Before You Make an Offer, Here are 4 Tips for Success!

So, you’ve been searching for that perfect house to call a ‘home,’ and you finally found it! The price is right, and in such a competitive market, you want to make sure that you make a good offer so that you can guarantee that your dream of making this house yours comes true!

Freddie Mac covered “4 Tips for Marking an Offer” in their Executive Perspective. Here are the 4 tips they covered along with some additional information for your consideration:

1.Understand How Much You Can Afford

“While it’s not nearly as fun as house hunting, fully understanding your finances is critical in making an offer.”

This ‘tip’ or ‘step’ should really take place before you start your home search process.

Getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mortgage for that amount. You will also need to know if you are prepared to make any repairs that may need to be made to the house (ex: new roof, new furnace).

2.Act Fast

“Even though there are fewer investors, the inventory of homes for sale is also low and competition for housing continues to heat up in many parts of the country.”

The inventory of homes listed for sale has remained well below the 6-month supply that is needed for a ‘normal’ market. Buyer demand has continued to outpace the supply of homes for sale, causing buyers to compete with each other for their dream homes.

Make sure that as soon as you decide that you want to make an offer, you work with your agent to present it as soon as possible.

3.Make a Solid Offer

Freddie Mac offers this advice to help make your offer the strongest it can be:

“Your strongest offer will be comparable with other sales and listings in the neighborhood. A licensed real estate agent active in the neighborhoods you are considering will be instrumental in helping you put in a solid offer based on their experience and other key considerations such as recent sales of similar homes, the condition of the house and what you can afford.”

Talk with your agent to find our if there are any ways that you can make your offer stand out in this competitive market!

4.Be Prepared to Negotiate

“It’s likely that you’ll get at least one counteroffer from the sellers so be prepared. The two things most likely to be negotiated are the selling price and closing date. Given that, you’ll be glad you did your homework first to understand how much you can afford.

Your agent will also be key in the negotiation process, giving you guidance on the counteroffer and making sure that the agreed-to contract terms are met.”

If your offer is approved, Freddie mac urges you to “always get an independent home inspection, so you know the true condition of the home.” If the inspector uncovers undisclosed problems or issues, you can discuss any repairs that may need to be made with the seller, or cancel the contract.

Bottom Line

Whether buying your first home or your fifth, having a local real estate professional who is an expert in their market on your side is your best bet to make sure the process goes smoothly. Let’s talk about how we can make your dreams of homeownership a reality!

To view original article, please visit Keeping Current Matters.

Buyer Interest Is Growing among Younger Generations

he demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

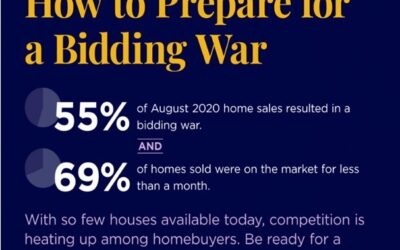

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.

The #1 Reason Not to Wait to List Your House for Sale

Let’s connect today to get your house on the market at this optimal time to sell.

Do You Have Enough Money Saved for a Down Payment?

Be careful not to let big myths keep you and your family out of the housing market. Let’s connect to discuss your options today.

6 Reasons You’ll Win by Selling with a Real Estate Agent This Fall

There are many benefits to working with a real estate professional when selling your house. Find out why.