“We are seeing a slow but steady increase in homes coming up for sale.“

An important factor in today’s market is the number of homes for sale. While inventory levels continue to sit near historic lows, there are indications we may have hit the lowest point we’ll see. Odeta Kushi, Deputy Chief Economist at First American, recently said of our supply challenges:

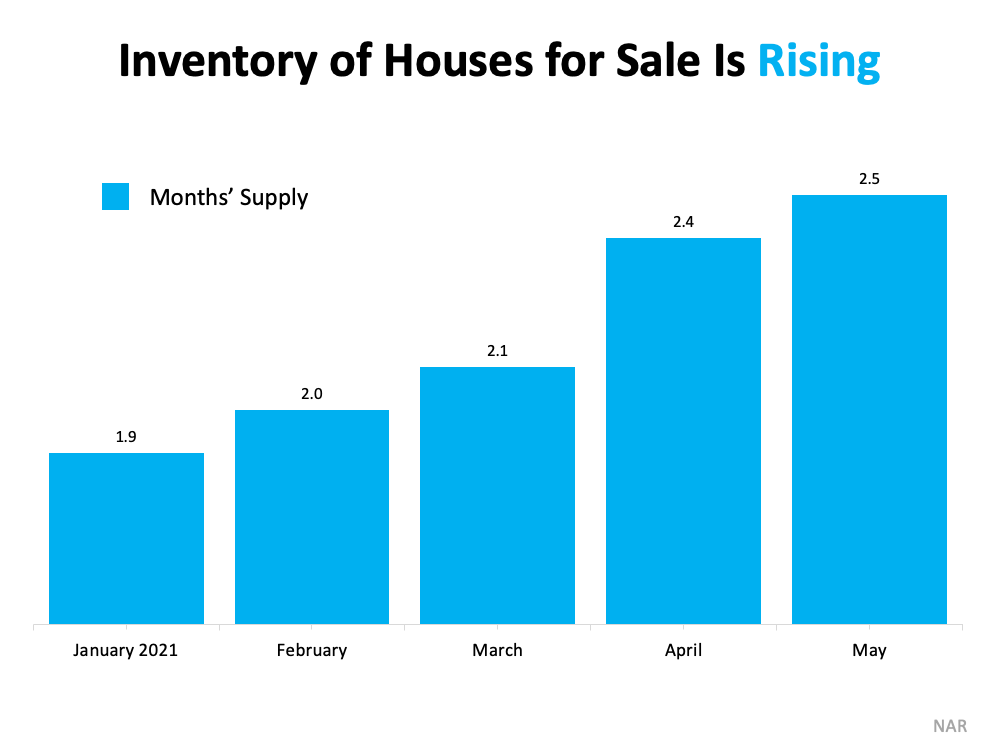

“It looks like inventory may have hit a bottom (we’ve seen this in the higher frequency data as well). Unsold inventory in May was at 2.5 months supply, up from 2.4.”

To put it into perspective, the graph below shows levels of inventory rising since the beginning of the year: We’re still not close to a balanced market, which would be a 6 months’ supply of homes for sale. However, we are seeing a slow but steady increase in homes coming up for sale. And that leaves many buyers and sellers wondering the same thing: what does that mean for me?

We’re still not close to a balanced market, which would be a 6 months’ supply of homes for sale. However, we are seeing a slow but steady increase in homes coming up for sale. And that leaves many buyers and sellers wondering the same thing: what does that mean for me?

Buyers: More Options Are Arriving, so It’s Time To Act

If you’re a buyer, more inventory coming to market is a welcome sight. More supply means more options and less competition, which could mean fewer bidding wars.

According to the latest Monthly Housing Market Trends Report, supply levels are continuing to increase, which is different from the typical summer market:

“In June, newly listed homes grew by 5.5% on a year-over-year basis, and by 10.9% on a month-over-month basis. Typically, fewer newly listed homes appear on the market in the month of June compared to May. This year, growth in new listings is continuing later into the summer season, a welcome sign for a tight housing market.”

If you’re having trouble finding your next home, this news should give you the hope and motivation to keep your buying process moving forward. Experts project mortgage rates will begin increasing, which will make purchasing a home less affordable as time passes. You can still capitalize on today’s low interest rates, so stick with your search as more homes come to market.

Sellers: Our Supply Challenges Aren’t Over Yet, so Now Is the Time To Sell

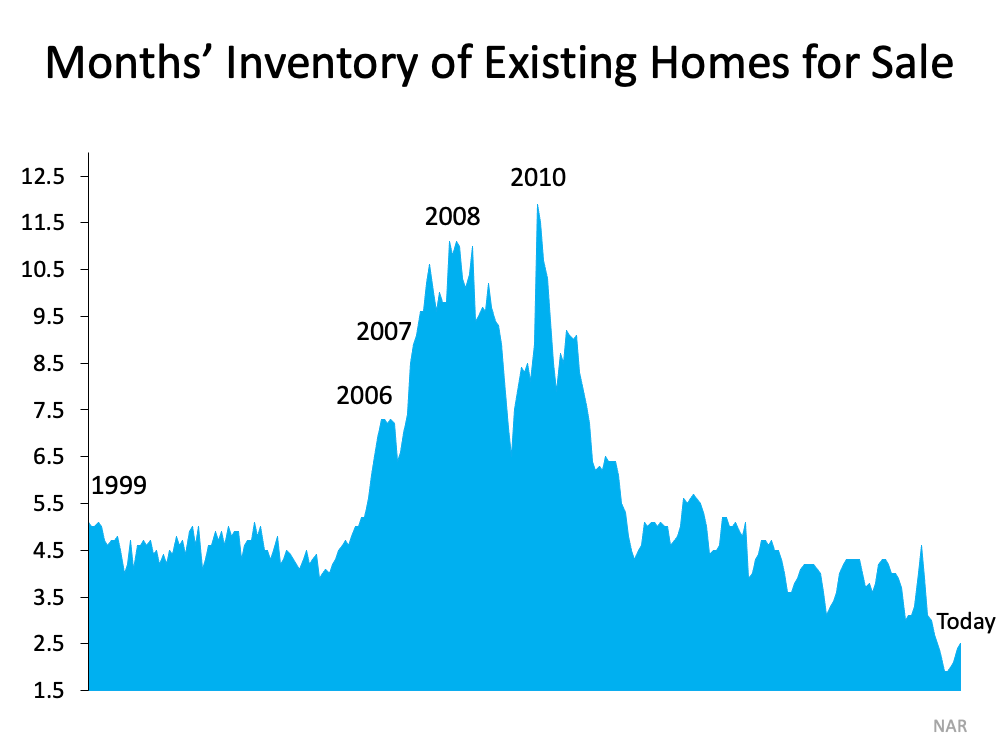

If you’ve been putting off selling your house, you shouldn’t wait much longer. The year’s month-over-month gains in homes for sale have helped buyers, but we’re still very much in a sellers’ market.

As the graph below shows, even with the number of homes for sale rising, we’re still well below the supply levels we’ve seen historically: Of course, more homes are coming to market now, and more are expected in the coming months. Selling your house this summer gives you the chance to get ahead of the competition and maximize your sales potential before more homes are put up for sale in your neighborhood.

Of course, more homes are coming to market now, and more are expected in the coming months. Selling your house this summer gives you the chance to get ahead of the competition and maximize your sales potential before more homes are put up for sale in your neighborhood.

Bottom Line

More homes for sale means more options for buyers and more competition for sellers. Whether you’re looking to buy or sell, let’s connect today to discuss your options and why it’s still a good time to make your move.

To view original article, visit Keeping Current Matters.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.

Where Are People Moving Today and Why?

If you’re thinking of moving, you may be considering the inventory and affordability challenges in the housing market and how to offset these.