Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

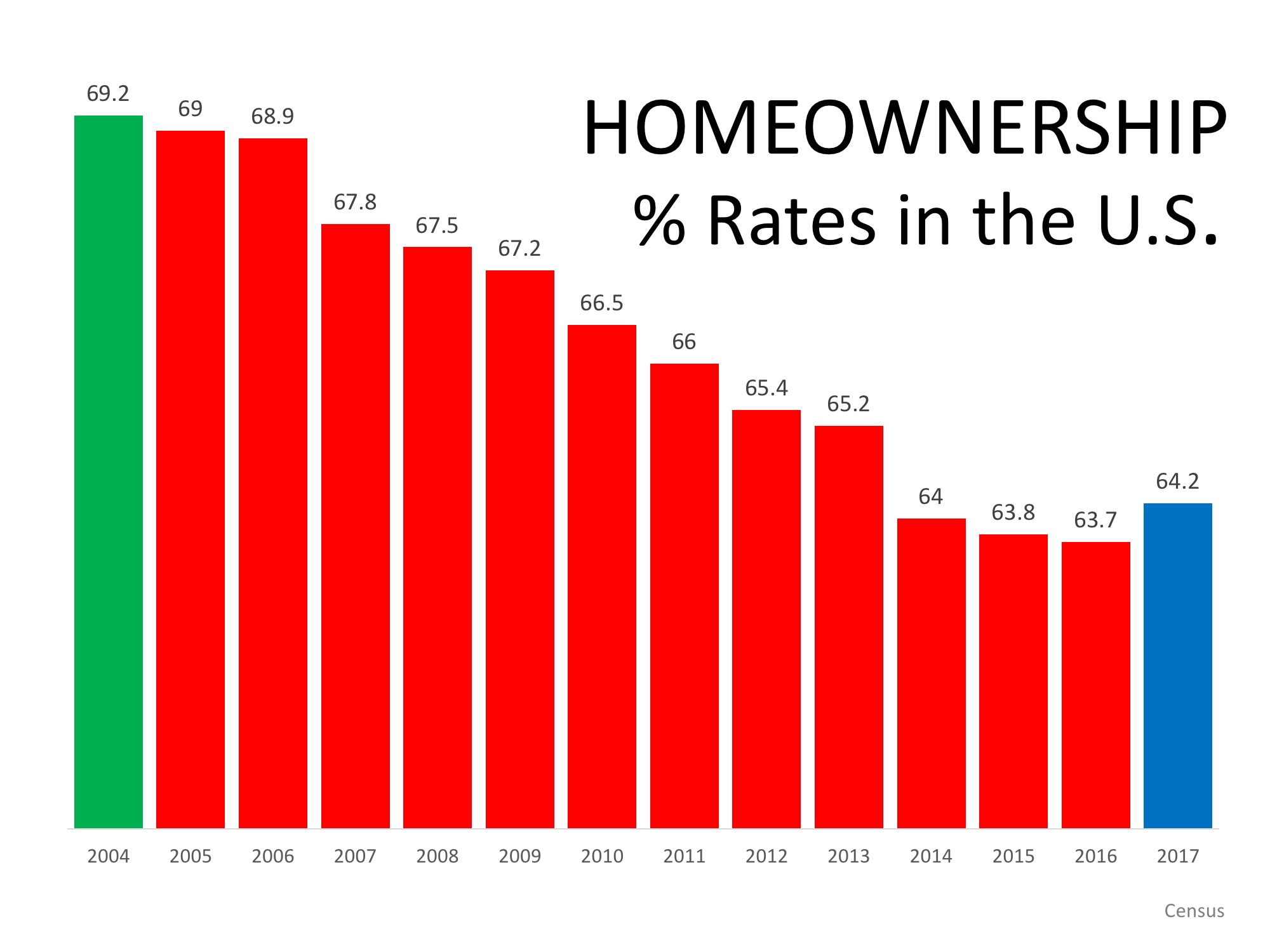

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not importantBottom Line: Homeownership has been, is and will always be a crucial element of the American Dream.

What’s Behind Today’s Mortgage Rate Volatility?

The best way to navigate this landscape is to have a team of real estate experts by your side.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.

Is a Fixer Upper Right for You?

The perfect home is the one you perfect after buying it. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

How Real Estate Agents Take the Fear Out of Moving

Real estate agents are trusted guides to help you navigate the complexities of the housing market with confidence and ease.

Why Home Sales Bounce Back After Presidential Elections

As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.