“The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped.”

There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

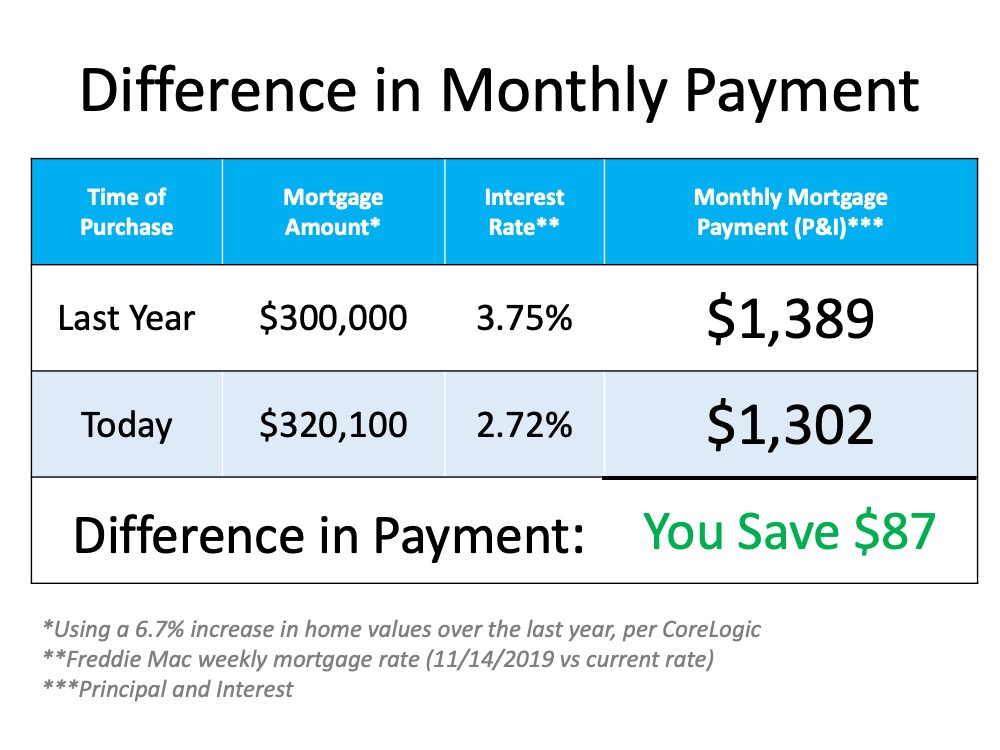

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100: Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.

To view original article, visit Keeping Current Matters.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.