“The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped.”

There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

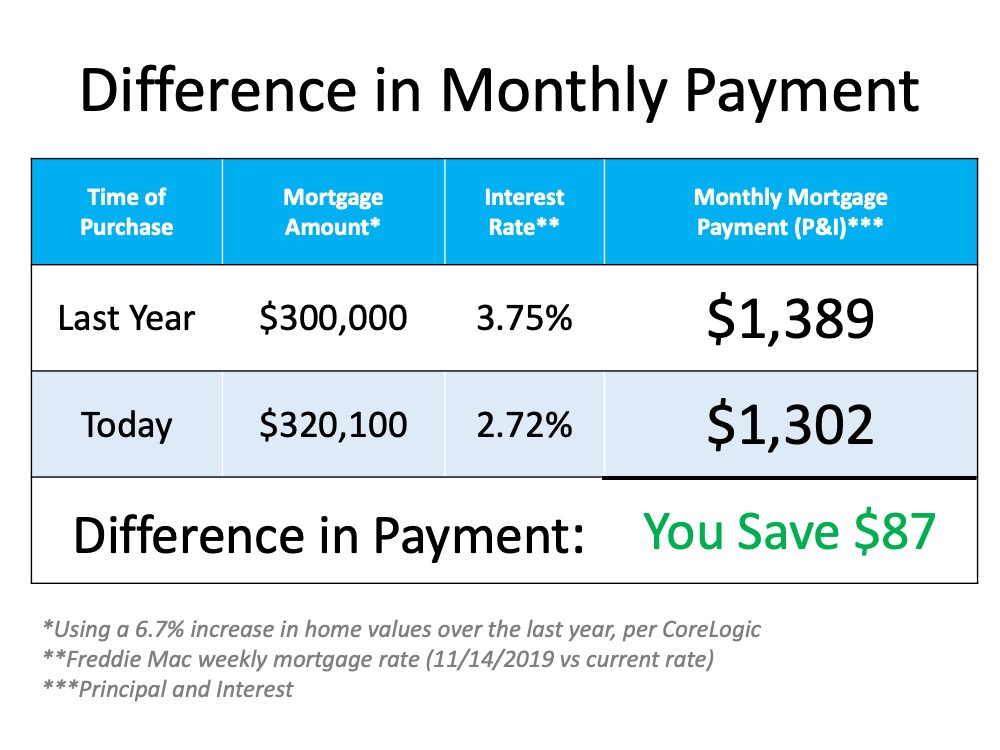

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100: Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.

To view original article, visit Keeping Current Matters.

Finding Your Perfect Home in a Fixer Upper

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment.

The Benefits of Downsizing When You Retire

When you downsize your house, you often end up downsizing the bills that come with it, like energy costs, and maintenance requirements.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Why You Want an Agent’s Advice for Your Move

A real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.