Low Interest Rates Have a High Impact on Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.92%, which is still near record lows in comparison to recent history!

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget.

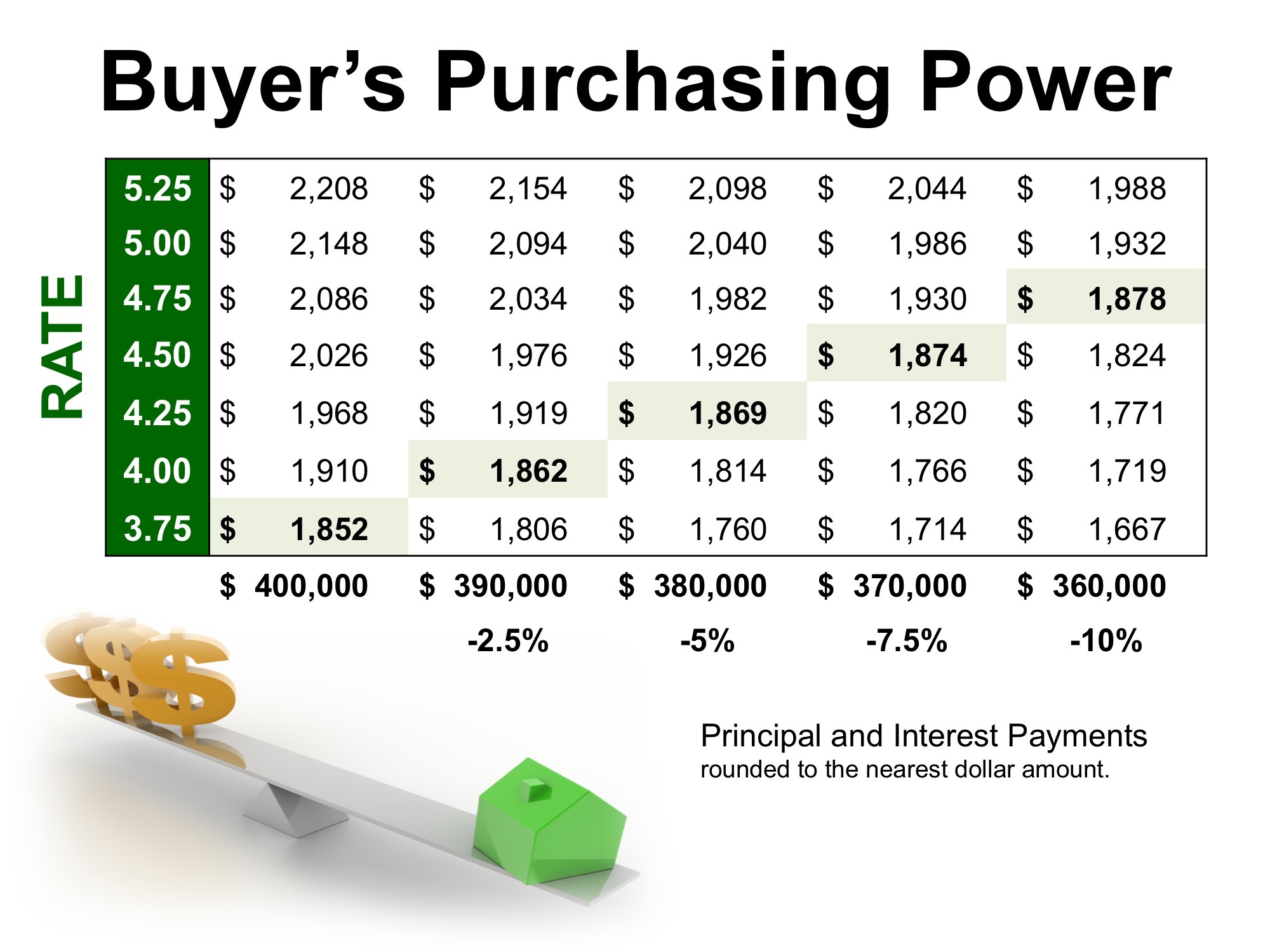

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments between $1,850-$1,900 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money.

To view original article, please visit Keeping Current Matters.

Why Working with a Real Estate Professional Is Crucial Right Now

A real estate expert can carefully walk you through the whole real estate process and advise you on the best ways to achieve success.

Why Moving to a Smaller Home After Retirement Makes Life Easier

As you approach retirement, its important to think about whether your current home still fits your needs.

Why Your Asking Price Matters Even More Right Now

Accurate pricing depends on current market conditions – and only an agent has all information necessary to price your home correctly.

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash.

Real Estate Still Holds the Title of Best Long-Term Investment

Homeownership has long been tied to building wealth—and for good reason.

What To Do When Your House Didn’t Sell

If you want an expert’s advice on why your home didn’t sell, rely on a trusted real estate agent.

Do Elections Impact the Housing Market?

While Presidential elections do have some impact on the housing market, the effects are usually small and temporary. For help navigating the market, election year or not, let’s connect.

How Long Will It Take To Sell My House?

You may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Why a Vacation Home Is the Ultimate Summer Upgrade

If you’re excited about getting away and having some fun in the sun, it might make sense to own your own vacation home.