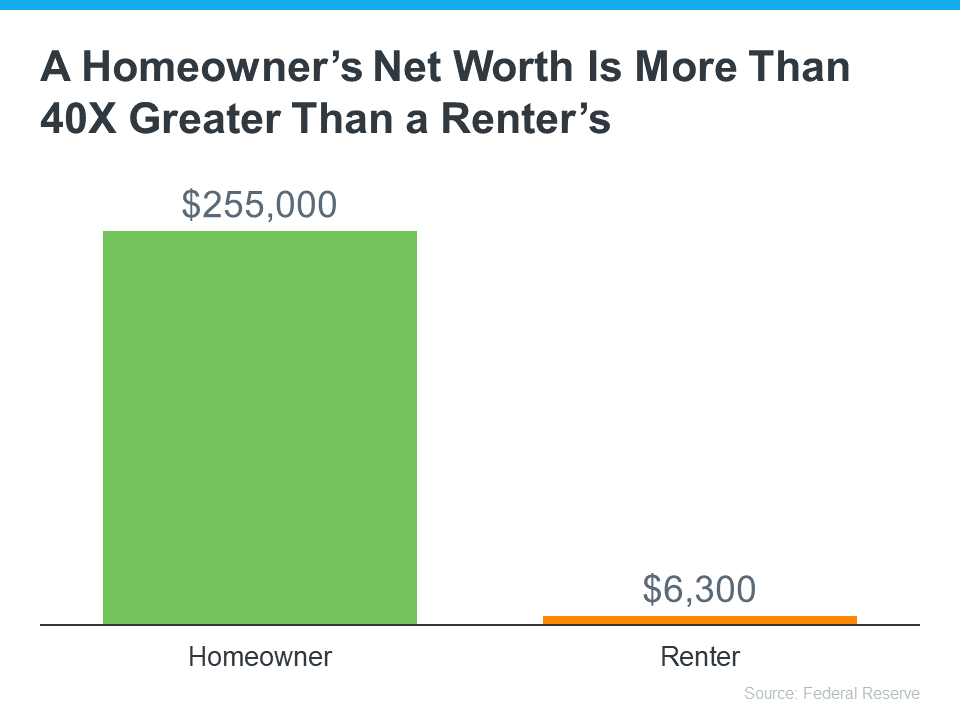

“A homeowner’s net worth is 40 times greater than a renter’s.”

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below):

So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.

Bottom Line

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

To view original article, visit Keeping Current Matters.

Why Owning a Home Is Worth It in the Long Run

Increased home values are a major reason so many homeowners are still happy with their decision today!

Sell Your House During the Winter Sweet Spot

While inventory is higher this year than the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot.

Should You Sell Your House As-Is or Make Repairs?

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

How Co-Buying a Home Helps with Affordability Today

If you are an aspiring homeowner, buying a home with your family or friends could be an option.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Most homeowners today are employed and have low-interest mortgages they can afford, so they are able to make payments.

What’s Behind Today’s Mortgage Rate Volatility?

The best way to navigate this landscape is to have a team of real estate experts by your side.