“While equitable access to housing has come a long way, homeownership can be a steeper climb for households of color.”

As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeownership can be a steeper climb for households of color. It’s an important experience to talk about, along with how it can make all the difference for diverse homebuyers to work with the right real estate experts.

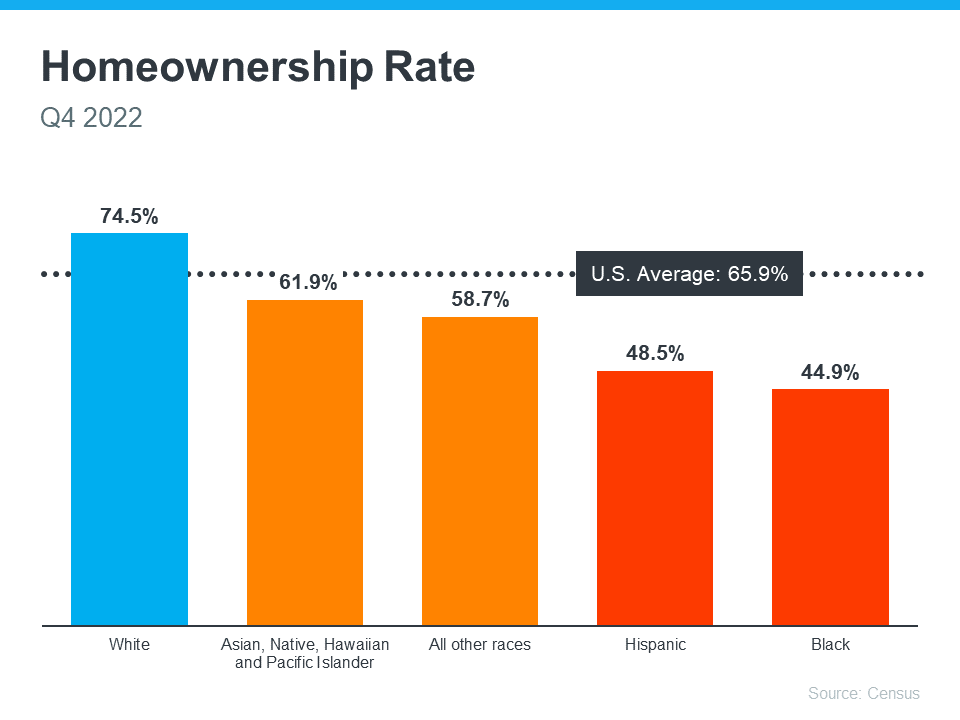

We know it’s more challenging for some to buy a home because there’s still a measurable gap between the overall average U.S. homeownership rate and that of non-white groups. Today, the lowest homeownership rate persists in the Black community (see graph below):

Homeownership is an essential piece for building household wealth that can be passed down to future generations. However, there are obstacles in the homebuying process that can negatively impact certain groups. This can delay or prevent many from achieving homeownership, challenging their ability to benefit from everything owning a home offers. A recent report from the National Association of Realtors (NAR) explains:

“. . . not all [households] have the same opportunities to homeownership, with many of them facing more constraints in their effort to achieve the American Dream. . . . Given that homeownership contributes to wealth accumulation and the homeownership rate is lower in minority groups, data shows that the net worth for these groups is also lower.”

However, with the right support and resources, there are solutions if you’re part of this community and planning to buy a home. Jacob Channel, Senior Economist at LendingTree, shares:

“The problem does exist. We have data that back that up. But there are solutions, and Black homebuyers shouldn’t lose faith that they’ll never be able to become homeowners.”

That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals aren’t only experienced advisors who understand the local market and give the best advice. They’re also compassionate allies who will advocate for your best interests every step of the way.

Bottom Line

Access to housing improves every day, but there are still equity challenges that some buyers face. Let’s connect to make sure you have an advocate on your side as you walk the path to homeownership.

To view original article, visit Keeping Current Matters.

A Key to Building Wealth is Homeownership

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

The Many Benefits of Homeownership

Home ownership can extend beyond your shelter to help create social, community, and civic benefits as well. You’ll feel a strong connection to the community around you.

The Average Homeowner Gained More Than $55K in Equity over the Past Year

The equity you’re gaining in today’s market, may be what you need to cover a large portion of the down payment on your next home.

Don’t Get Caught Off Guard by Closing Costs

The best way to understand what you’ll need at the closing table is to work with a team of trusted real estate professionals.

This Spring Presents Sellers with a Golden Opportunity

Home prices have been skyrocketing in recent years because of the imbalance of supply and demand.

How to Navigate a Market Where Multiple Offers Is the New Normal

To help you navigate bidding wars with multiple offers, an expert real estate advisor is key.