“What is home equity and how can you use it to your advantage?”

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this:

“Home equity is the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

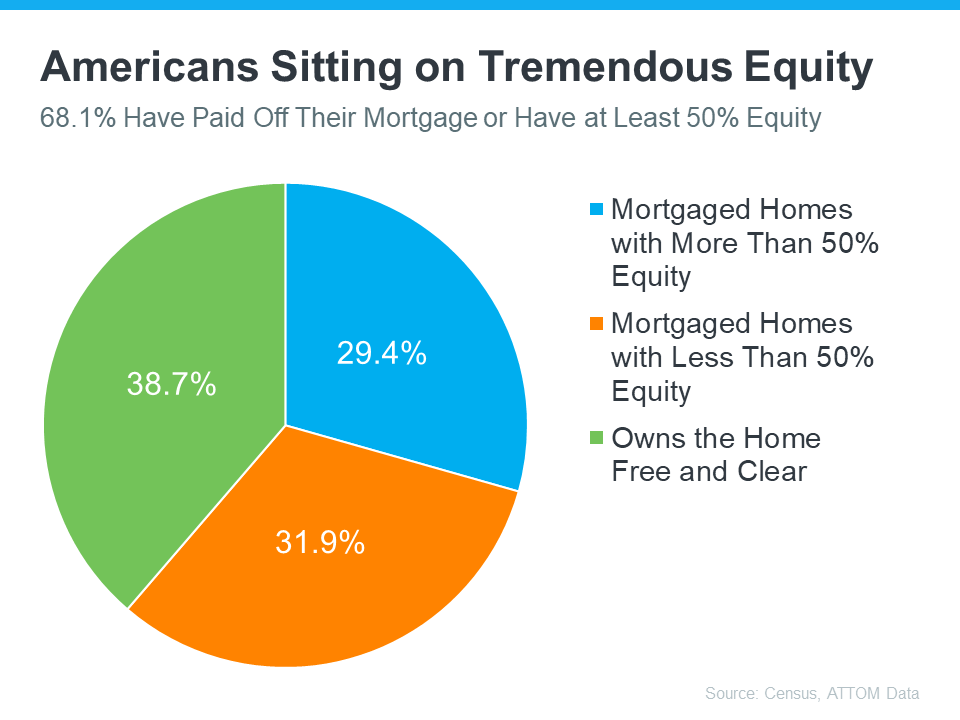

Majority of Americans Have a Large Amount of Equity

If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of equity right now (see graph below):

And having such large amounts of equity is a benefit to homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

“Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008.”

Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home.

Bottom Line

By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect today so you can find out how much home equity you have and start planning your next move.

To view original article, visit Keeping Current Matters.

What Mortgage Rate Are You Waiting For?

If you’ve been holding out and waiting for rates to come down, know that it’s already happening.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.

What Credit Score Do You Really Need to Buy a House?

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy.

Is Affordability Starting to Improve?

While affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Here’s a look at the latest data.