How Fast Can You Save for a Down Payment?

![20170424-Share-STM[1] Keeping Current Matters https://goo.gl/NEVTMv](https://brookhampton.com/wp-content/uploads/blog-post-images/20170424-Share-STM1.jpg)

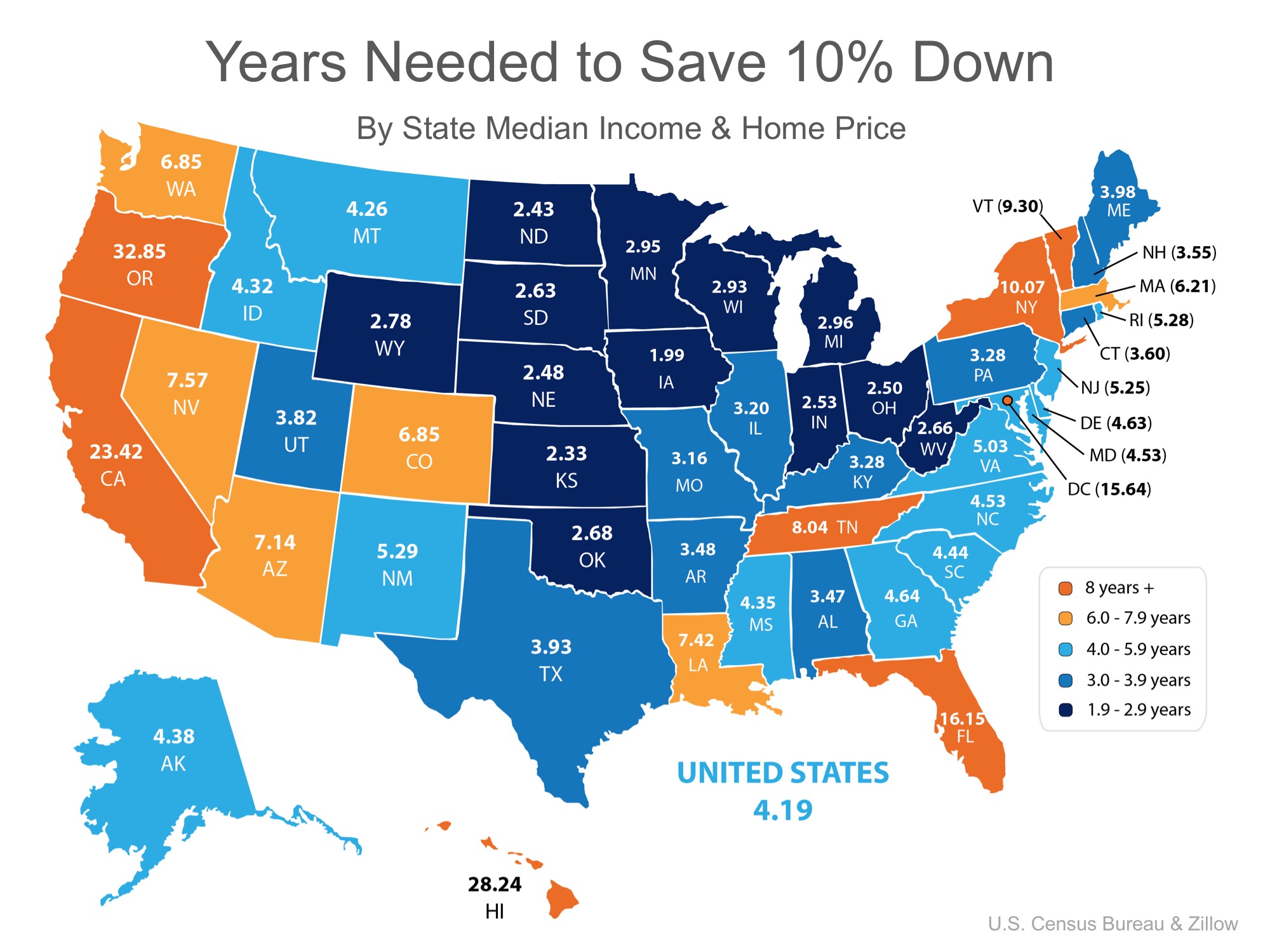

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

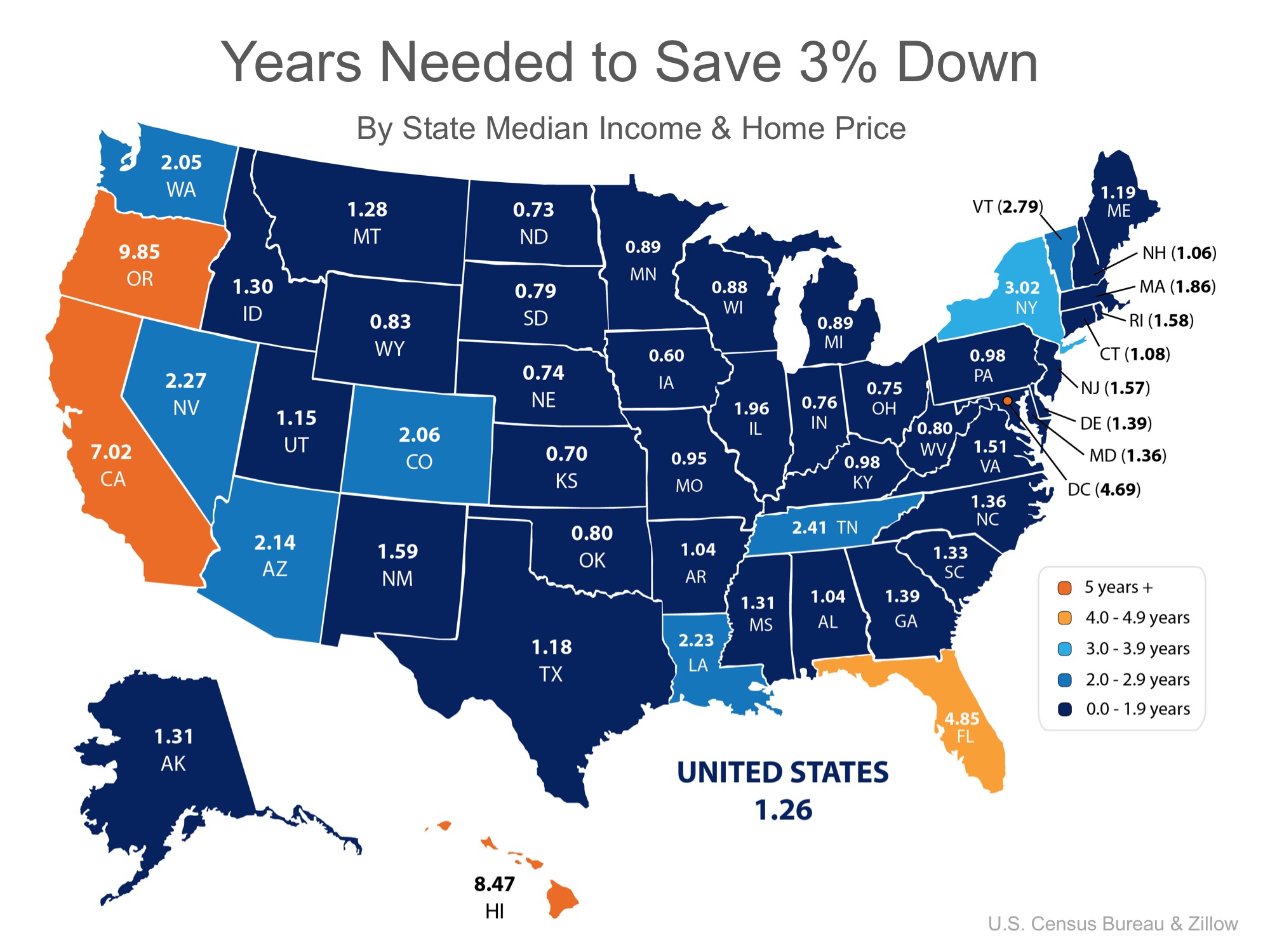

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Is the Housing Market Starting To Balance Out?

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years.

Do You Know How Much Your Home Is Worth?

The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

Buying a Home May Help Shield You from Inflation

A fixed-rate mortgage protects your budget, and home price appreciation grows your net worth.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

It’s crucial to understand what’s happening in your local market and a local real estate agent can really help.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

If you’re debating whether to buy now or wait, remember: real estate rewards those in the market, not those who try to time it perfectly.

Are Investors Actually Buying Up All the Homes?

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth

Are You Asking Yourself These Questions About Selling Your House?

The market isn’t at a standstill. Every day, thousands of people buy, and they’re looking for homes like yours.

Is a Newly Built Home Right for You? The Pros and Cons

An agent can walk you through the pros and cons of considering a newly built home and help you decide if it makes sense for you.

How To Buy a Home Without Waiting for Lower Rates

Even if mortgage rates don’t drop substantially, there are still ways to make buying a home more affordable.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

Find the right agent to make sure your house is prepped, priced, and marketed well, so you can get ahead of the competition!