“As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there.”

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

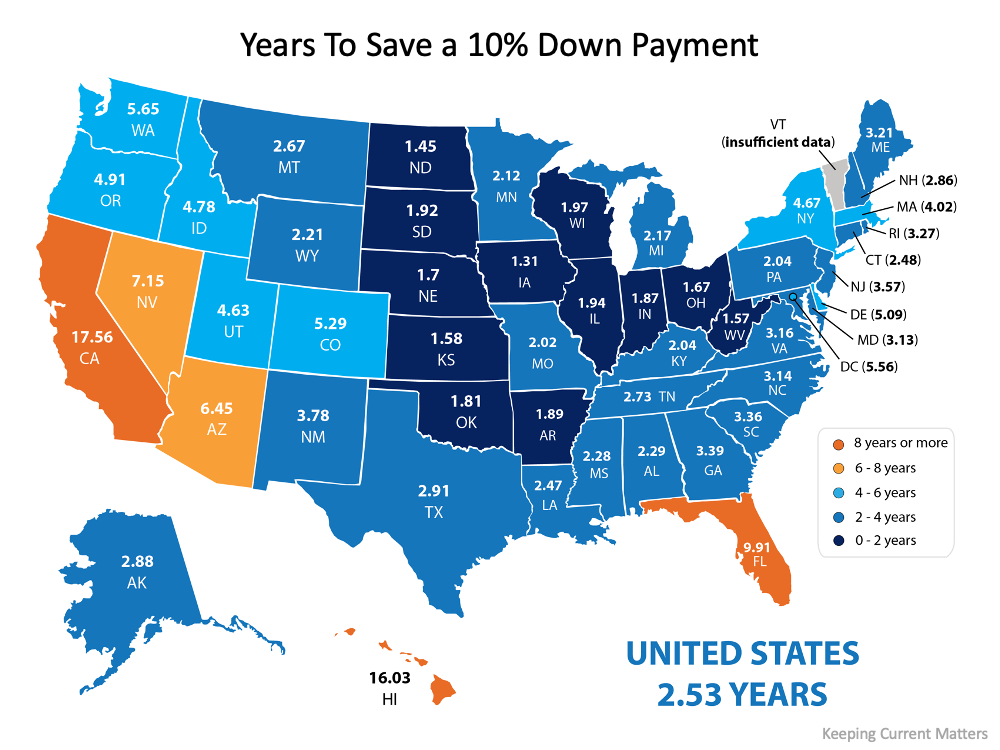

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

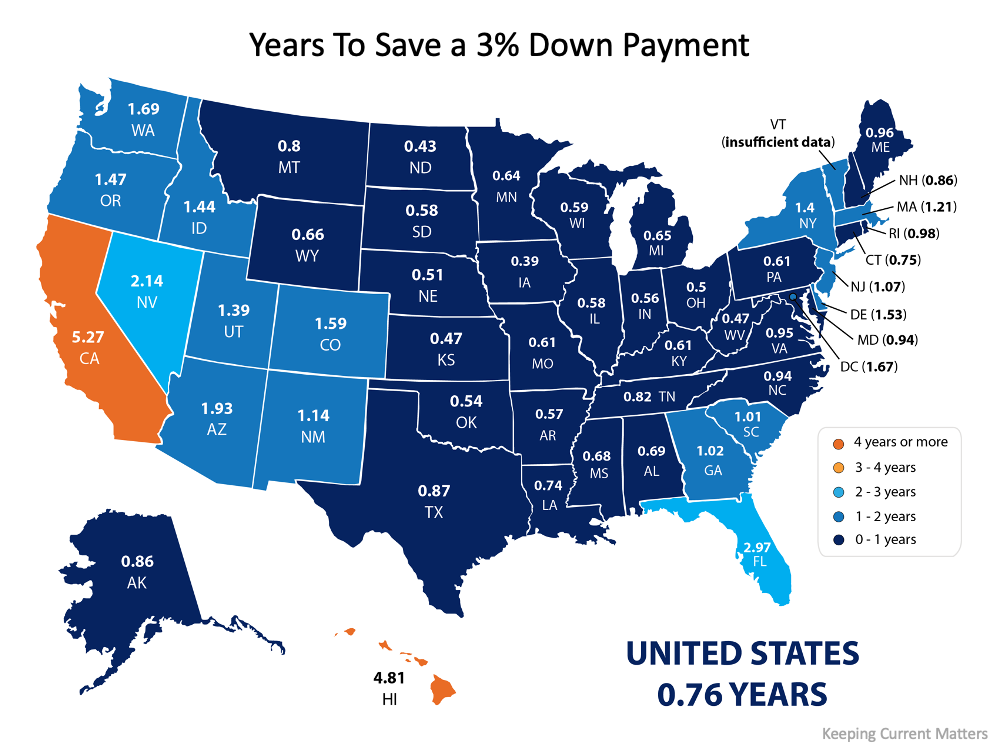

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

Bottom Line

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.

To view original article, visit Keeping Current Matters.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

Find the right agent to make sure your house is prepped, priced, and marketed well, so you can get ahead of the competition!

The Real Benefits of Buying a Home This Year

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

It’s crucial to understand what’s happening in your local market and a local real estate agent can really help.

The Secret To Selling? Using an Agent To Get Your House Noticed

The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers.

Buyer Bright Spot: There Are More Homes on the Market

The number of homes for sale has grown a whole lot lately and that’s true for both existing and newly built homes.

How Home Equity Can Help Fuel Your Retirement

Your agent will help you understand how much equity to have and how you can use it and help you navigate the entire process.