“Purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.”

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

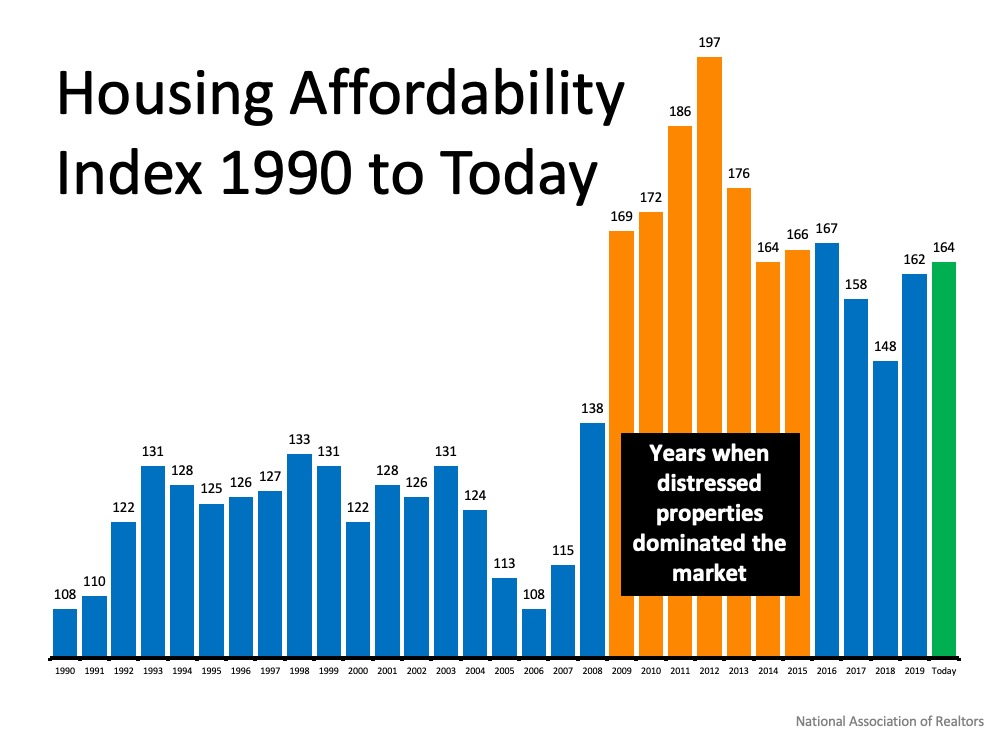

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.”

Bill Banfield, EVP of Capital Markets, Quicken Loans:

“No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.”

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

“Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.

To view original article, visit Keeping Current Matters.

Home Builders Ramp Up Construction Based on Demand

If you’re having a hard time finding a home to buy, it may be time to talk to your trusted real estate advisor about a newly built home.

Are We in a Housing Bubble? Experts Say No.

The current climb in house prices reflects strong demand amid tight supply, helped along by record-low interest rates.

What Do Experts See on the Horizon for the Second Half of the Year?

As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic!

Save Time and Effort by Selling with an Agent

Before you decide to sell your house yourself, let’s discuss your options so we can make sure you get the most out of the sale.

Demand for Vacation Homes Is Still Strong

There is still high demand for second getaway homes in 2021 even as the pandemic winds down.

Pre-Approval Makes All the Difference When Buying a Home

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing.