How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

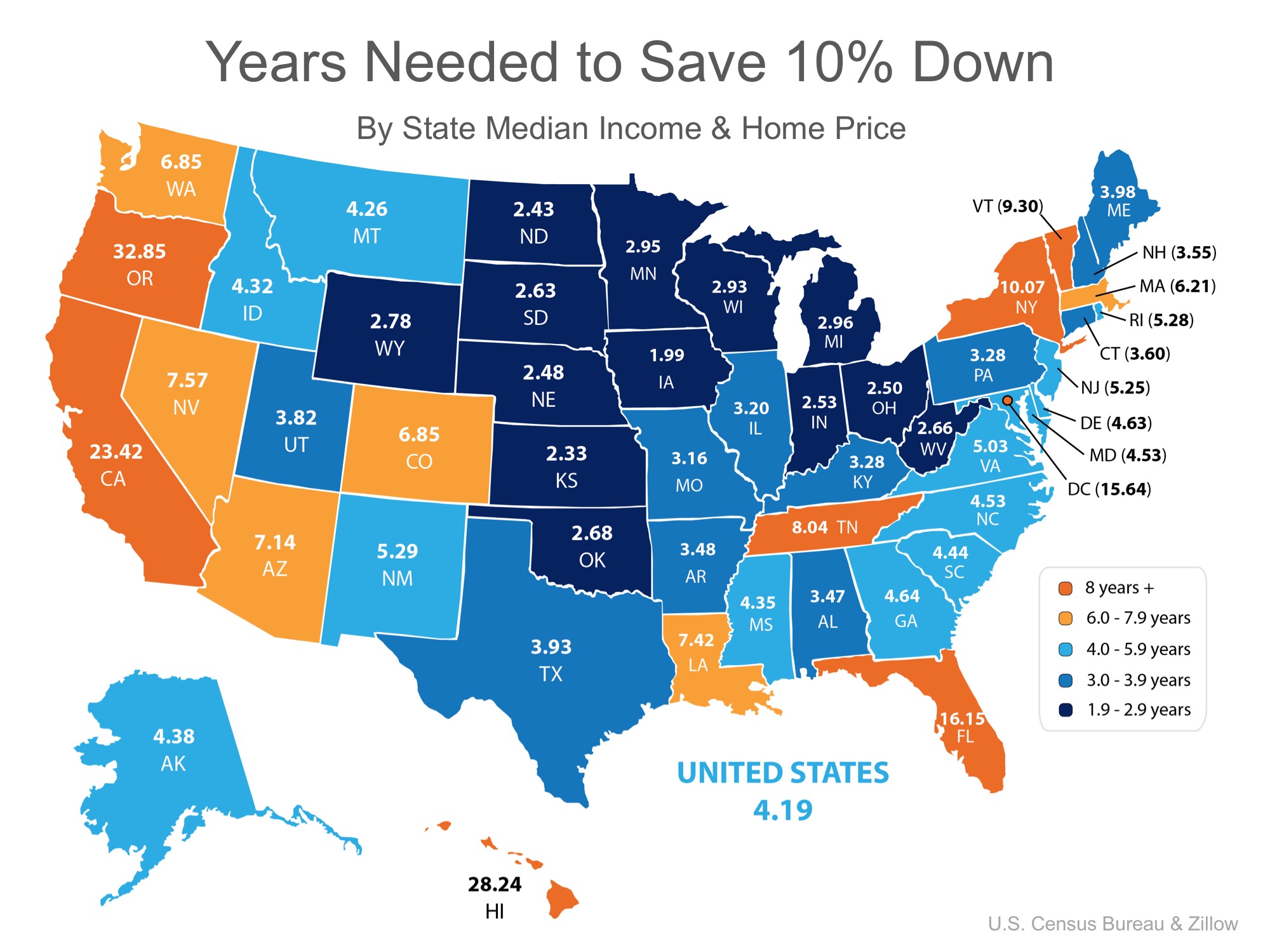

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

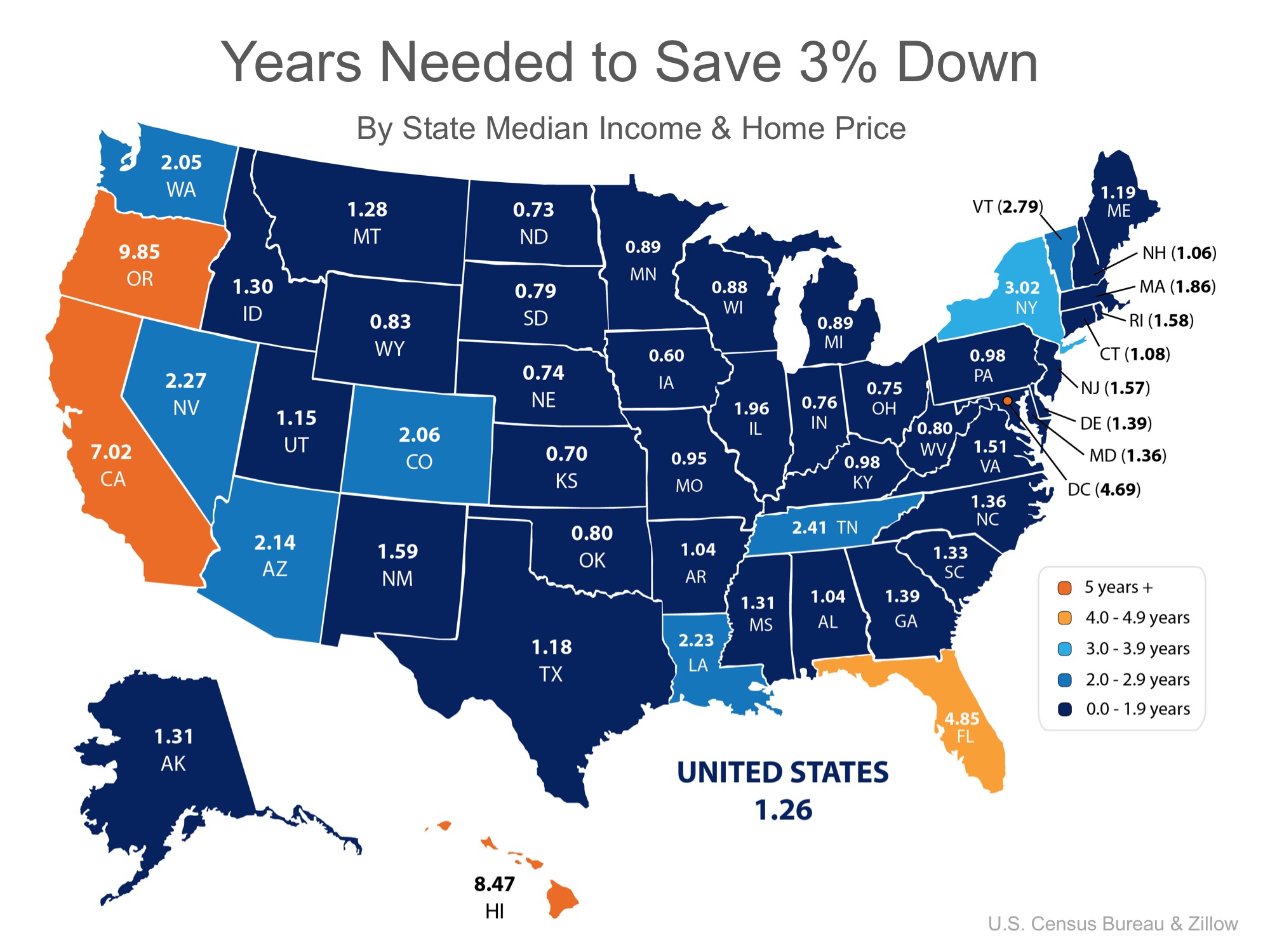

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

The Number of Homes for Sale Is Increasing

In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area.

Thinking of Selling? You Want an Agent with These Skills

A great agent will be very good at explaining what’s happening in the housing market in a way that’s easy to understand.

Home Prices Are Climbing in These Top Cities

Persistent demand coupled with limited housing supply are key drivers pushing home values upward.

How Buying or Selling a Home Benefits Your Community

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

Tips for Younger Homebuyers: How To Make Your Dream a Reality

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones.

What Is Going on with Mortgage Rates?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year.

What More Listings Mean When You Sell Your House

if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now.

Now’s a Great Time To Sell Your House

Late spring and early summer are generally considered the best times to sell a house as these are the seasons most people move and buyer demand grows.

Is a Multi-Generational Home Right for You?

Looking for the perfect multi-generational home is a bit trickier than finding a regular house. A local real estate agent can help you out.

What You Really Need To Know About Home Prices

If you’re worried about if home prices will be coming down, here’s what you need to know.