“As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there.”

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

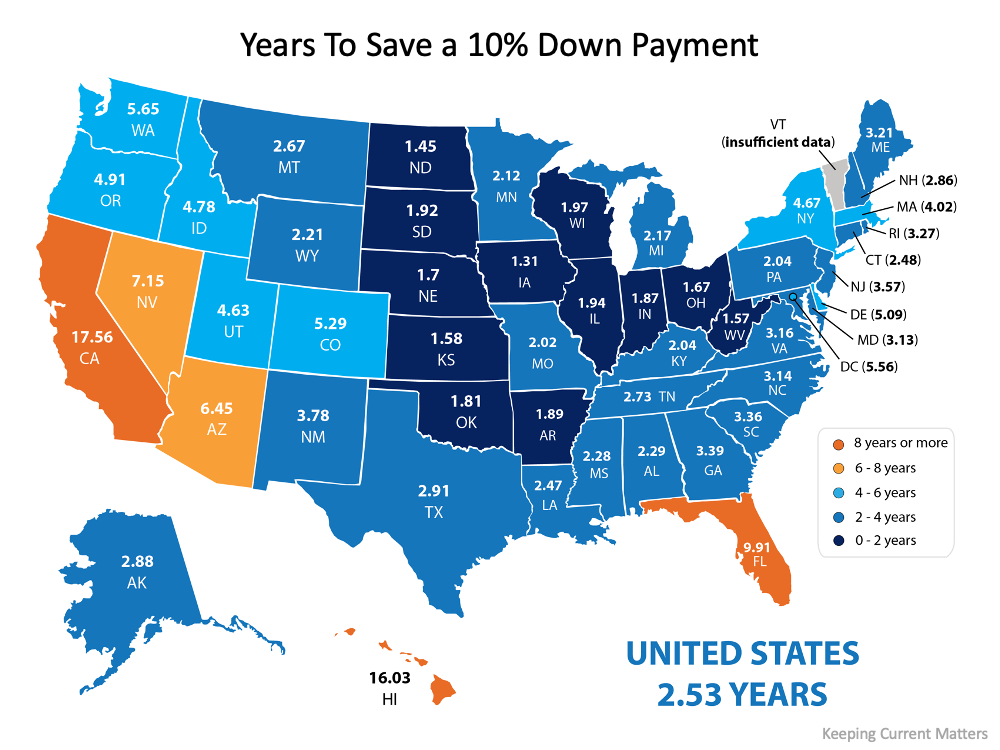

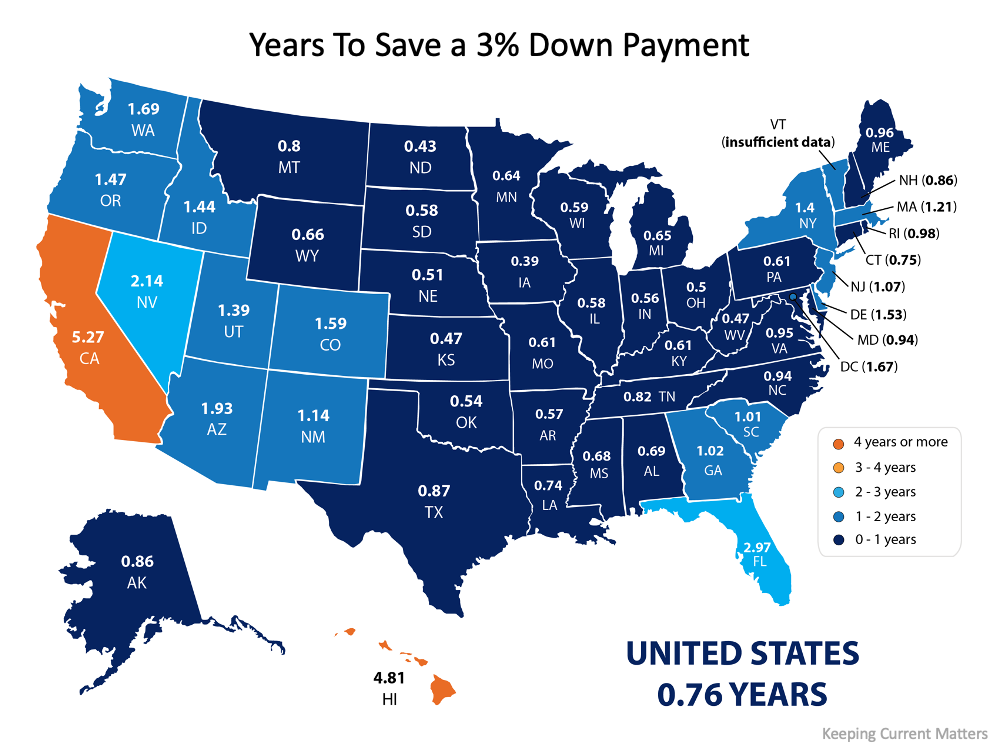

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

Bottom Line

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.

To view original article, visit Keeping Current Matters.

How Owning a Home Builds Your Net Worth

Homeownership is still considered one of the most reliable ways to build wealth.

A Trusted Real Estate Advisor Provides Expert Advice

With their expertise, a real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why You May Want To Start Your Home Search Today

Inventory growth this year is certainly good news for you, especially if you’ve had trouble finding a home that meets your needs.

3 Tips for Buying a Home Today

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional.

What Does the Rest of the Year Hold for Home Prices?

Despite what you’ve heard, experts say home prices won’t fall in most markets. They’ll just appreciate more moderately.

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

Today, data shows buyer demand is moderating in the wake of higher mortgage rates.