How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

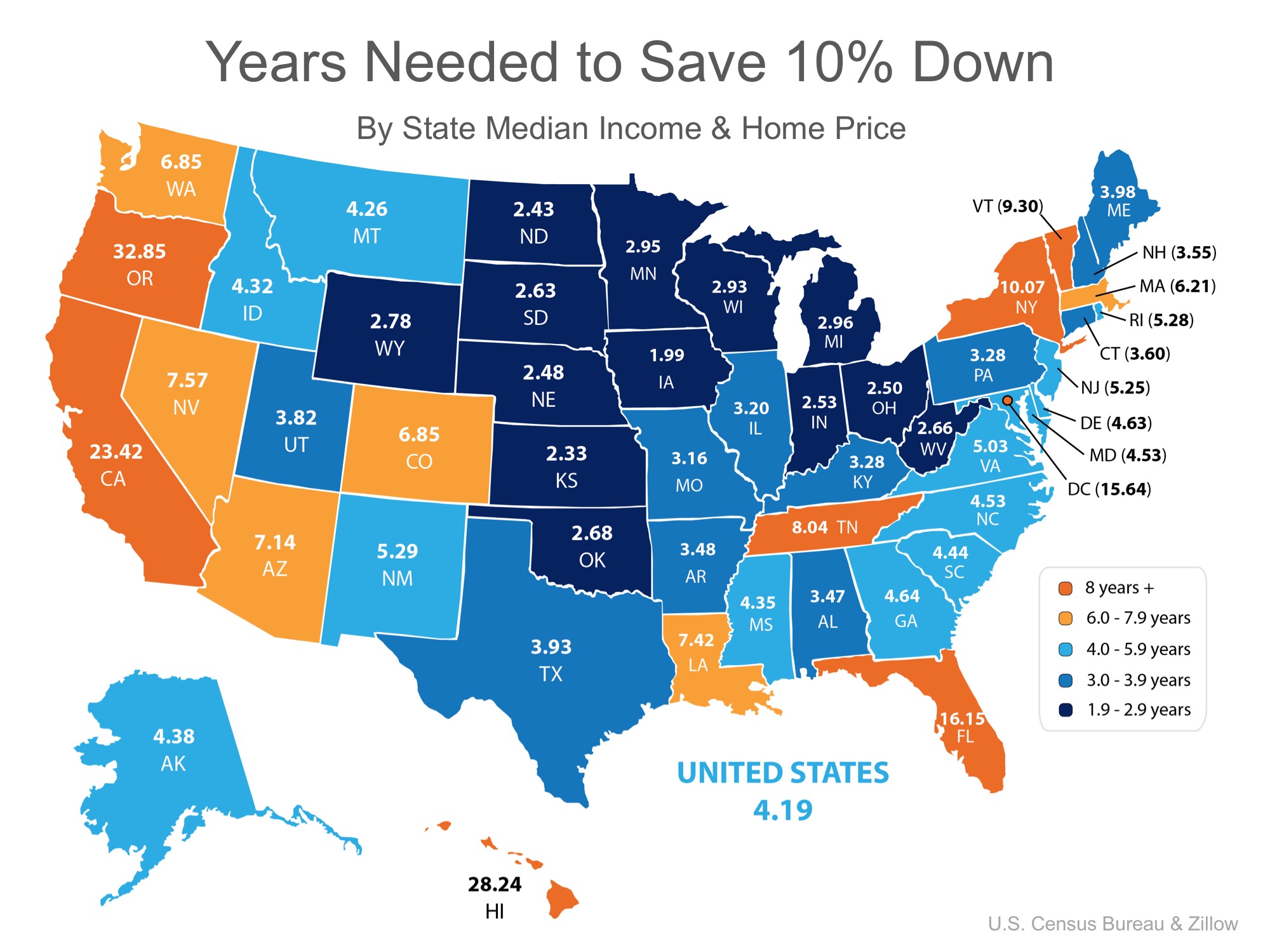

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

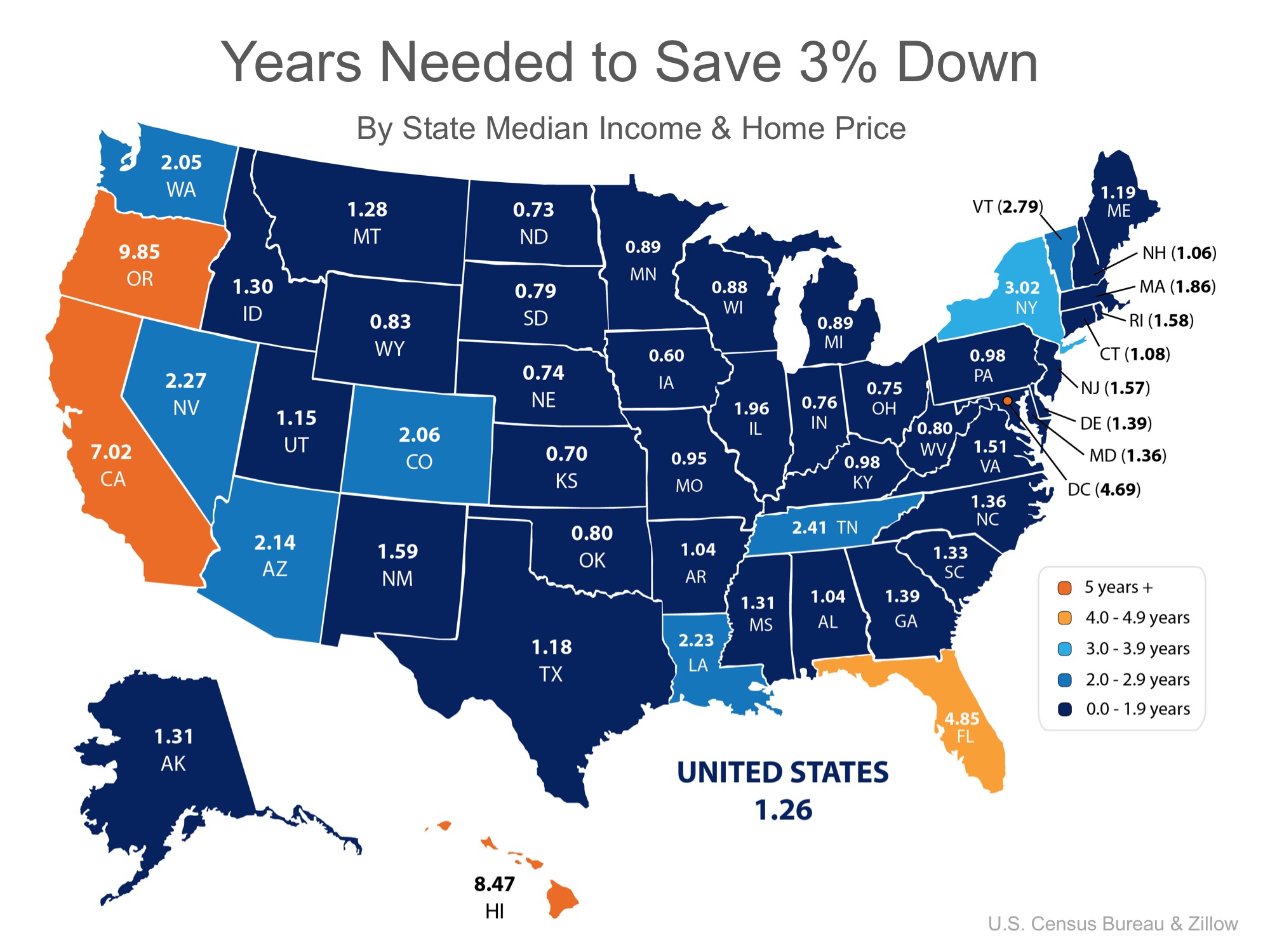

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

What You Need To Know About Saving for a Home in 2024

It’s important to work with a real estate professional to understand what’s best for your situation in your local area.

Expert Quotes on the 2024 Housing Market Forecast

If you’re thinking about making a move next year, know that early signs show we’re turning a corner.

The Perfect Home Could Be the One You Perfect After Buying

Take a close look at your wish list and considering what features you really need in your next home versus which ones are nice-to-have.

Experts Project Home Prices Will Rise over the Next 5 Years

Experts project home prices will continue to rise across the country for years to come at a pace that’s more normal for the market.

Retiring Soon? Why Moving Might Be the Perfect Next Step

Whether you’re looking to downsize or simply be closer to loved ones, your home equity can be a key to realizing your homeownership goals.

Why Now Is Still a Great Time To Sell Your House

Nationally, demand is still high compared to the last normal years in the housing market and plenty of buyers are making moves right now

Why You Need To Use a Real Estate Agent When You Buy a Home

When it comes to buying a home, there are a lot of moving pieces. That’s why the best place to start is connecting with a real estate agent.

Sell Smarter: Why Working with a Real Estate Agent May Beat Going Solo

A real estate agent can help you price your home correctly and guide you through the paperwork.

If Your House Hasn’t Sold Yet, It May Be Overpriced

With today’s higher mortgage rates already putting a stretch on their budget, buyers are being a bit more sensitive about price.

When You Sell Your House, Where Do You Plan To Go?

Working with a real estate agent throughout the process is mission-critical to your success. They’ll help you explore all of your options.