“If you’re on the fence about whether to buy a home or not, it’s helpful to know exactly how mortgage rate shifts affect your purchasing power.”

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

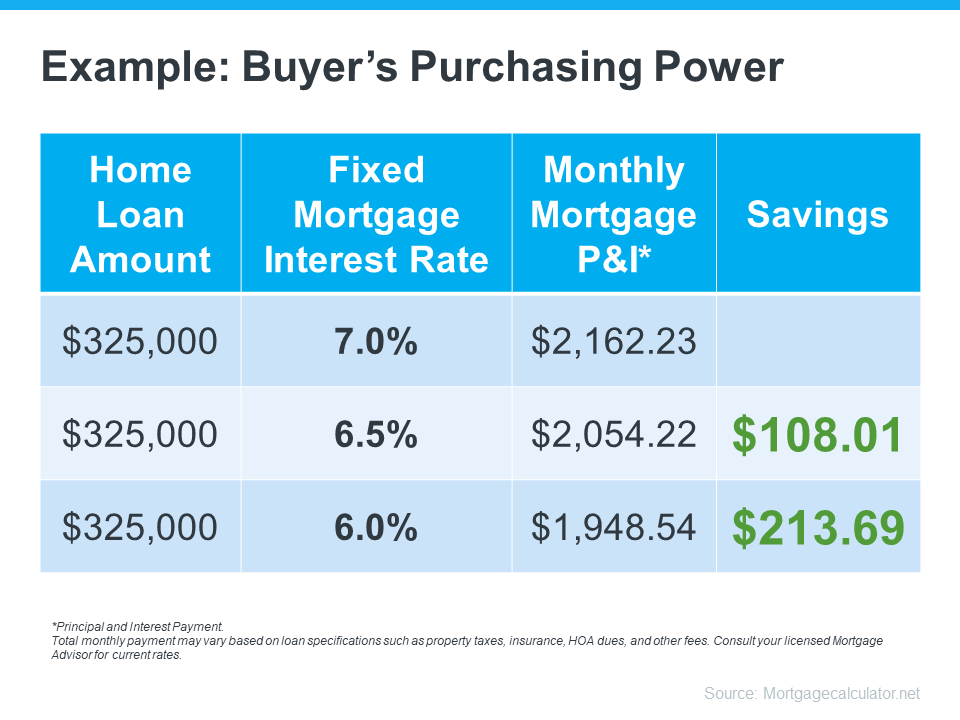

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

Is the Economic Recovery Beating All Projections?

Is the U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected?

Homes Across the Country Are Selling Fast

Buyers are actively searching for and purchasing homes at a record-breaking pace.

How Low Inventory May Impact the Housing Market This Fall

Considering selling your house? Let’s talk about how you can benefit from the market trends in our area.

The Surging Real Estate Market Continues to Climb

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum.

Two New Surveys Indicate Urban to Suburban Lean

Americans are feeling less enamored with living in a large city and may be longing for the open spaces in suburban and rural areas.

Just Listed! 1884 Belt Street

Check out the latest listing by Donna Variale!

Well maintained, 5 bedroom, 2 bath Expanded Cape!

#brookhamptonrealty