Millionaire to Millennials: Buy a Home Now!

In a CNBC article, self-made millionaire David Bach explained that “the single biggest mistake millennials are making” is not purchasing a home because buying real estate is “an escalator to wealth.”

Bach went on to explain:

“If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.”

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!”

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists. He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

To see original article please visit Keeping Current Matters.

Real Estate Is a Driving Force in the Economy

The American Dream of homeownership has continued to thrive in the midst of this year’s economic downturn.

Rent vs. Buy: How to Decide What’s Best for You

With today’s low mortgage rates, there’s great opportunity for current renters to make a move into homeownership.

4 Reasons Why the Election Won’t Dampen the Housing Market

Recent trends suggest that the housing market will continue its strong momentum in the months to come.

Buyer Interest Is Growing among Younger Generations

he demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

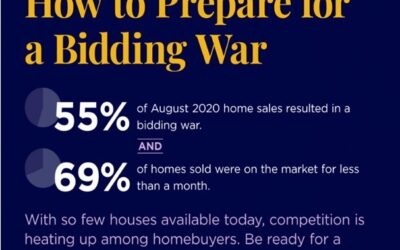

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.