“If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment?”

If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this year.

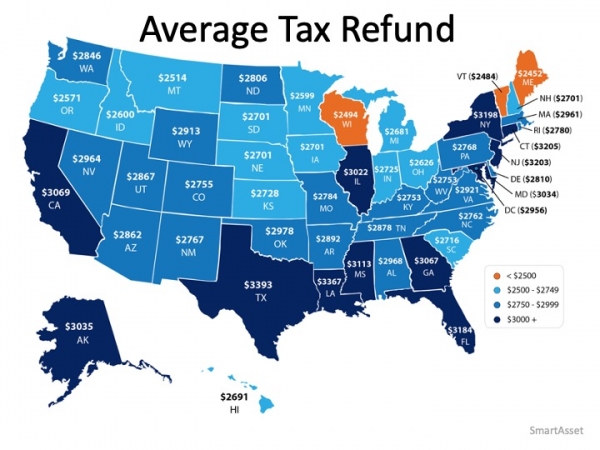

Based on data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $2,962 when filing their taxes this year.

The map below shows the average tax refund Americans received last year by state: According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

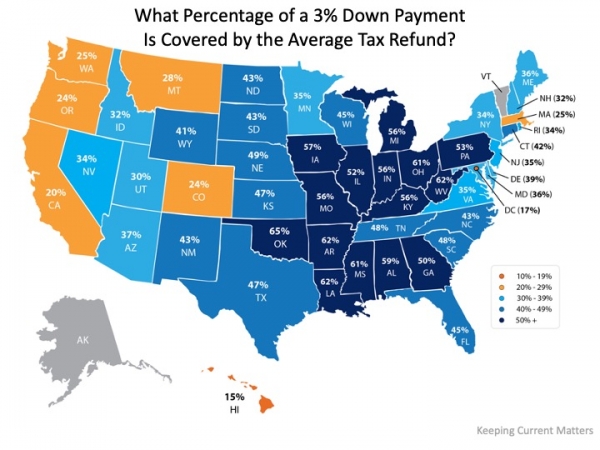

According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

How can my tax refund help?

If you’re a first-time buyer, your tax refund may cover more of a down payment than you ever thought possible.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average tax refund: The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

Bottom Line

Saving for a down payment can seem like a daunting task, but the more you know about what’s required, the more prepared you’ll be to make the best decision for you and your family. This tax season, your refund could be your key to homeownership.

To view original article, visit Keeping Current Matters.

Lower Mortgage Rates Are Bringing Buyers Back to the Market

The upcoming months should see a return of buyers, as mortgage rates have been coming down since mid-November.

Where Will You Go If You Sell? You Have Options.

By working with a trusted real estate agent, you can be confident you’re making the most educated, informed decision.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.