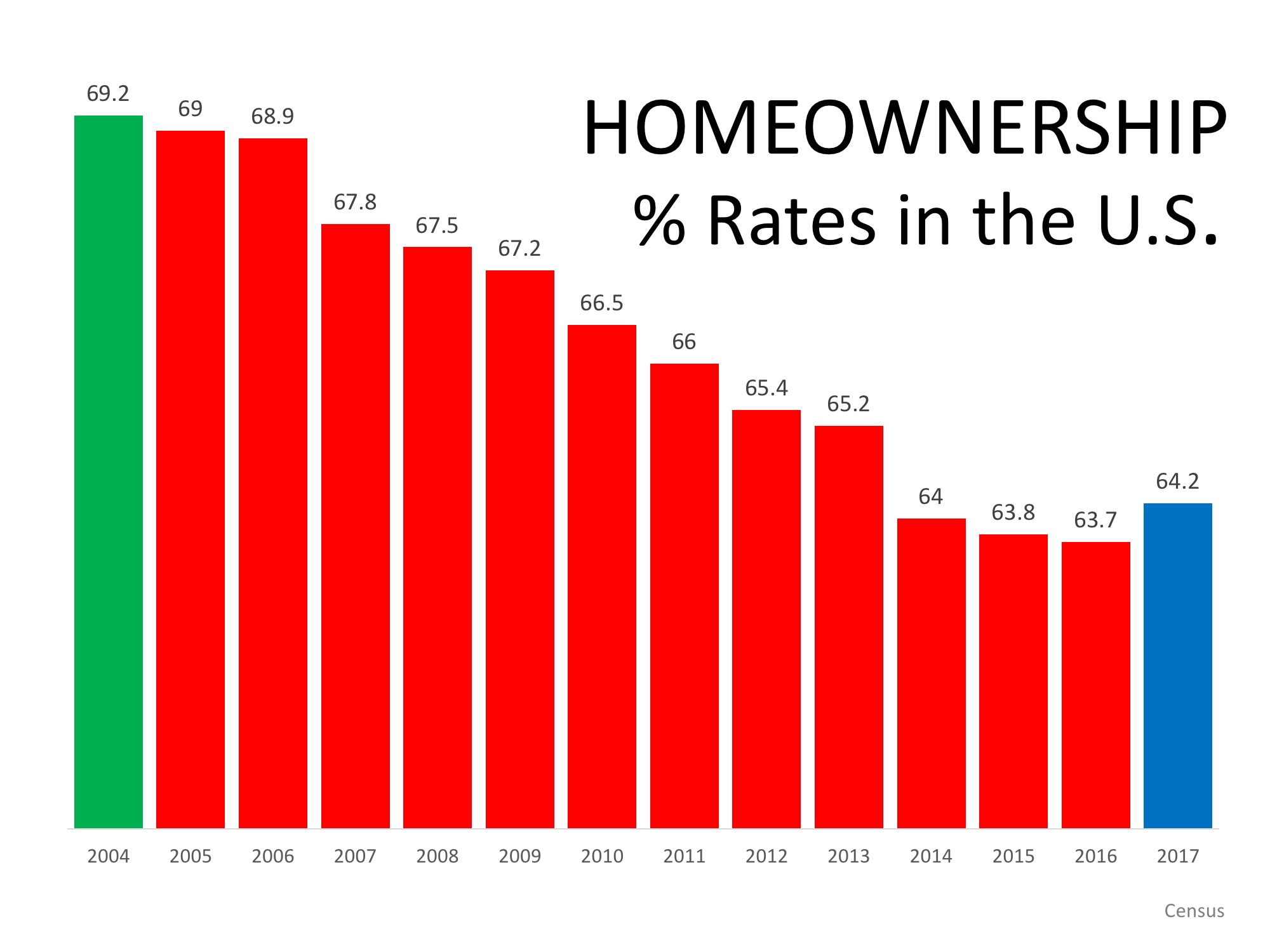

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not importantBottom Line: Homeownership has been, is and will always be a crucial element of the American Dream.

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream.

Key Factors Affecting Home Affordability Today

When you think about affordability, remember the full picture includes mortgage rates, home prices and wages.

Sell Your House Before the Holidays

A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

3 Trends That Are Good News for Today’s Homebuyers

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too.

Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first but a trusted real estate professional can help.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.

How To Prep Your House for Sale This Fall

Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment.

If You’re Thinking of Selling Your House This Fall, Hire a Pro

A trusted real estate advisor will keep you updated and help you make the best decisions based on current market trends.