“If you’re on the fence about whether to buy a home or not, it’s helpful to know exactly how mortgage rate shifts affect your purchasing power.”

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

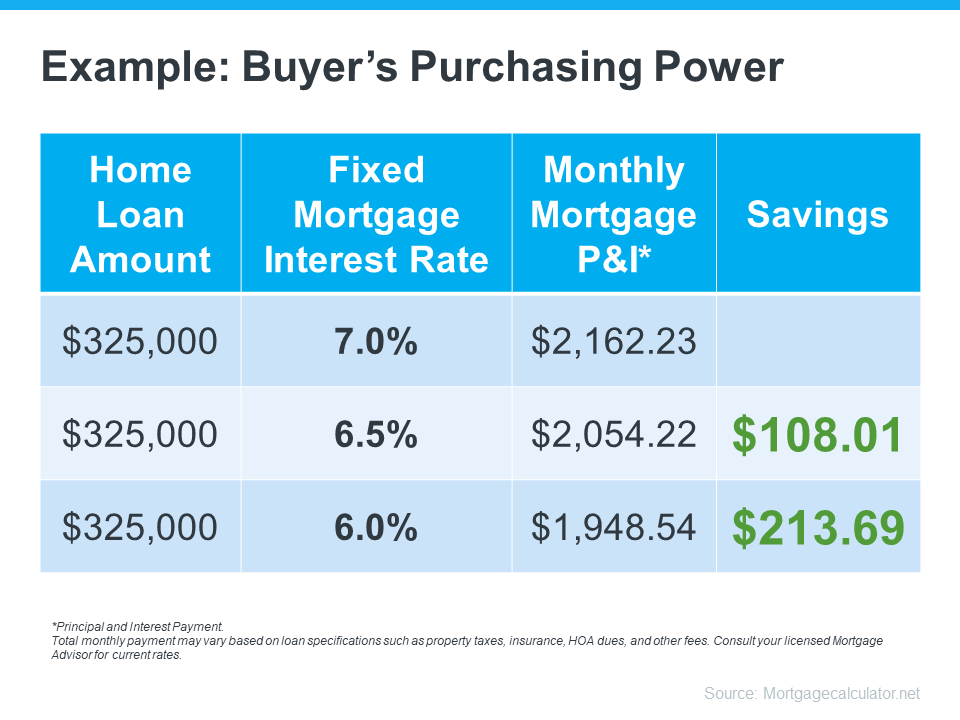

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

3 Reasons to Be Optimistic about Real Estate in 2021

While the economy improves and interest rates remain low, homes are expected to continue appreciating in the coming year.

Did You Outgrow Your Home in 2020?

It may seem hard to imagine that the home you’re in today might not be your forever home. Many needs have changed in 2020 and your home may no longer fit your lifestyle.

Happy Holidays!

May your holiday season be filled with health,

happiness and laughter through the New Year!

#brookhamptonrealty

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.