How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

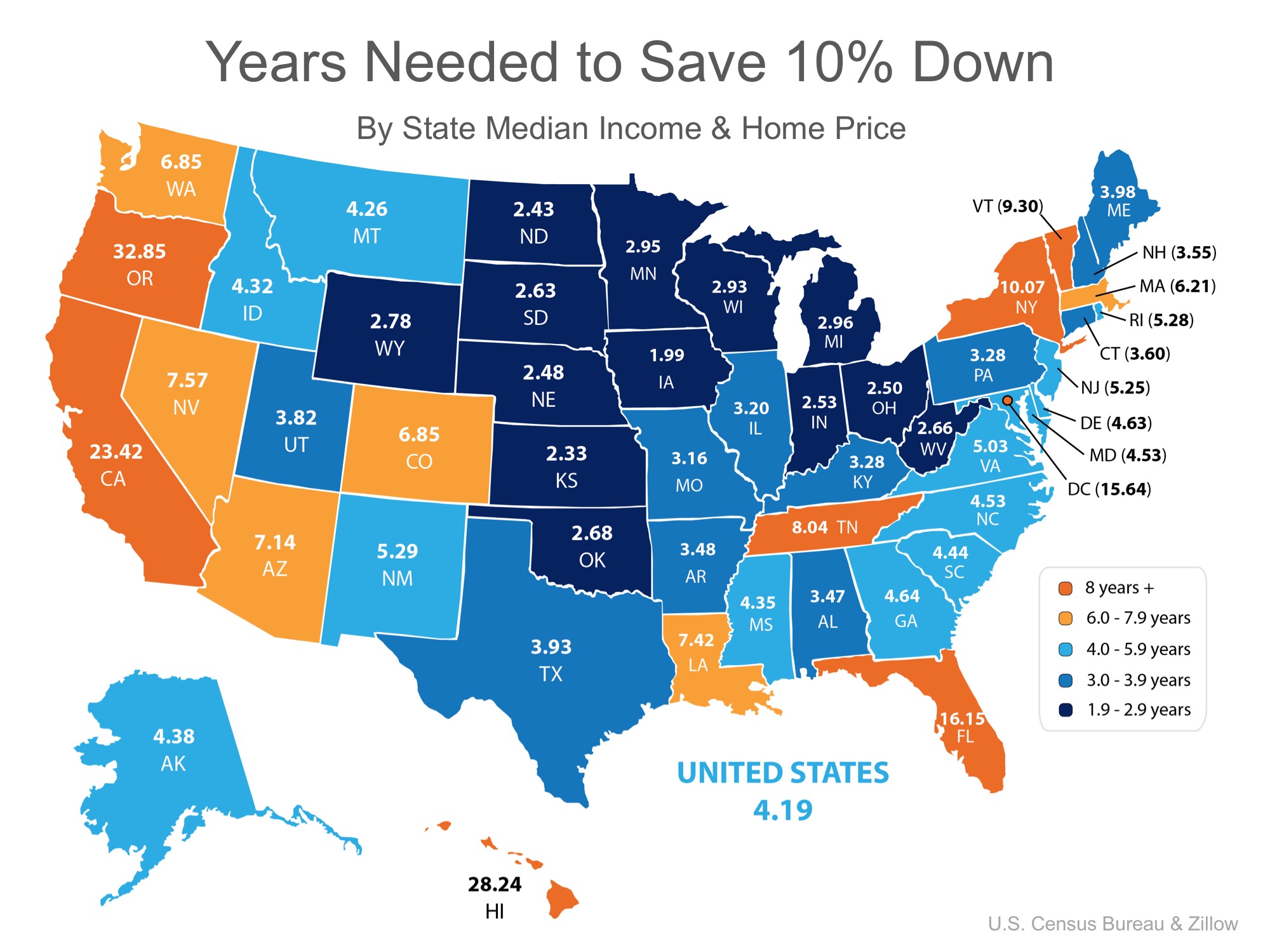

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

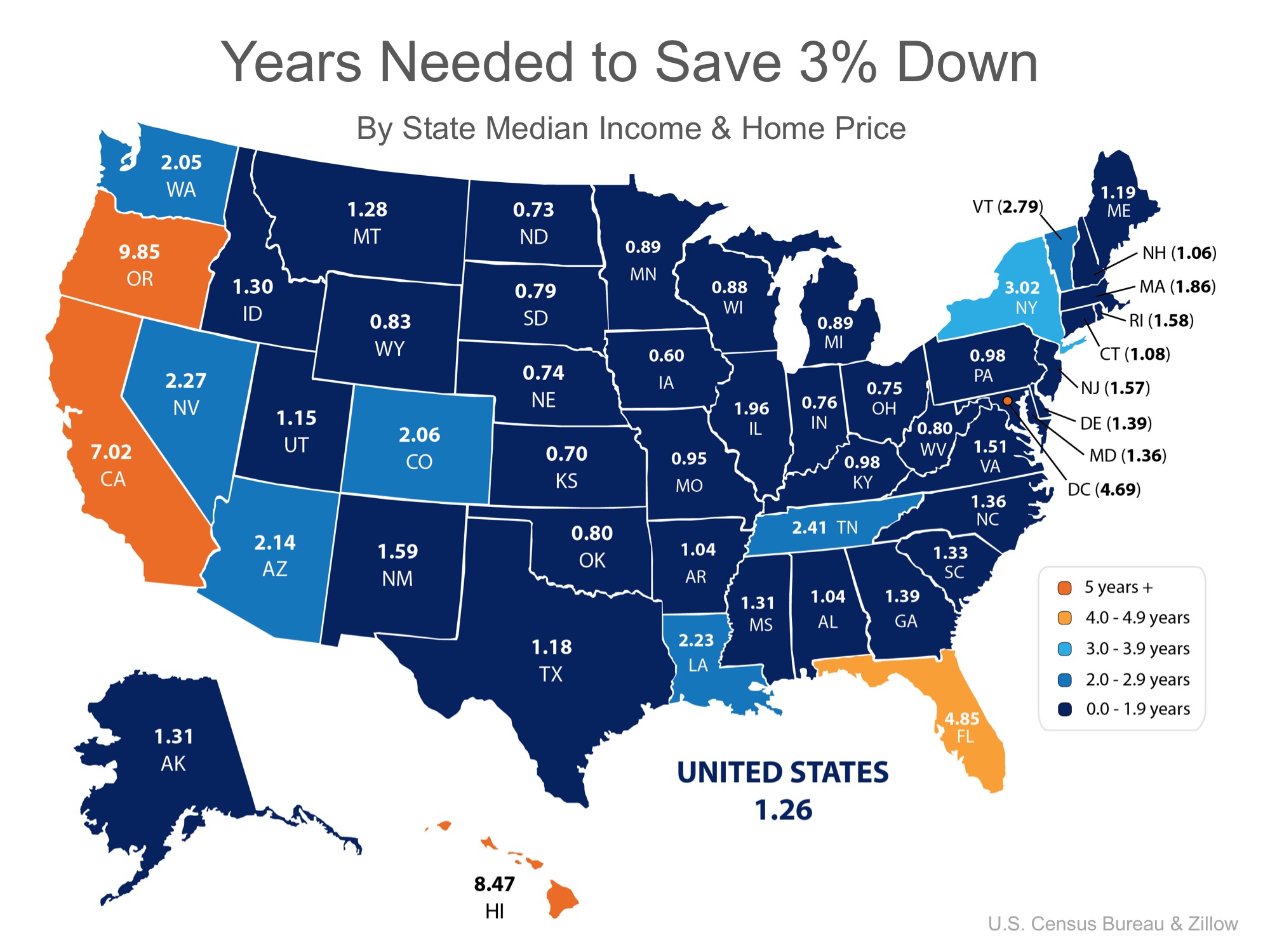

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Are The Top 3 Housing Market Questions on Your Mind?

When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

Thinking About Using Your 401(k) To Buy a Home?

Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.

Don’t Believe Everything You Read About Home Prices

If you believe home prices are falling, it may be time to get your insights from the experts, and they’re saying prices are climbing.

Is Wall Street Buying Up All the Homes in America?

Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

Homeowner Net Worth Has Skyrocketed

Buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time, meaning you have more equity.

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.

Reasons To Sell Your House Before the New Year

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition.