“Here’s a look at what leading experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus!”

As our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human toll may forever change families, but the economic impact will rebound with a cycle of downturn followed by economic expansion like we’ve seen play out in the U.S. economy many times over.

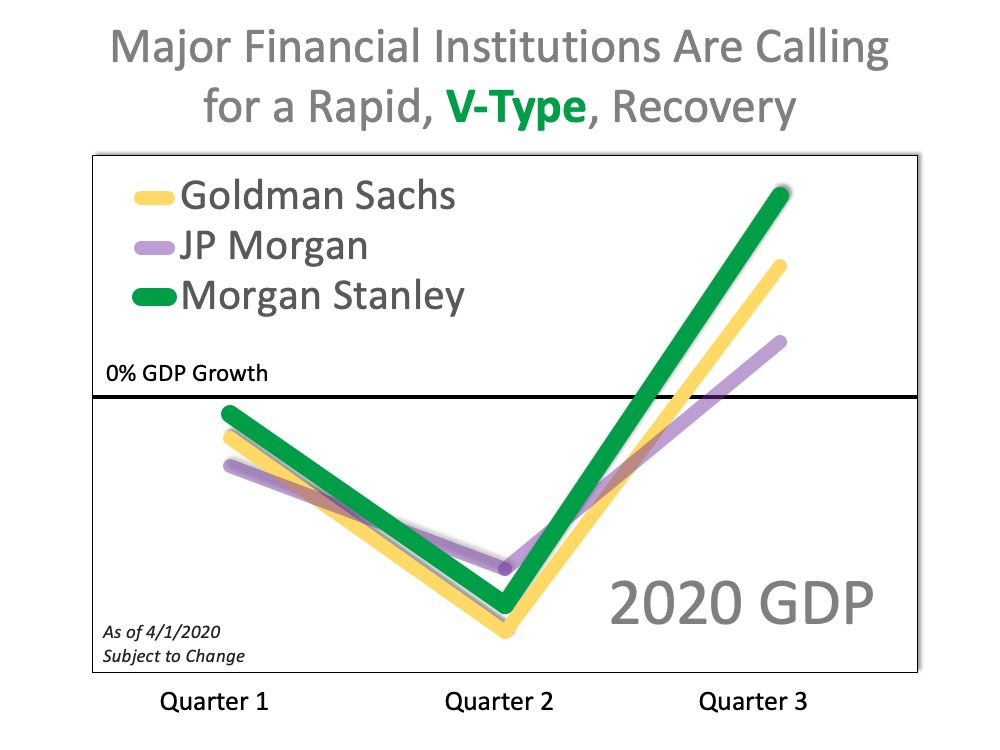

Here’s a look at what leading experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus. It starts with a forecast of U.S. Gross Domestic Product (GDP).

According to Investopedia:

“Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of the country’s economic health.”

When looking at GDP (the measure of our country’s economic health), a survey of three leading financial institutions shows a projected sharp decline followed by a steep rebound in the second half of this year: A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

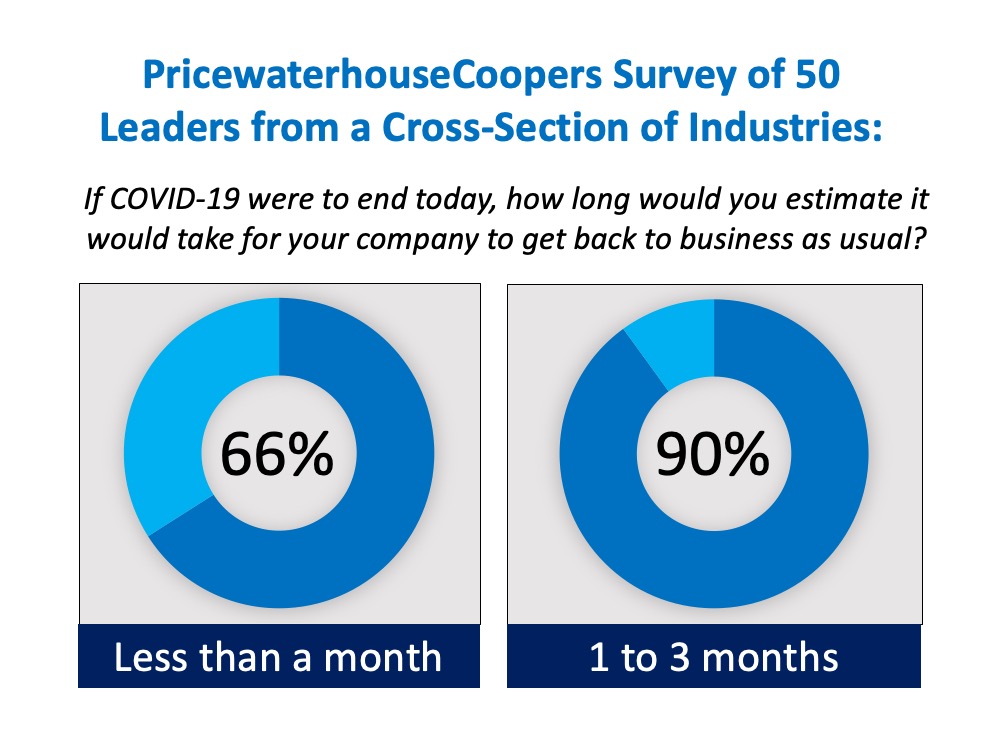

With this historical analysis in mind, many business owners are also optimistic for a bright economic return. A recent PricewaterhouseCoopers survey shows this confidence, noting 66% of surveyed business owners feel their companies will return to normal business rhythms within a month of the pandemic passing, and 90% feel they should be back to normal operation 1 to 3 months after: From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

Bottom Line

Lives and businesses are being impacted by the coronavirus, but experts do see a light at the end of the tunnel. As the economy slows down due to the health crisis, we can take guidance and advice from experts that this too will pass.

To view original article, visit Keeping Current Matters.

Reasons To Sell Your House Before the New Year

Selling now, while other homeowners may hold off until after the holidays, can help you get a leg up on your competition.

Don’t Believe Everything You Read About Home Prices

If you believe home prices are falling, it may be time to get your insights from the experts, and they’re saying prices are climbing.

Foreclosures and Bankruptcies Won’t Crash the Housing Market

Foreclosure filings are inching back up to pre-pandemic numbers, BUT they’re still way lower than when the housing market crashed in 2008.

Affordable Homeownership Strategies for Gen Z

One of your best resources on the journey as a young homebuyer is a trusted real estate agent.

The Perks of Selling Your House When Inventory Is Low

Buyers have fewer choices now than they did in more typical years. And that’s why you could see some great perks if you sell today.

Why Home Prices Keep Going Up

Even though higher mortgage rates has caused buyer demand to moderate, home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.