How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

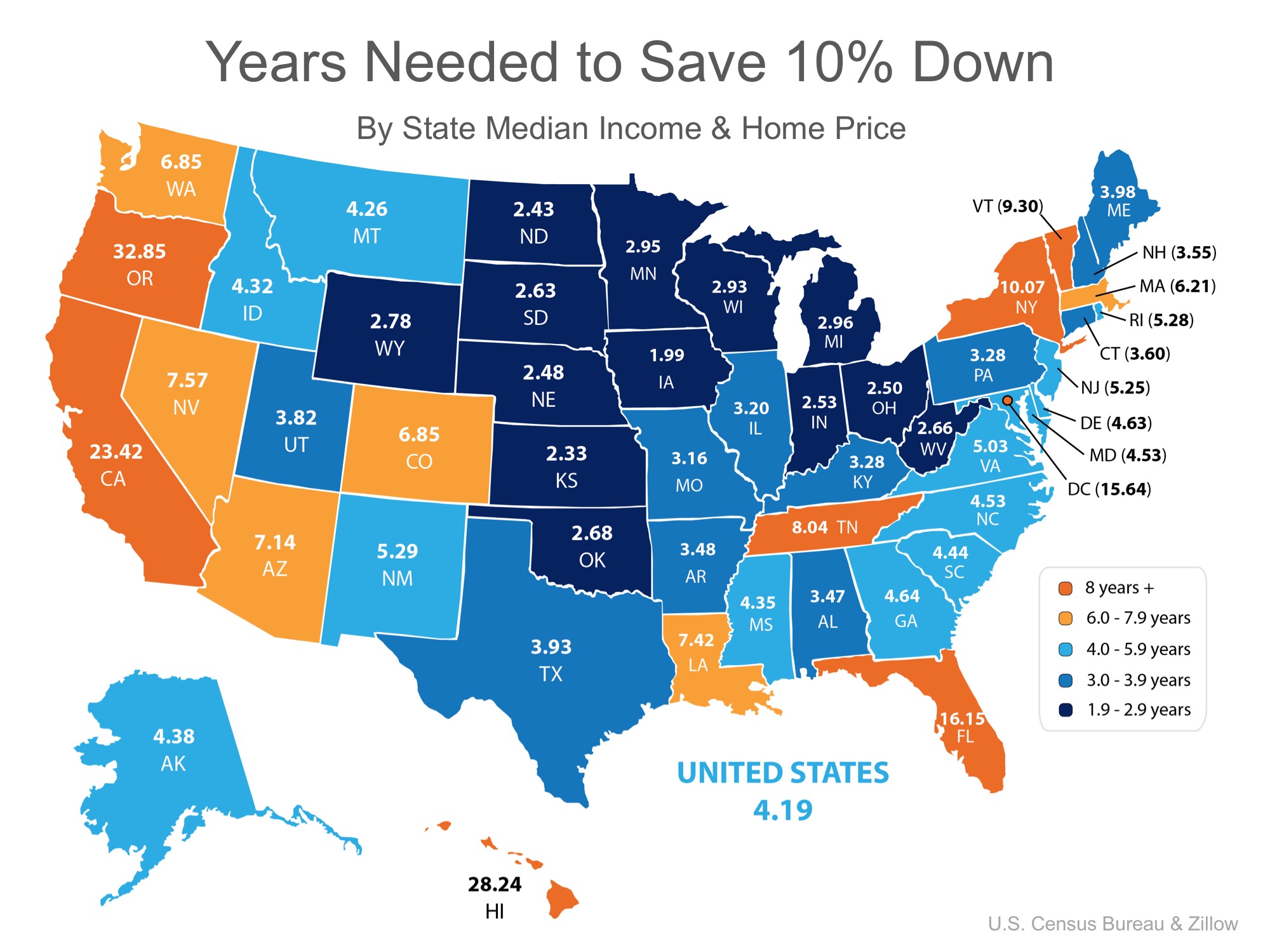

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

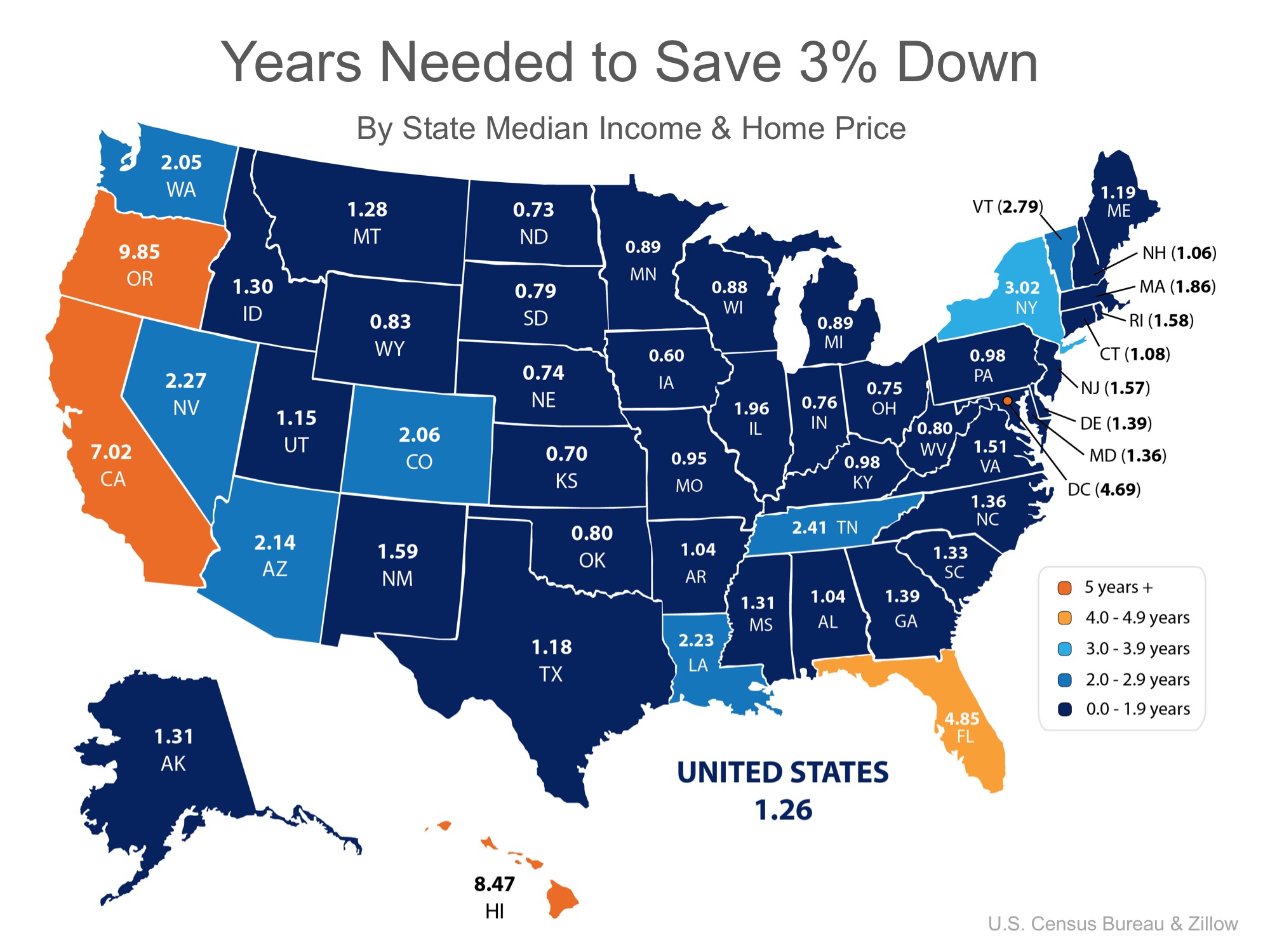

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Reasons To Sell Your House Before the New Year

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition.

Affordable Homeownership Strategies for Gen Z

One of your best resources on the journey as a young homebuyer is a trusted real estate agent.

Are Higher Mortgage Rates Here To Stay?

Experts typically recommend focusing your search on the right home purchase — not the interest rate environment.

Home Prices Are Not Falling

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Don’t Believe Everything You Read About Home Prices

If you believe home prices are falling, it may be time to get your insights from the experts, and they’re saying prices are climbing.

The Perks of Selling Your House When Inventory Is Low

Buyers have fewer choices now than they did in more typical years. And that’s why you could see some great perks if you sell today.

Key Skills You Need Your Listing Agent To Have

A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.

Foreclosures and Bankruptcies Won’t Crash the Housing Market

Foreclosure filings are inching back up to pre-pandemic numbers, BUT they’re still way lower than when the housing market crashed in 2008.

Why Home Prices Keep Going Up

Even though higher mortgage rates has caused buyer demand to moderate, home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

Are You a Homebuyer Worried About Climate Risks?

Homebuyers are interested in finding out if the house they want will be exposed to things like floods, extreme heat, and wildfires.