“As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there.”

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

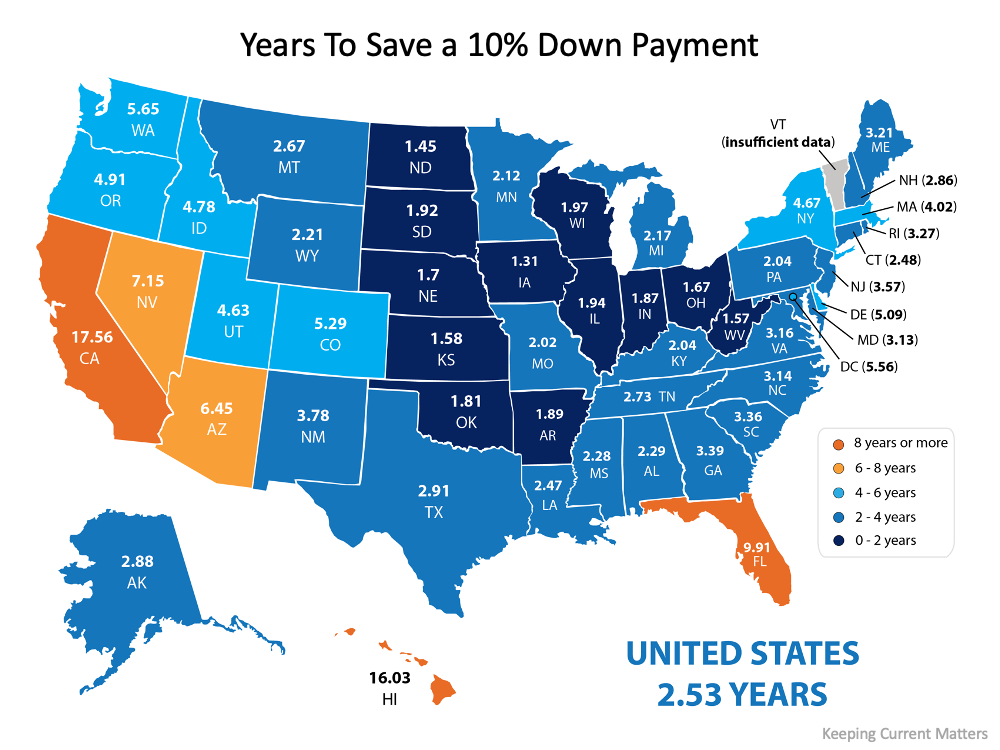

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

What if you only need to save 3%?

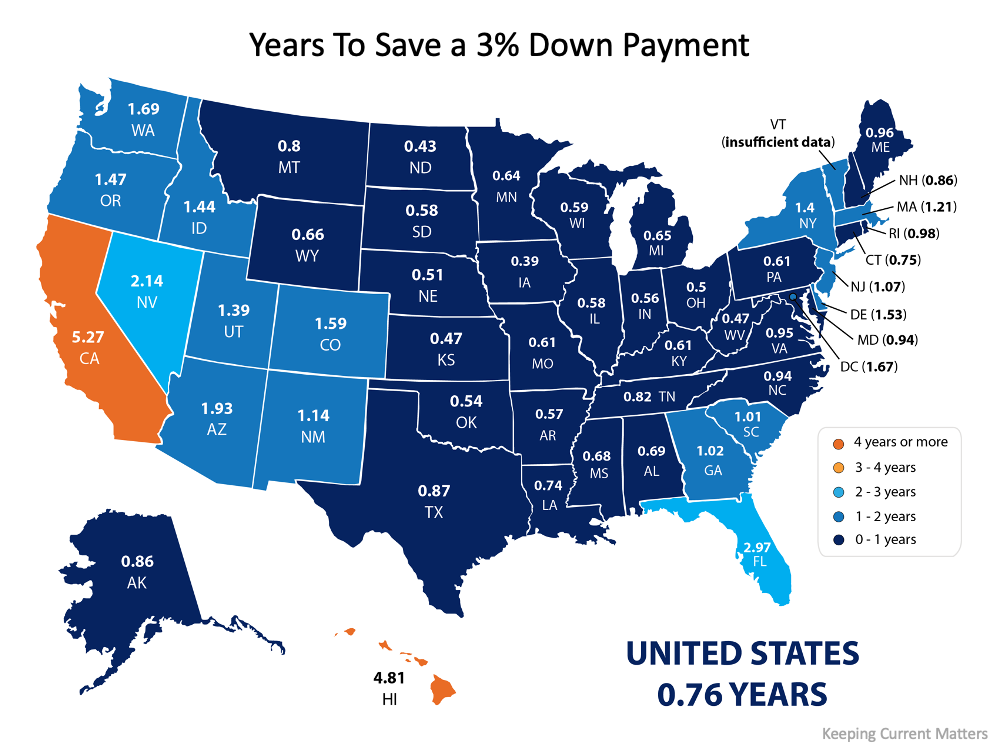

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

Bottom Line

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.

To view original article, visit Keeping Current Matters.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.

Where Are People Moving Today and Why?

If you’re thinking of moving, you may be considering the inventory and affordability challenges in the housing market and how to offset these.

There’s Only Half the Inventory of a Normal Housing Market Today

If you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year.