“If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment?”

If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this year.

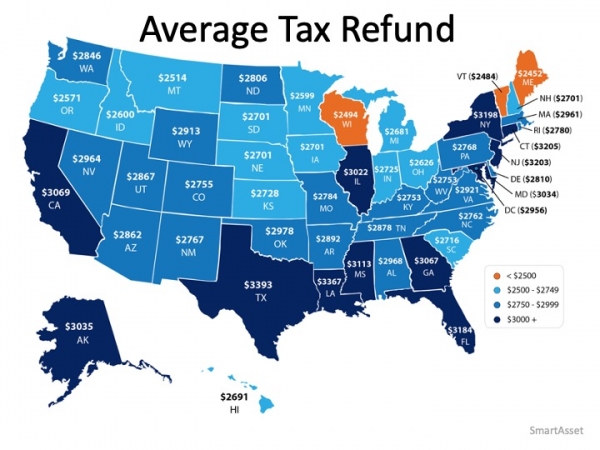

Based on data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $2,962 when filing their taxes this year.

The map below shows the average tax refund Americans received last year by state: According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

According to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. Truth be told, a 20% down payment is not always required to buy a home, even though that’s a common misconception about homebuying. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

How can my tax refund help?

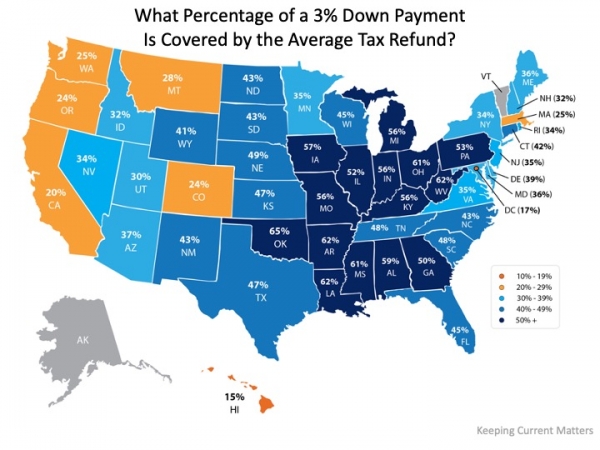

If you’re a first-time buyer, your tax refund may cover more of a down payment than you ever thought possible.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average tax refund: The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership in one of these programs. Maybe this is the year to plan ahead and put your tax refund toward a down payment on a home.

Bottom Line

Saving for a down payment can seem like a daunting task, but the more you know about what’s required, the more prepared you’ll be to make the best decision for you and your family. This tax season, your refund could be your key to homeownership.

To view original article, visit Keeping Current Matters.

What’s Going on with Home Prices? Ask a Professional.

Your local real estate professional will be able to explain the latest trends in your specific market.

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

It’s important to be mindful of what’s a necessity and what’s a nice-to-have when searching for a home.

3 Ways You Can Use Your Home Equity

A real estate professional is the best resource to help you understand how much home equity you have and advise you on some of the ways you can use it.

Your House Could Be the #1 Item on a Homebuyer’s List During the Holidays

Each year, homeowners planning to make a move are faced with a decision: sell their house during the holidays or wait.

What Homeowners Want To Know About Selling in Today’s Market

The key to success today is being realistic and working with a trusted real estate advisor.

Mortgage Rates Will Come Down, It’s Just a Matter of Time

As we get through the inflation battle and start to see that coming down, we should expect mortgage rates to follow.