“If your needs have changed, it may be time to re-evaluate your home.”

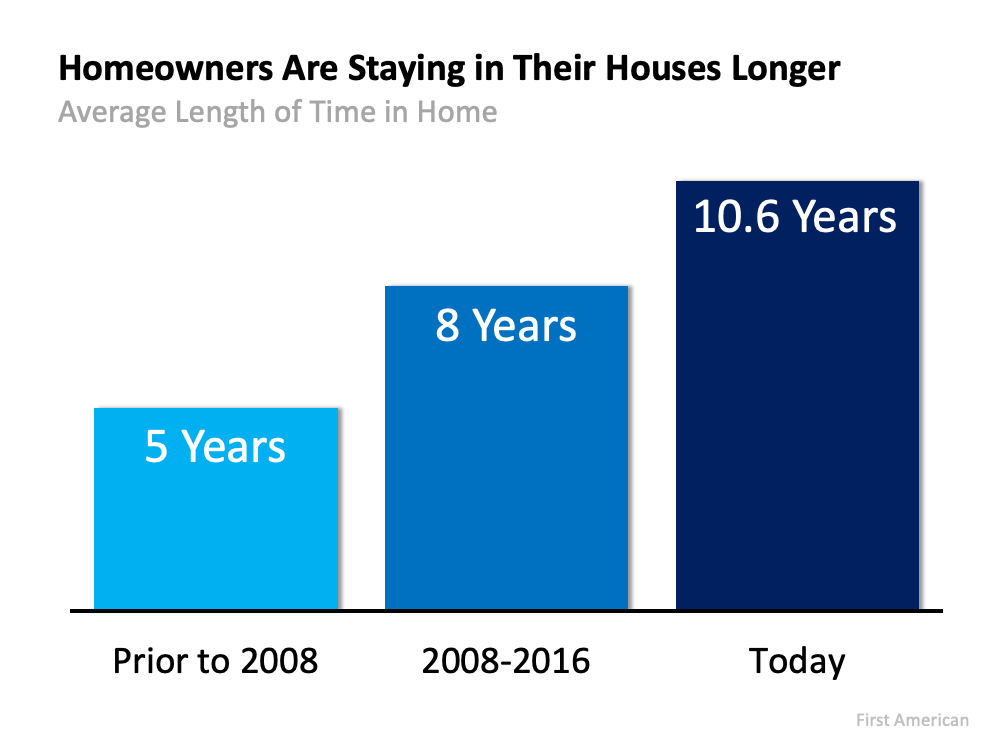

If you’ve been in your home for longer than five years, you’re not alone. According to recent data from First American, homeowners are staying put much longer than historical averages (see graph below): As the graph shows, before 2008, homeowners sold their houses after an average of just five years. Today, that number has more than doubled to over 10 years. The housing industry refers to this as your tenure.

As the graph shows, before 2008, homeowners sold their houses after an average of just five years. Today, that number has more than doubled to over 10 years. The housing industry refers to this as your tenure.

To really explore tenure, it’s important to understand what drives people to make a move. An article from The Balance explores some of the primary reasons individuals choose to sell their houses. It says:

“People who move for home-related reasons might need a larger home or a house that better fits their needs, . . . Financial reasons for moving include wanting a nicer home, moving to a newer home to avoid making repairs on the old one, or cashing in on existing equity.”

If you’ve been in your home for longer than the norm, chances are you’re putting off addressing one, if not several, of the reasons other individuals choose to move. If this sounds like you, here are a few things to consider:

If your needs have changed, it may be time to re-evaluate your home.

As the past year has shown, our needs can change rapidly. That means the longer you’ve been in your home, the more likely it is your needs have evolved. The Balance notes several personal factors that could lead to your home no longer meeting your needs, including relationship and job changes.

For example, many workers recently found out they’ll be working remotely indefinitely. If that’s the case for you, you may need more space for a dedicated home office. Other homeowners choose to sell because the number of people living under their roof changes. Now more than ever, we’re spending more and more time at home. As you do, consider if your home really delivers on what you need moving forward.

It’s often financially beneficial to sell your house and move.

One of the biggest benefits of homeownership is the equity your home builds over time. If you’ve been in your house for several years, you may not realize how much equity you have. According to the latest Homeowner Equity Report from CoreLogic, homeowners gained an average of $33,400 in equity over the past year.

That equity, plus today’s low mortgage rates, can fuel a major upgrade when you sell your home and purchase a new one. Or, if you’re looking to downsize, your equity can help provide a larger down payment and lower your monthly payments over the life of your next loan. No matter what, there are significant financial benefits to selling in today’s market.

Bottom Line

If you’ve been in your home for 5-10 years or more, now might be the time to explore your options. Today’s low rates and your built-up equity could provide you with the opportunity to address your evolving needs. If you feel it’s time to sell, let’s connect.

To view original article, visit Keeping Current Matters.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.

What Are the Experts Saying About the Spring Housing Market?

Buyers are going to see more competition than they might expect because there are not many homes on the market.

The Power of Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

What’s the Difference Between a Home Inspection and an Appraisal?

Your trusted real estate professional will help you navigate both the inspection as well as any issues that arise during the buying process.

5 Reasons Millennials Are Buying Homes

The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own.

Think Twice Before Waiting for Lower Home Prices

The best way to understand what home values are doing is to work with a local real estate agent who can give you the latest insights.