“Based on gains in home equity, family wealth could increase by $42,000 over that five-year period.”

Many of the questions currently surrounding the real estate industry focus on home prices and where they are heading. The most recent Home Price Expectation Survey (HPES) helps target these projected answers.

Here are the results from the Q2 2019 Survey:

- Home values will appreciate by 4.1% in 2019

- The average annual appreciation will be 3.2% over the next 5 years

- The cumulative appreciation will be 16.8% by 2023

- Even experts representing the most “bearish” quartile of the survey project a cumulative appreciation of over 6.7% by 2023

What does this mean for you?

A substantial portion of family wealth comes from home equity. As the value of a family’s home (an asset) increases, so does their equity.

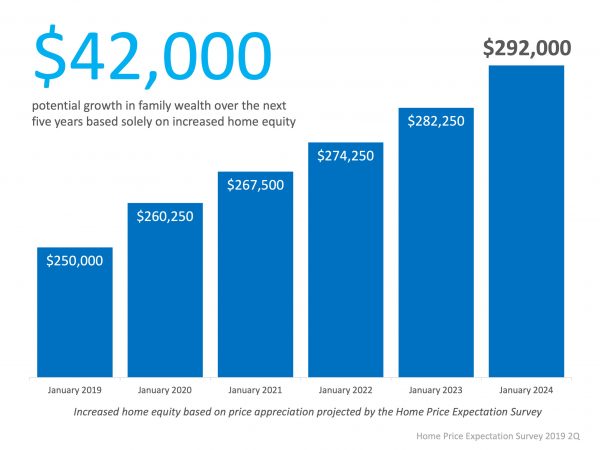

Using the projections from the HPES, here is a look at the potential equity a family could earn over the next five years if they purchased a $250,000 home in January of 2019:

Based on gains in home equity, their family wealth could increase by $42,000 over that five-year period.

Bottom Line

If you don’t yet own a home, now may be the time to purchase. Owning or moving up to your dream home could allow you to ride the increase in equity of a growing asset.

To view original article, visit Keeping Current Matters.

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.