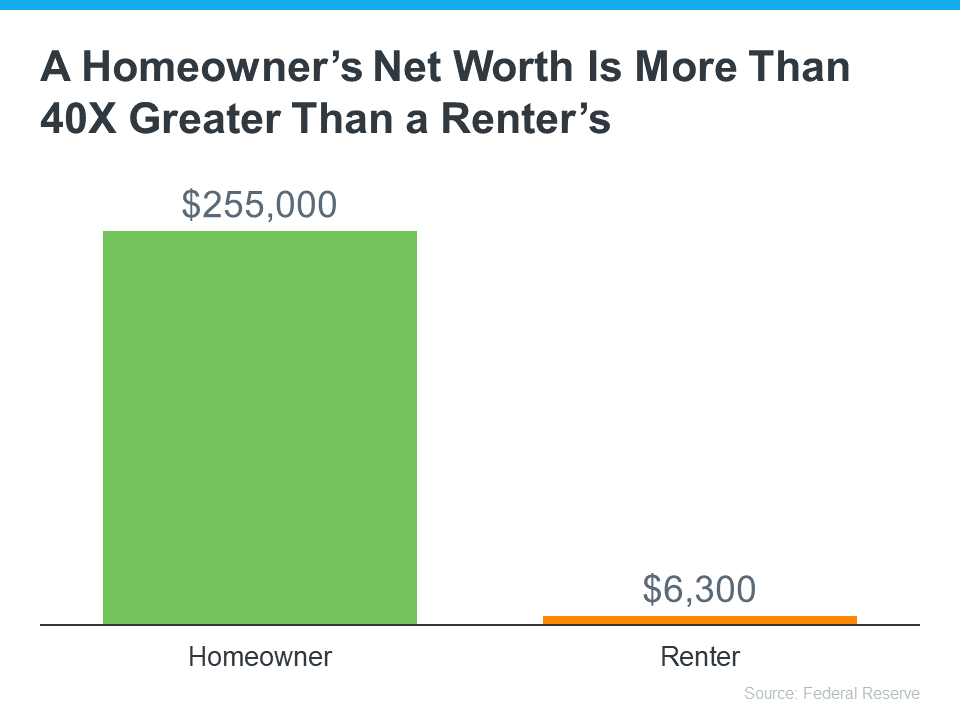

“A homeowner’s net worth is 40 times greater than a renter’s.”

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below):

So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.

Bottom Line

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

To view original article, visit Keeping Current Matters.

With Mortgage Rates Climbing, Now’s the Time to Act

Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades.

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.

Real Estate Professionals Are Experts at Keeping You Safe When You Sell

Real estate professionals have learned new technologies plus safety and sanitation measures.

There Won’t Be a Wave of Foreclosures in the Housing Market

Most homeowners exited their forbearance plan either fully caught up or with a plan from the bank to start making payments again.

Avoid the Rental Trap in 2022

Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

How Much Do You Need for Your Down Payment?

Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.