“Purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.”

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

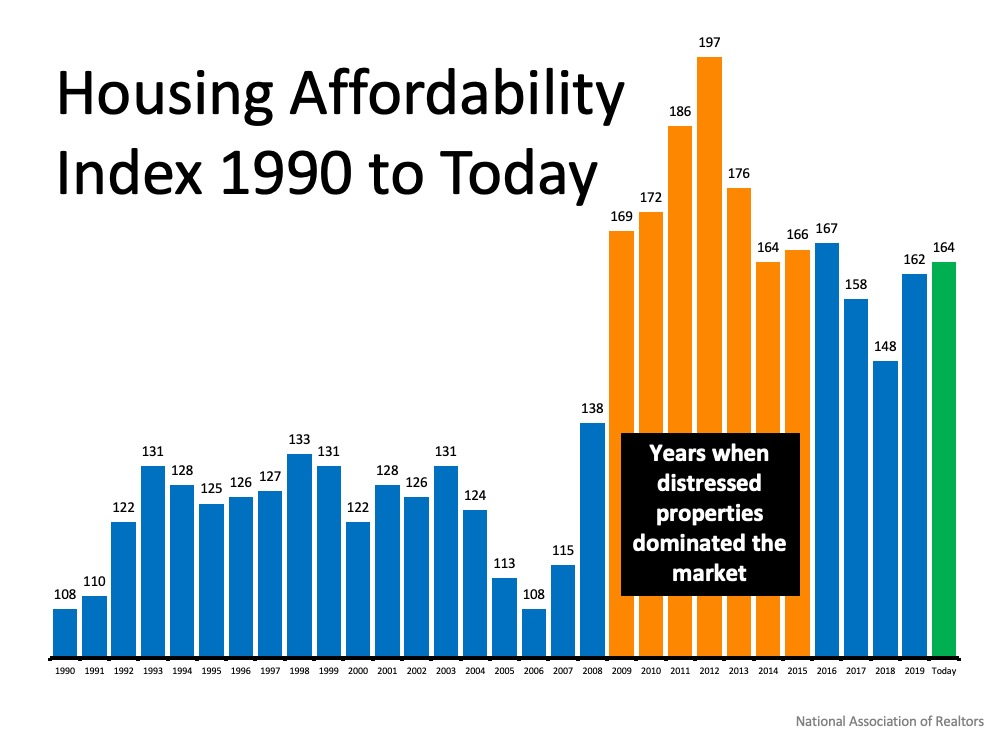

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.”

Bill Banfield, EVP of Capital Markets, Quicken Loans:

“No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.”

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

“Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.

To view original article, visit Keeping Current Matters.

6 Reasons You’ll Win by Selling with a Real Estate Agent This Fall

There are many benefits to working with a real estate professional when selling your house. Find out why.

Should You Buy a Retirement Home Sooner Rather than Later?

If you’re a retiree with a single-family home and want to move closer to your family, now is the time to put your house on the market.

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

The housing market has made a full recovery, and all-time low interest rates are giving home buyers a big boost in purchasing power.

Is it Time to Move into a Single-Story Home?

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Why Pricing Your House Right Is Essential

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way.

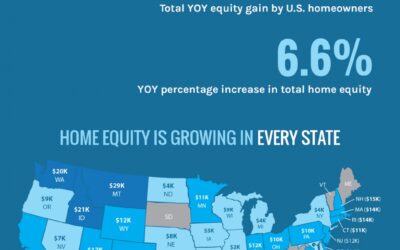

Rising Home Equity Can Power Your Next Move

Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.