“Your home is your stake in the community, a strong financial investment, and an achievement to be proud of.”

Defining the American dream is personal, and no one individual will have the same definition as another. But the feelings it brings about – success, freedom, and a sense of prosperity – are universal. That’s why, for many people, homeownership remains a key part of the American dream. Your home is your stake in the community, a strong financial investment, and an achievement to be proud of.

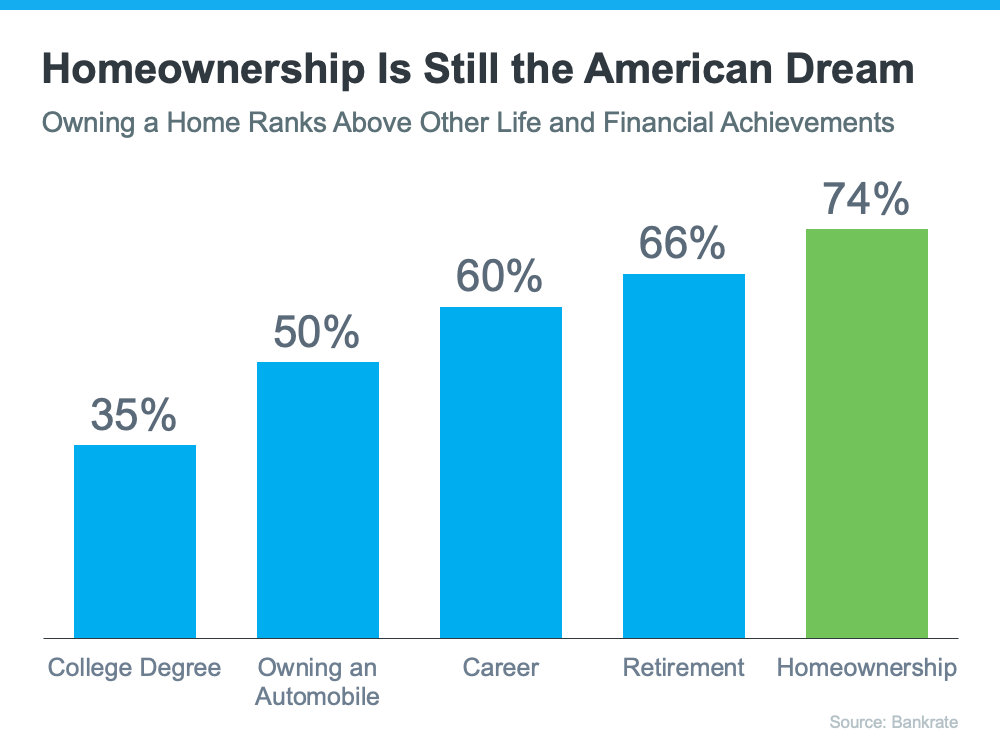

A recent survey from Bankrate asked respondents to rank achievements as indicators of financial success, and the responses prove that owning a home is still important to so many Americans today (see graph below):

As the graph shows, homeownership ranks above other significant milestones, including retirement, having a successful career, and earning a college degree.

That could be because owning a home is a significant wealth-building tool and provides meaningful financial stability. The National Association of Realtors (NAR) explains:

“Homeownership builds financial security. With 65.5% of Americans owning homes, the net worth of a typical homeowner is nearly 40 times the net worth of a non-owner.”

There are other ways your home acts as more than just a roof over your head, too. The Mortgage Reports highlights a few of the many benefits homeowners enjoy, including:

- Your equity (and wealth) grows through home price appreciation.

- Your housing costs are fixed – and that can help combat rising costs from inflation.

- You’ll have greater privacy and the opportunity to customize your living space.

Plus, homeowners tend to be more active in their community. Like NAR says:

“Living in one place for a longer amount of time creates and [sic] obvious sense of community pride, which may lead to more investment in said community.”

What Does That Mean for You?

If your definition of the American Dream involves greater freedom and prosperity, then homeownership could play a major role in helping you achieve that dream. When you set out to buy, know there are incredible benefits waiting for you at the end of your journey. You’ll have a place you can call your own, feel most comfortable, and grow your wealth.

First American puts it best, saying:

“Homeownership remains central to the pursuit of the American Dream. It is a critical driver of economic mobility, delivering financial and social advantages. . . .”

Bottom Line

Buying a home is a powerful decision and a key part of the American Dream. And if homeownership is part of your personal dreams this year, let’s connect and start the process today.

To view original article, visit Keeping Current Matters.

What Credit Score Do You Really Need to Buy a House?

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy.

Is Affordability Starting to Improve?

While affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Here’s a look at the latest data.

Are There More Homes for Sale Where You Live?

Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.

Where Will You Go After You Sell?

Want to see what’s available? Your real estate agent can show you what homes are for sale in your area, so you can see if there’s one that works for you and your needs.

Helpful Negotiation Tactics for Today’s Housing Market

One thing is true whether you’re a buyer or a seller, and that’s how much your agent can help you throughout the process.

What Every Homeowner Should Know About Their Equity

Understanding how much equity you have is the first step to unlocking what you can afford when you move.