“While equitable access to housing has come a long way, homeownership can be a steeper climb for households of color.”

As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeownership can be a steeper climb for households of color. It’s an important experience to talk about, along with how it can make all the difference for diverse homebuyers to work with the right real estate experts.

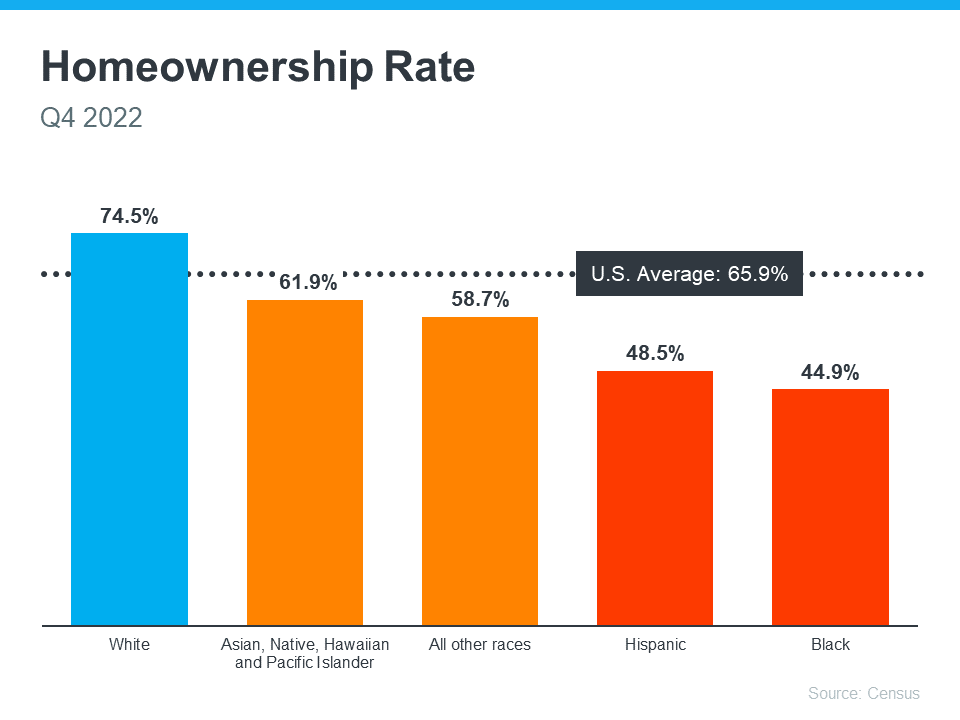

We know it’s more challenging for some to buy a home because there’s still a measurable gap between the overall average U.S. homeownership rate and that of non-white groups. Today, the lowest homeownership rate persists in the Black community (see graph below):

Homeownership is an essential piece for building household wealth that can be passed down to future generations. However, there are obstacles in the homebuying process that can negatively impact certain groups. This can delay or prevent many from achieving homeownership, challenging their ability to benefit from everything owning a home offers. A recent report from the National Association of Realtors (NAR) explains:

“. . . not all [households] have the same opportunities to homeownership, with many of them facing more constraints in their effort to achieve the American Dream. . . . Given that homeownership contributes to wealth accumulation and the homeownership rate is lower in minority groups, data shows that the net worth for these groups is also lower.”

However, with the right support and resources, there are solutions if you’re part of this community and planning to buy a home. Jacob Channel, Senior Economist at LendingTree, shares:

“The problem does exist. We have data that back that up. But there are solutions, and Black homebuyers shouldn’t lose faith that they’ll never be able to become homeowners.”

That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals aren’t only experienced advisors who understand the local market and give the best advice. They’re also compassionate allies who will advocate for your best interests every step of the way.

Bottom Line

Access to housing improves every day, but there are still equity challenges that some buyers face. Let’s connect to make sure you have an advocate on your side as you walk the path to homeownership.

To view original article, visit Keeping Current Matters.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.

How To Prep Your House for Sale This Fall

Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment.

If You’re Thinking of Selling Your House This Fall, Hire a Pro

A trusted real estate advisor will keep you updated and help you make the best decisions based on current market trends.

The True Strength of Homeowners Today

Home equity allows homeowners to be in control. This is yet another reason we won’t see the housing market crash like we saw in 2008 when many owed more on their homes than they were worth.