“Unless specified by your loan type or lender, it’s typically not required to put 20% down.”

As you set out on your homebuying journey, you likely have a plan in place, and you’re working on saving for your purchase. But do you know how much you actually need for your down payment?

If you think you have to put 20% down, you may have set your goal based on a common misconception. Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

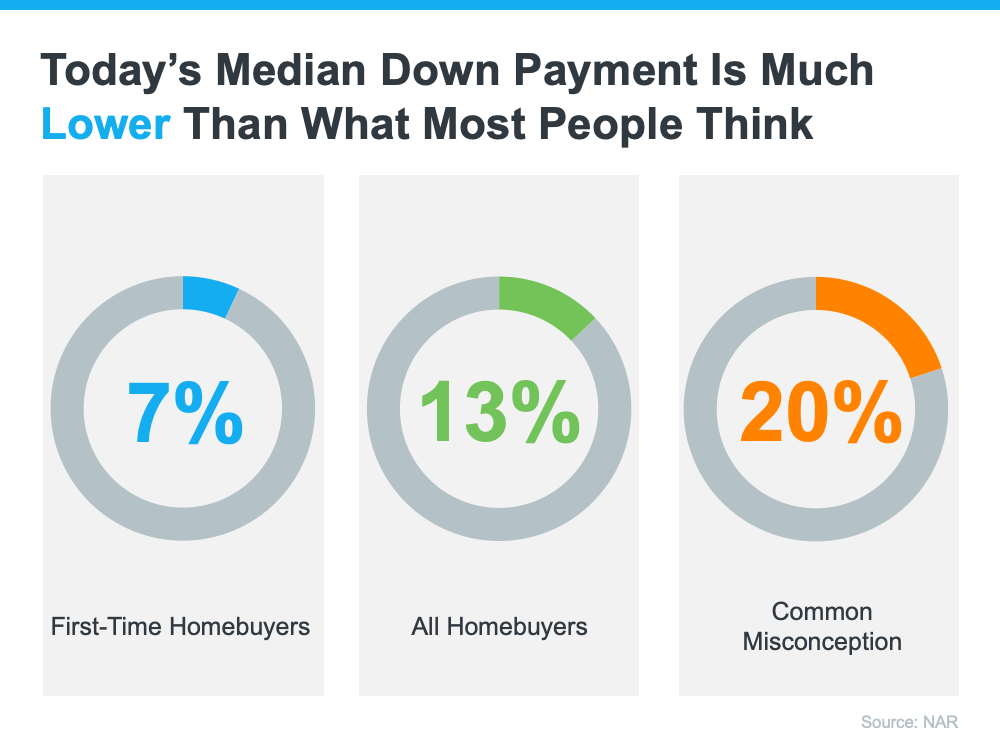

Unless specified by your loan type or lender, it’s typically not required to put 20% down. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today, that number is only 13%. And it’s even lower for first-time homebuyers, whose median down payment is only 7% (see graph below):

What Does This Mean for You?

While a down payment of 20% or more does have benefits, the typical buyer is putting far less down. That’s good news for you because it means you could be closer to your homebuying dream than you realize.

If you’re interested in learning more about low down payment options, there are several places to go. There are programs for qualified buyers with down payments as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Remember: a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation and explore your down payment options.

To view original article, visit Keeping Current Matters.

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.

Homeownership Is Still at the Heart of the American Dream

Buying a home is a powerful decision, and it remains at the heart of the American Dream.