How Homeownership Delivers Unsurpassed Family Wealth

There are many financial benefits to homeownership, but probably none more important than its ability to create family wealth.

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is an online resource for research and information on how homeownership contributes to individual and community success.

Their article, The First Rung on the Ladder to Economic Opportunity Is Housing, explains the importance of homeownership to a family’s financial health. In that article, they simply stated:

“The ladder to economic success can stretch only so high without the asset-building power of homeownership.”

To this point, National Association of Realtors’ (NAR) Economists’ Outlook Blog revealed in a recent post:

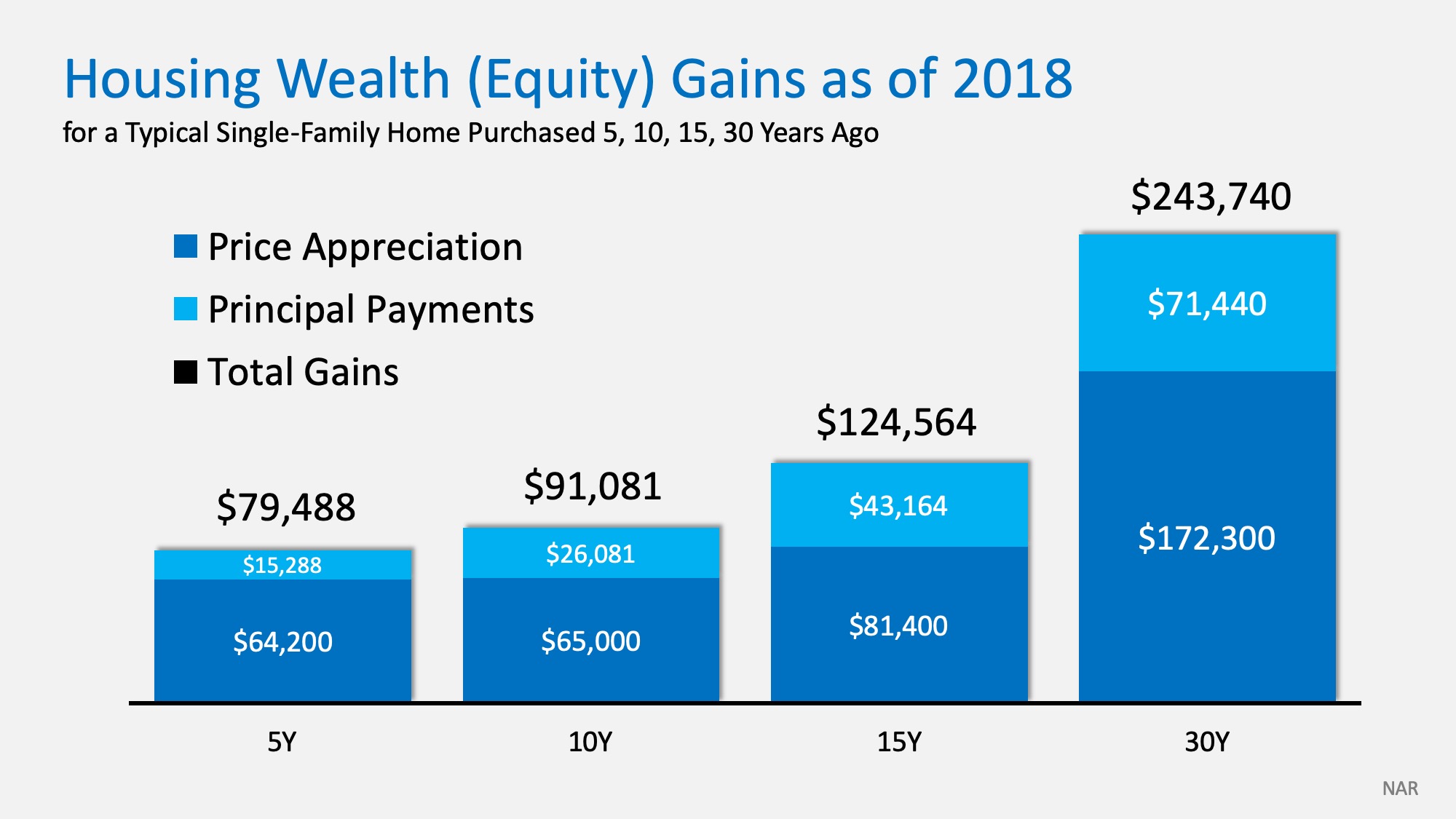

“Housing wealth contributes positively to the homeowner’s and children’s economic condition, because home equity can be tapped for expenditures such as investing in another property (which can generate rental income), home renovation (which further increases the home value), a child’s college education, emergency or major life events, or expenses in retirement… Housing wealth (or net worth or equity) is built up over time via the home price appreciation and the principal payments that the homeowner makes on the loan.”

Here is a graph showing the build-up of wealth over time: Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:

Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:

“Homeowners in the majority of markets are continuing to enjoy price gains, albeit at a slower rate of growth. A typical homeowner accumulated $9,500 in wealth over the past year.”

Later in life, this wealth is crucial…

This wealth is important to a family’s retirement plans. In a recent report from the Joint Center for Housing Studies at Harvard University titled, Housing America’s Older Adults 2018, they revealed that a renter 65 years old or older has a net worth of $6,710. Meanwhile, a homeowner 65+ years old has a net worth of $319,200. That huge difference will allow for a dramatic upgrade in one’s lifestyle during your retirement years.

Bottom Line

Homeownership builds wealth. This, in turn, allows families to have more and better options when it comes to their children and their life in retirement.

To view original article, visit Keeping Current Matters.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.