How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

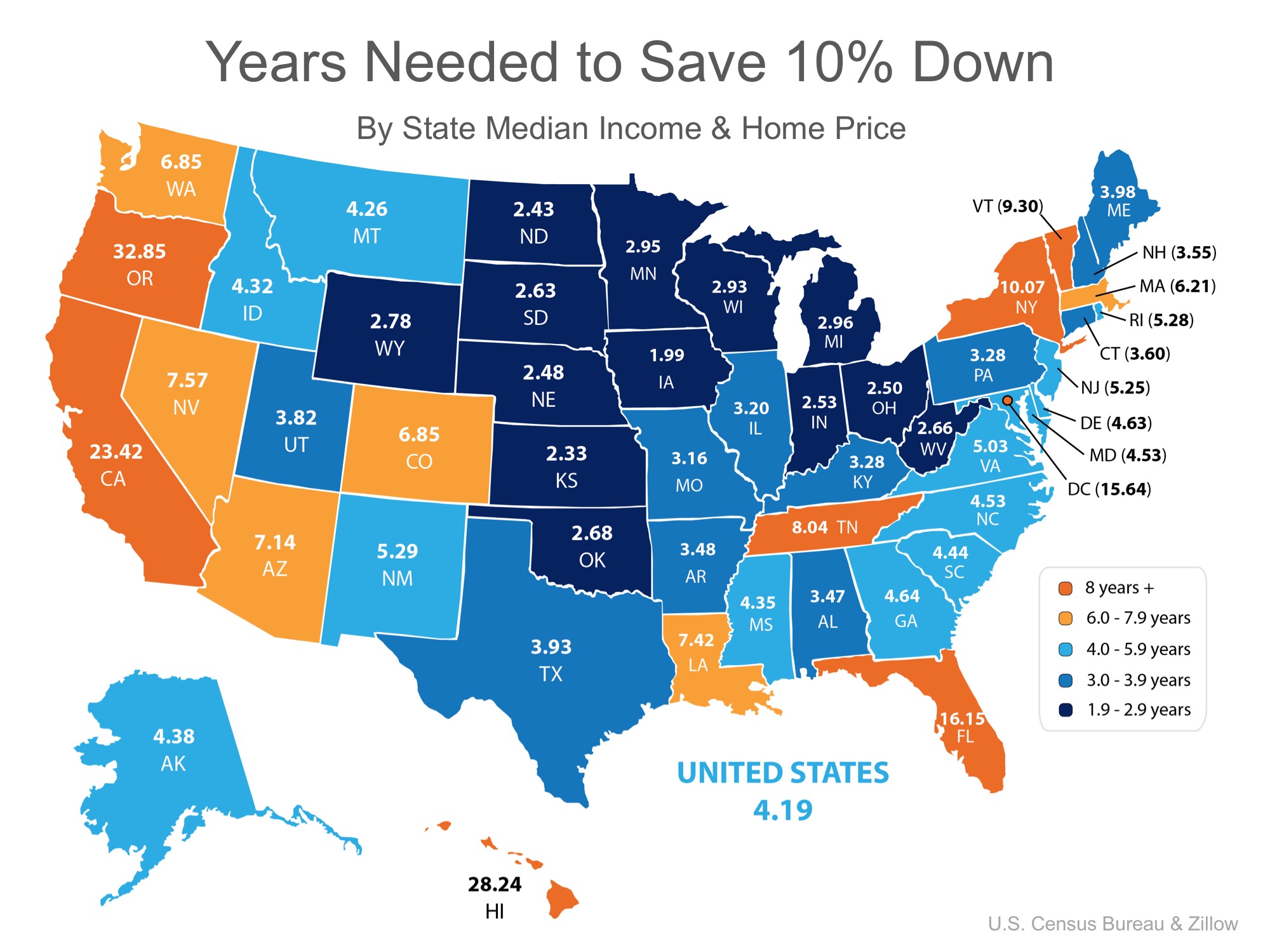

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

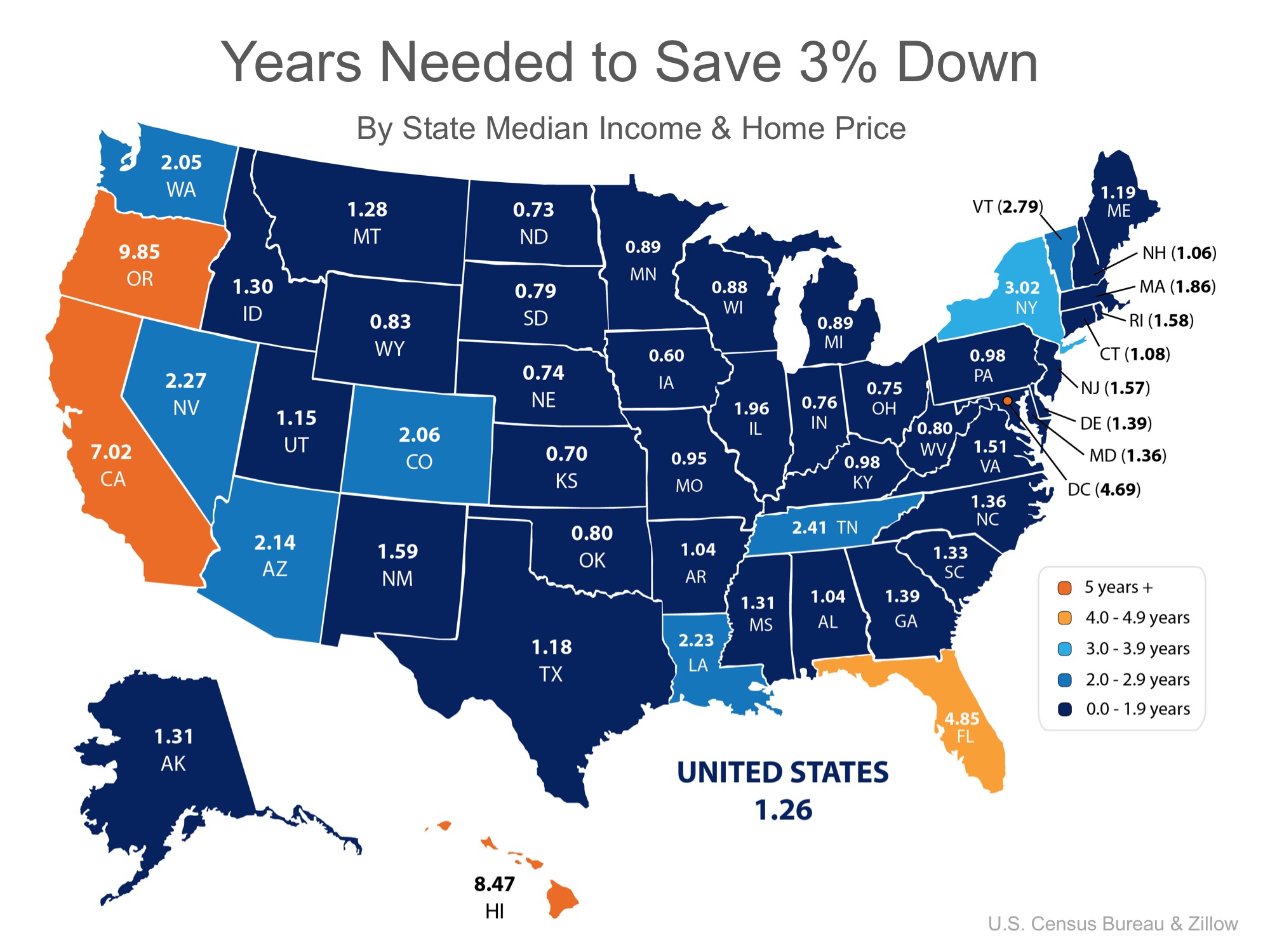

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Ever wonder why they change?

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.

3 Keys To Hitting Your Homeownership Goals in 2024

The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead.

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

Homeownership Is Still at the Heart of the American Dream

Buying a home is a powerful decision, and it remains at the heart of the American Dream.

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why Pre-Approval Is Your Homebuying Game Changer

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip.