“Today’s mortgage rates are still very low, but experts project they’ll continue to rise modestly this year.”

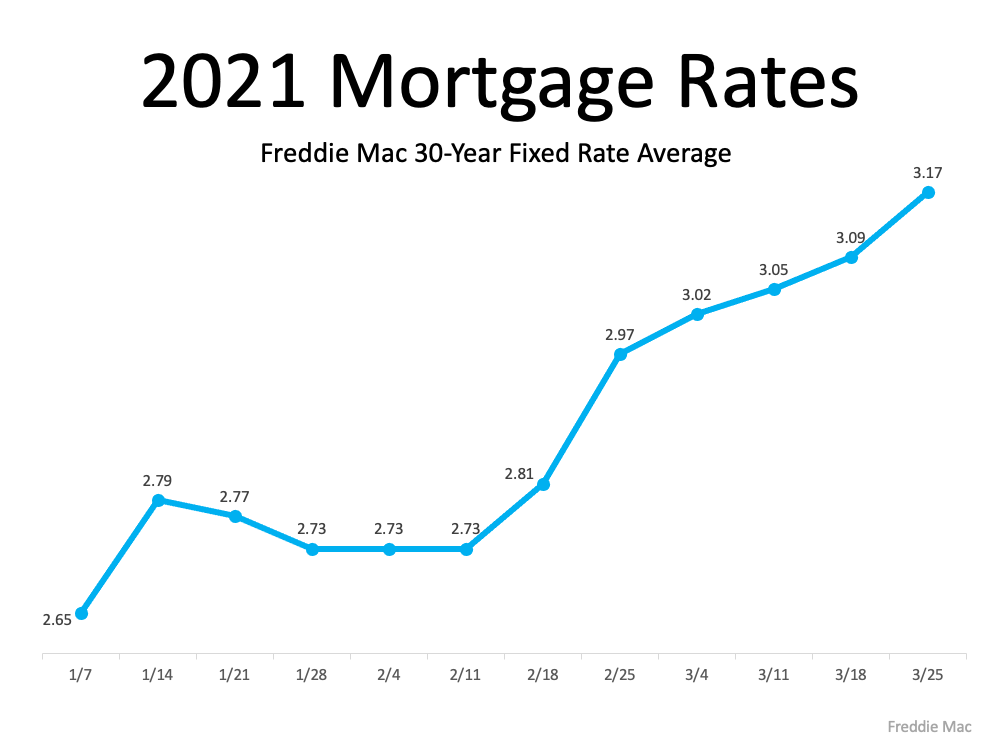

Mortgage rates are on the rise this year, but they’re still incredibly low compared to the historic average. However, anytime there’s a change in the mortgage rate, it affects what you can afford to borrow when you’re buying a home. As Sam Khater, Chief Economist at Freddie Mac, shares:

“Since January, mortgage rates have increased half a percentage point from historic lows and home prices have risen, leaving potential homebuyers with less purchasing power.” (See graph below):

When buying a home, it’s important to determine a monthly budget so you can plan for and understand what you can afford. However, when you need to stick to your budget, even a small increase in the mortgage rate can make a big difference.

When buying a home, it’s important to determine a monthly budget so you can plan for and understand what you can afford. However, when you need to stick to your budget, even a small increase in the mortgage rate can make a big difference.

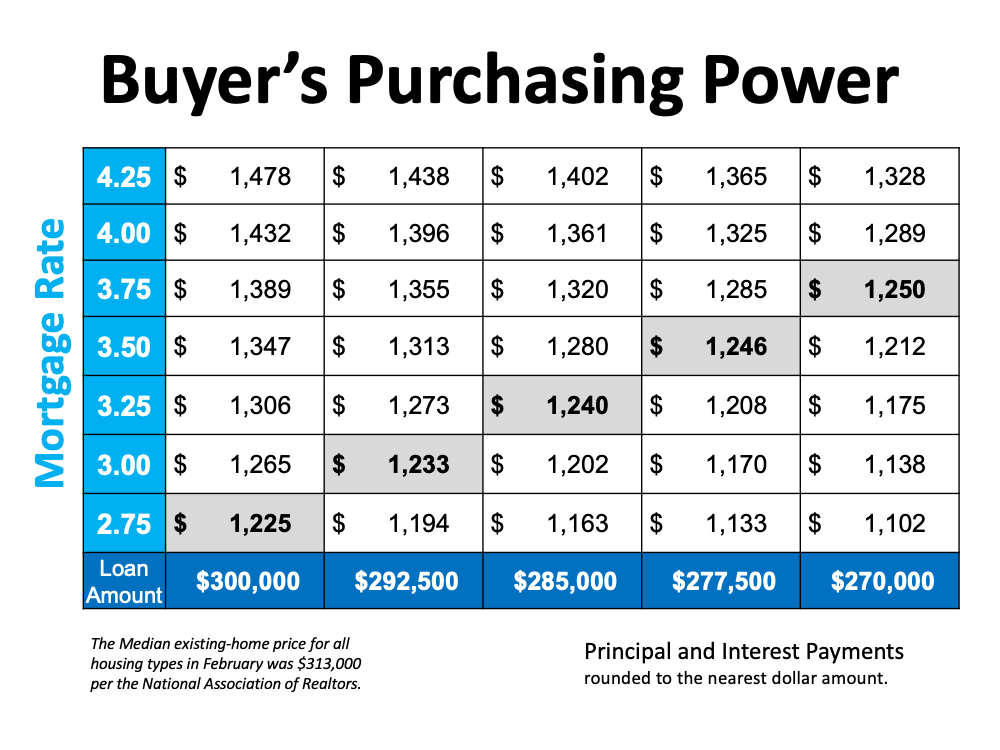

According to the National Association of Realtors (NAR), today, the median existing-home price is $313,000. Using $300,000 as a simple number close to the median price, here’s an example of how a change in mortgage rate impacts your monthly principal and interest payments on a home. If, for example, you’re getting ready to buy a home and know your budget allows for a monthly payment of $1200-1250 (marked in gray on the table above), every time the mortgage rate increases, the loan amount has to decrease to keep your monthly cost in range. This means you may have to look for lower-priced homes as mortgage rates go up if you want to be able to maintain your budget.

If, for example, you’re getting ready to buy a home and know your budget allows for a monthly payment of $1200-1250 (marked in gray on the table above), every time the mortgage rate increases, the loan amount has to decrease to keep your monthly cost in range. This means you may have to look for lower-priced homes as mortgage rates go up if you want to be able to maintain your budget.

In essence, it’s ideal to close on a home loan when mortgage rates are low, so you can afford to borrow more money. This gives you more purchasing power when you buy a home. Mark Fleming, Chief Economist at First American, explains:

“Monthly payments have remained manageable despite soaring home prices because of low mortgage rates. In fact, monthly payments remain below the $1,250 to $1,260 range that we saw in both fall 2018 and spring 2019, but they are on track to hit that level this spring.

Although they remain low, mortgage rates have begun to increase and are expected to rise further later in the year, thus affordability will test buyer demand in the months ahead and likely help slow the pace of price growth.”

Today’s mortgage rates are still very low, but experts project they’ll continue to rise modestly this year. As a result, every moment counts for homebuyers who want to secure the lowest mortgage rate they can in order to be able to afford the home of their dreams.

Bottom Line

Thanks to low mortgage rates, the spring housing market’s in bloom for buyers – but these favorable conditions may not last for long. Let’s connect today to start the homebuying process while your purchasing power is still holding strong.

To view original article, visit Keeping Current Matters.

The Big Advantage If You Sell This Spring

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low.

Homebuyer Activity Shows Signs of Warming Up for Spring

The recent uptick in mortgage applications, and the decline in mortgage rates, is good news for sellers!

Trying To Buy a Home? Hang in There.

As we move into the spring buying season, even though we are still in a sellers’ market, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving and let’s connect today!

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂