“If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment?”

If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this year.

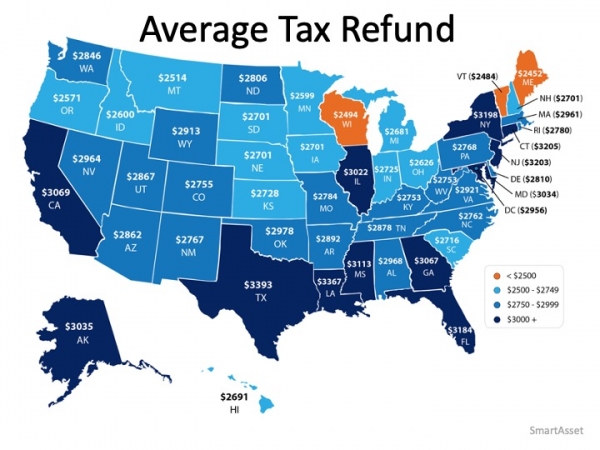

Based on data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $2,962 when filing their taxes this year.

The map below shows the average tax refund Americans received last year by state: According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

How can my tax refund help?

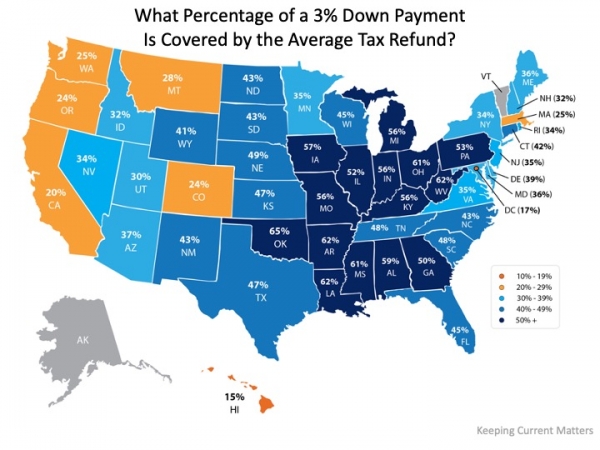

If you’re a first-time buyer, your tax refund may cover more of a down payment than you ever thought possible.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average tax refund: The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

Bottom Line

Saving for a down payment can seem like a daunting task, but the more you know about what’s required, the more prepared you’ll be to make the best decision for you and your family. This tax season, your refund could be your key to homeownership.

To view original article, visit Keeping Current Matters.

Why It’s Easy To Fall in Love with Homeownership

Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them.

What You Should Know About Closing Costs

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too.

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

Your house would be welcome in a market that has fewer homes for sale than it did in the years leading up to the pandemic.

How Experts Can Help Close the Gap in Today’s Homeownership Rate

Homeownership is an essential piece for building household wealth that can be passed down to future generations.

The Top Reasons for Selling Your House

If you also find yourself wanting a change in location, needing more space than your current house can provide or feel the need to downsize, it may be time to sell.

Experts Forecast a Turnaround in the Housing Market in 2023

As we move through 2023, there are signs things are finally going to turn around.