Throughout Women’s History Month, we reflect on the impact women have in our lives, and that includes impact on the housing market. In fact, since at least 1981, single women have bought more homes than single men each year, and they make up 17% of all households.

Why Is Homeownership So Important to Women?

The rise in women pursuing homeownership hasn’t just made an impact on the housing market. It’s also been an asset for those buyers and their households. That’s because homeownership has many benefits, both financial and personal.

On the financial side, housing proves to be the key to building wealth for single women. Ksenia Potapov, Economist at First American, says:

“For single women, housing has always made up a large share of total assets. Over the last 30 years, the average single woman’s wealth has increased 88% on an inflation-adjusted basis, from just over $142,000 in 1989 to $267,000 in 2019, and housing has remained the single largest component of their wealth.”

The financial security and independence homeownership provides can be life changing, too. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

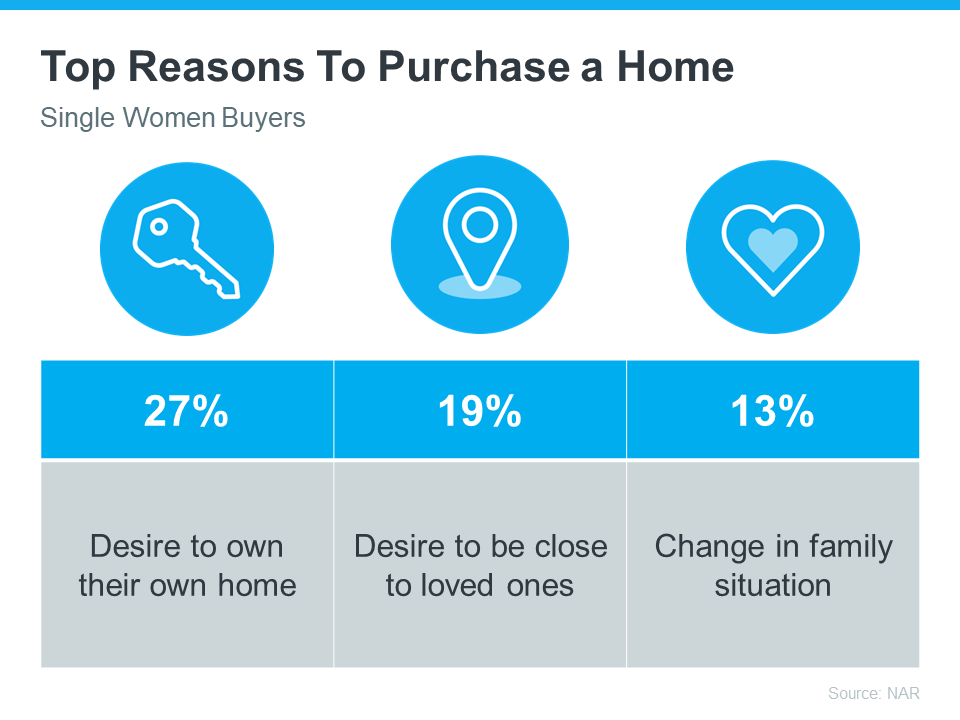

A recent report from the National Association of Realtors (NAR) shares the top reasons single women are buying a home right now (see chart below):

Bottom Line

Homeownership can be life changing no matter who you are. Let’s connect today to talk about your goals in the housing market.

Why Home Prices Keep Going Up

Even though higher mortgage rates has caused buyer demand to moderate, home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

Are Higher Mortgage Rates Here To Stay?

Experts typically recommend focusing your search on the right home purchase — not the interest rate environment.

Key Skills You Need Your Listing Agent To Have

A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.

Are You a Homebuyer Worried About Climate Risks?

Homebuyers are interested in finding out if the house they want will be exposed to things like floods, extreme heat, and wildfires.

Home Prices Are Not Falling

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Unpacking the Long-Term Benefits of Homeownership

Higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if you should buy a home right now.