“Unless specified by your loan type or lender, it’s typically not required to put 20% down.”

As you set out on your homebuying journey, you likely have a plan in place, and you’re working on saving for your purchase. But do you know how much you actually need for your down payment?

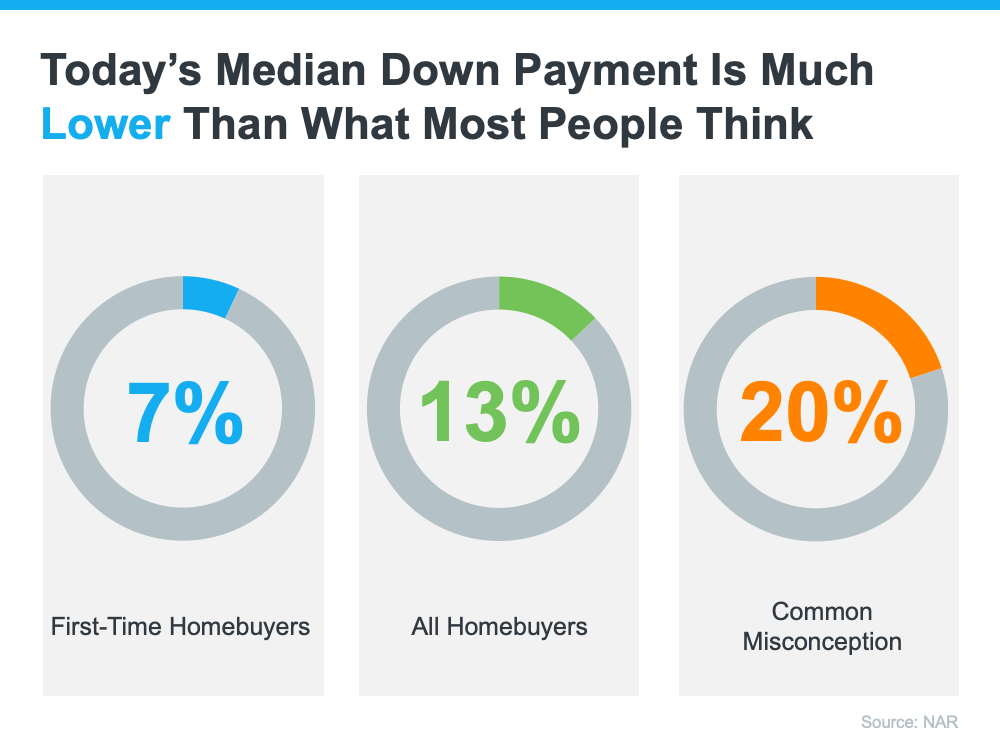

If you think you have to put 20% down, you may have set your goal based on a common misconception. Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

Unless specified by your loan type or lender, it’s typically not required to put 20% down. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today, that number is only 13%. And it’s even lower for first-time homebuyers, whose median down payment is only 7% (see graph below):

What Does This Mean for You?

While a down payment of 20% or more does have benefits, the typical buyer is putting far less down. That’s good news for you because it means you could be closer to your homebuying dream than you realize.

If you’re interested in learning more about low down payment options, there are several places to go. There are programs for qualified buyers with down payments as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Remember: a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation and explore your down payment options.

To view original article, visit Keeping Current Matters.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.

The Biggest Mistakes Buyers Are Making Today

There’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice.

How Do Climate Risks Affect Your Next Home?

How can you be sure your investment is safe from the elements? Work with a local real estate agent!

Questions You May Have About Selling Your House

If you’ve been considering selling your house, and have some questions, call us today for some clarity.