“If you’re on the fence about whether to buy a home or not, it’s helpful to know exactly how mortgage rate shifts affect your purchasing power.”

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

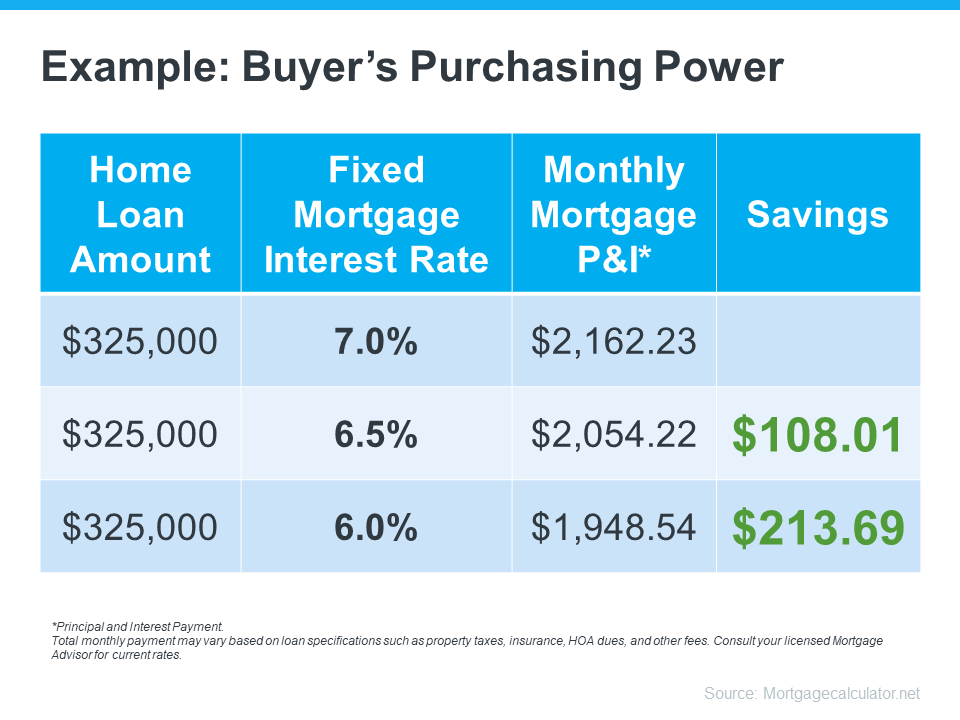

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

Will We See a Surge of Homebuyers Moving to the Suburbs?

With the ongoing health crisis, it’s no surprise that many people are starting to consider moving out of bigger cities.

Homeownership Rate Continues to Rise in 2020

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates.

Just Listed! 36A Miller Avenue

Another listing by Reade Stewart! This 3 bedroom country colonial home is waiting for you! Call Reade today to schedule a private viewing.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

A Real Estate Pro Is More Helpful NOW than Ever

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.